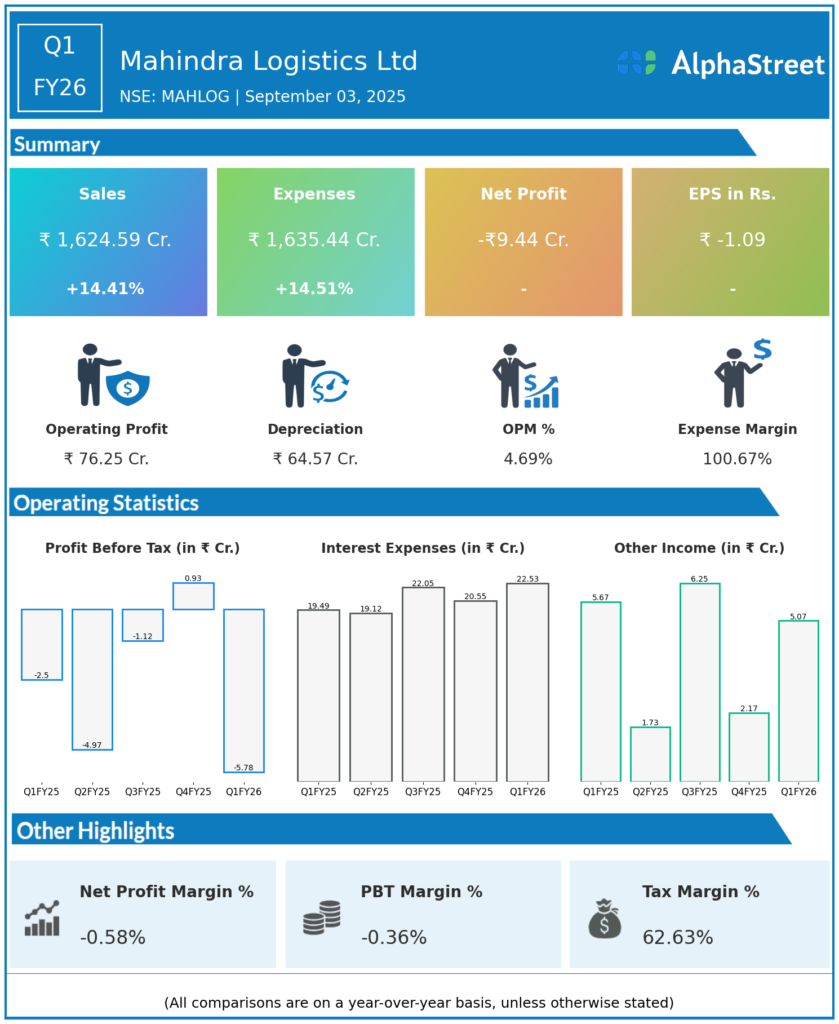

Mahindra Logistics Ltd is an integrated logistics & mobility solutions provider. The company offers Supply Chain expertise to diverse industry verticals such as Automotive, Engineering, Consumer Goods, Pharmaceuticals, Telecommunications, Commodities, and E-commerce. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income (Consolidated): ₹1,624 crores, up 14.4% YoY (Q1 FY25: ₹1,425.69 crores), up 12.1% QoQ (Q4 FY25: ₹1,453.64 crores).

-

Warehousing Revenue: ₹306 crores, up 18% YoY (Q1 FY25: ₹259 crores).

-

Total Expenses: ₹1,635.44 crores, up 14.5% YoY, up 11.8% QoQ.

-

Gross Margin: 9.4%, marginally down YoY (Q1 FY25: 9.5%).

-

EBITDA: ₹76.3 crores, up 15% YoY (Q1 FY25: ₹66.3 crores), down 2% QoQ.

-

Profit Before Tax (PBT): -₹5.78 crores, down from -₹2.50 crores YoY, but improvement over Q4 (-₹9.22 crores).

-

Profit After Tax (PAT): -₹9.44 crores, lower YoY (Q1 FY25: -₹7.84 crores); improved sequentially (Q4 FY25: -₹11.91 crores).

-

Earnings Per Share (EPS): -₹1.09, lower YoY (Q1 FY25: -₹1.30).

-

Express Business Revenue: ₹101 crores, first time crossing ₹100 crores; PAT loss ₹23.9 crores.

-

MLL Standalone Revenue: ₹1,346 crores (Q1 FY25: ₹1,157 crores), PAT ₹6.44 crores (Q1 FY25: ₹10.22 crores).

-

Mobility Revenue: ₹82 crores, PAT ₹4.6 crores.

-

Warehouse space under management: 21.1 million sq.ft.

-

Recent Developments: Cummins India Logistics Centre in Phaltan launched as flagship, improved operational excellence.

Management Commentary & Strategic Highlights

-

Management cited strong top-line growth in 3PL, last mile delivery, and express segments, partially offset by persistent yield and margin pressures in the current client mix.

-

The Express business achieved a milestone with revenues breaching ₹100 crores, but segment losses widened, dragging consolidated profitability.

-

Gross margins remained steady; cost controls, operational efficiency, and tech-driven initiatives underpin the company’s ongoing transformation.

-

Segmental performance in mobility and warehousing was positive; express and freight faced margin headwinds due to market conditions.

-

Warehousing and new client wins drove segment growth, with multiple new sites launched during the quarter.

Q4 FY25 Earnings Results

-

Total Income: ₹1,570 crores.

-

Profit After Tax (PAT): -₹5.29 crores.

-

EBITDA: ₹78 crores.

-

EPS: -₹0.68

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.