Mahindra & Mahindra Ltd is one of the most diversified automobile company in India with presence across 2-wheelers, 3-wheelers, PVs, CVs, tractors & earthmovers. Presenting below are its latest Q1 FY26 earnings.

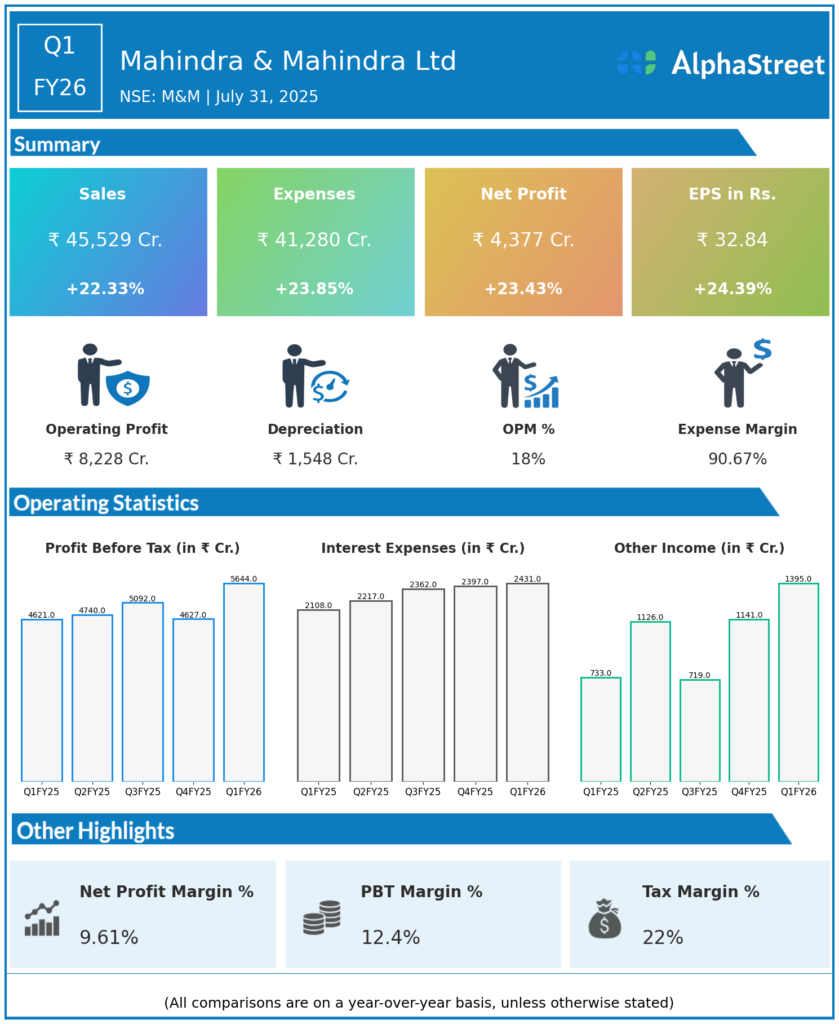

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Consolidated Revenue: ₹45,529 crore, up 22% year-over-year (YoY) from ₹37,218 crore in Q1 FY25.

-

Consolidated Net Profit (PAT): ₹4,377 crore, up 23% YoY from ₹3,283 crore.

-

Standalone Net Profit: ₹3,450 crore, up 32% YoY from ₹2,613 crore.

-

Revenue from Operations (Standalone): ₹34,083 crore, up 26.1% YoY from ₹27,035 crore.

-

EBITDA: ₹4,795 crore, up 17% YoY (standalone basis).

-

Automotive Segment Revenue: ₹25,999 crore, up 31.5% YoY.

-

Farm Equipment Segment Revenue: ₹10,892 crore, up 12.2% YoY.

-

Vehicle Sales: 2,47,249 units, up 17% YoY; SUV revenue market share up 570 bps to 27.3%, LCV (<3.5T) share up 340 bps to 54.2%.

-

Tractor Sales: 1,32,964 units, up 10% YoY; tractor market share climbed 50 bps to an all-time high of 45.2% in the quarter.

Key Management Commentary & Strategic Highlights

-

CEO Dr. Anish Shah highlighted “excellent quarter” results, with broad-based growth across all businesses and sustained operating excellence in both Auto and Farm sectors.

-

The Auto and Farm sectors delivered strong margin expansion and ongoing market share gains; auto standalone PBIT (excluding eSUV contract manufacturing) improved 50 bps to 10%, and core tractor PBIT margins rose 130 bps to 19.8%.

-

Tech Mahindra EBIT margin improved by 260 bps; Mahindra Finance (MMFSL) continued prudent growth with AUM up 15%, stable asset quality (GS3 under 4%).

-

Mahindra Logistics revenue up 14%; Mahindra Holidays expanded room capacity by 10%.

-

Management reaffirmed confidence in continued margin and market share gains, and strong value creation across group businesses.

-

M&M continues to target mid-to-high teen growth in SUV sales and has addressed supply concerns for critical inputs such as rare earth magnets.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

- Mahindra & Mahindra Ltd reported Revenues for Q4FY25 of ₹42,599.00 Crores up from ₹35,452.00 Crore year on year, a rise of 20.16%.

- Total Expenses for Q4FY25 of ₹39,114.00 Crores up from ₹32,172.00 Crores year on year, a rise of 21.58%.

- Consolidated Net Profit of ₹3,542.00 Crores up 13.34% from ₹3,125.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹26.50, up 19.64% from ₹22.15 in the same quarter of the previous year.