Mahindra Logistics Ltd is an integrated logistics & mobility solutions provider. The company offers Supply Chain expertise to diverse industry verticals such as Automotive, Engineering, Consumer Goods, Pharmaceuticals, Telecommunications, Commodities, and E-commerce. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

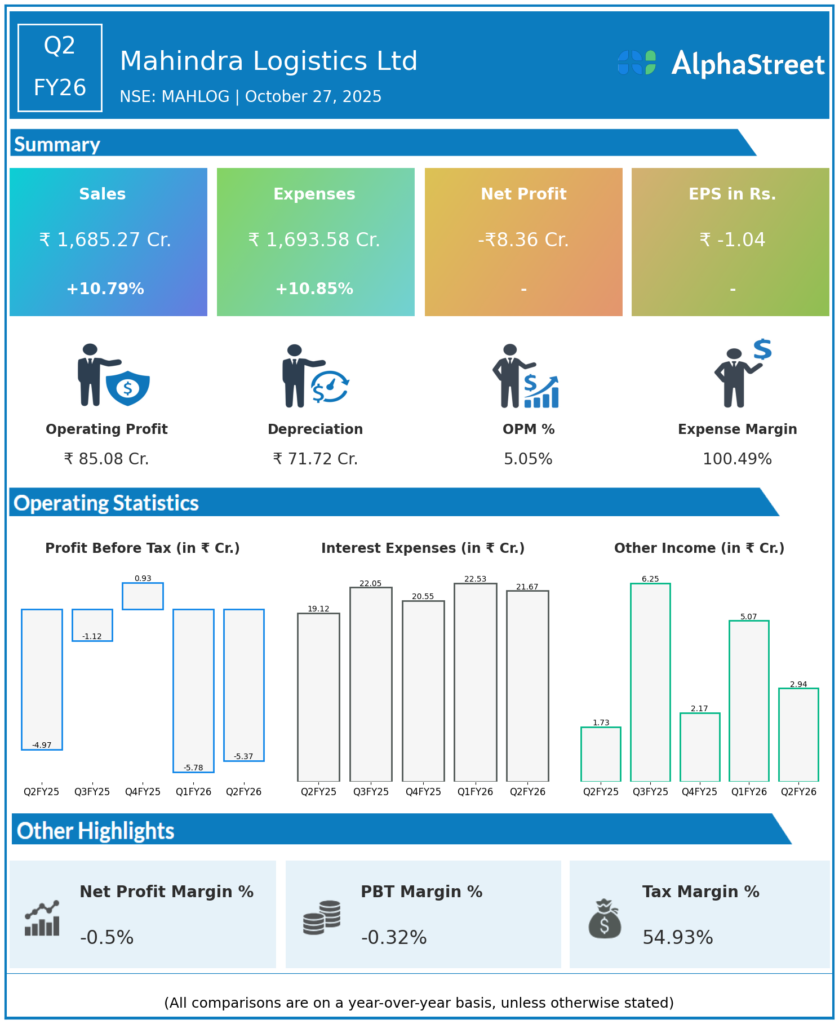

Consolidated Revenue from Operations: ₹1,685.3 crore, up 11% YoY from ₹1,521 crore in Q2 FY25.

EBITDA: ₹85 crore, up 29% YoY from ₹66 crore.

Profit Before Tax (PBT): ₹(5.41) crore loss, compared to ₹(4.97) crore loss YoY.

Profit After Tax (PAT): ₹(8.35) crore loss, compared to ₹(10.75) crore loss YoY.

Diluted EPS: ₹(1.20), compared to ₹(1.44) YoY.

H1 FY26: Consolidated Revenue ₹3,310 crore (up 12.5% YoY); PAT loss ₹21.15 crore vs ₹20.07 crore YoY.

Standalone Performance:

-

Revenue: ₹1,367 crore (up 10.6% YoY).

-

EBITDA: ₹82 crore (up 18.8% YoY).

-

PAT: ₹3.79 crore (down 56% YoY).

-

Diluted EPS: ₹0.44.

Key Segment/Operational highlights:

-

3PL, Freight Forwarding, Mobility and Express businesses drove broad-based growth.

-

Express segment delivered positive gross margin for the first time since acquisition, driven by yield discipline and 7.2% YoY volume growth.

-

Freight Forwarding revenues grew 22% sequentially, despite cross-border headwinds.

-

Mobility/Passenger segment posted 15% growth.

-

Warehousing footprint expanded to 22.1 million sq. ft. (including facilities in Guwahati and Agartala).

-

Multiple awards received from Amazon and Flipkart for service excellence.

Management Commentary & Strategic Decisions

-

Management emphasized strong revenue growth and margin improvement, despite ongoing challenges in profitability due to segmental losses and acquisition-related integration costs.

-

Express business achieved positive gross margin for the first time since acquisition, and investments in technology and process improvements are expected to support margin discipline.

-

Significant capex into physical infrastructure, especially in warehousing, and expansion in Eastern India driven by customer demand.

-

The new Alyte mobility service launched for B2C reflects the company’s focus on premium, tech-enabled solutions.

-

Recently completed rights issue of ₹749 crore will support debt repayment and further expansion.

-

Company remains committed to improving profitability and operational efficiency, with targeted investments in digital platforms and high-growth verticals.

Q1 FY26 Earnings Results

Consolidated Revenue: ₹1,625 crore, up 14% YoY.

EBITDA: ₹76 crore, up 15% YoY.

PAT Loss: ₹10.80 crore, compared to ₹9.32 crore YoY.

Diluted EPS: ₹(1.50).

Warehousing Revenue: ₹306 crore, up 18% YoY.

Gross Margin: 9.4%.

Express business revenue: Crossed ₹100 crore for the first time; PAT loss ₹23.9 crore.

Standalone Revenue: ₹1,346 crore; standalone PAT ₹6.4 crore

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.