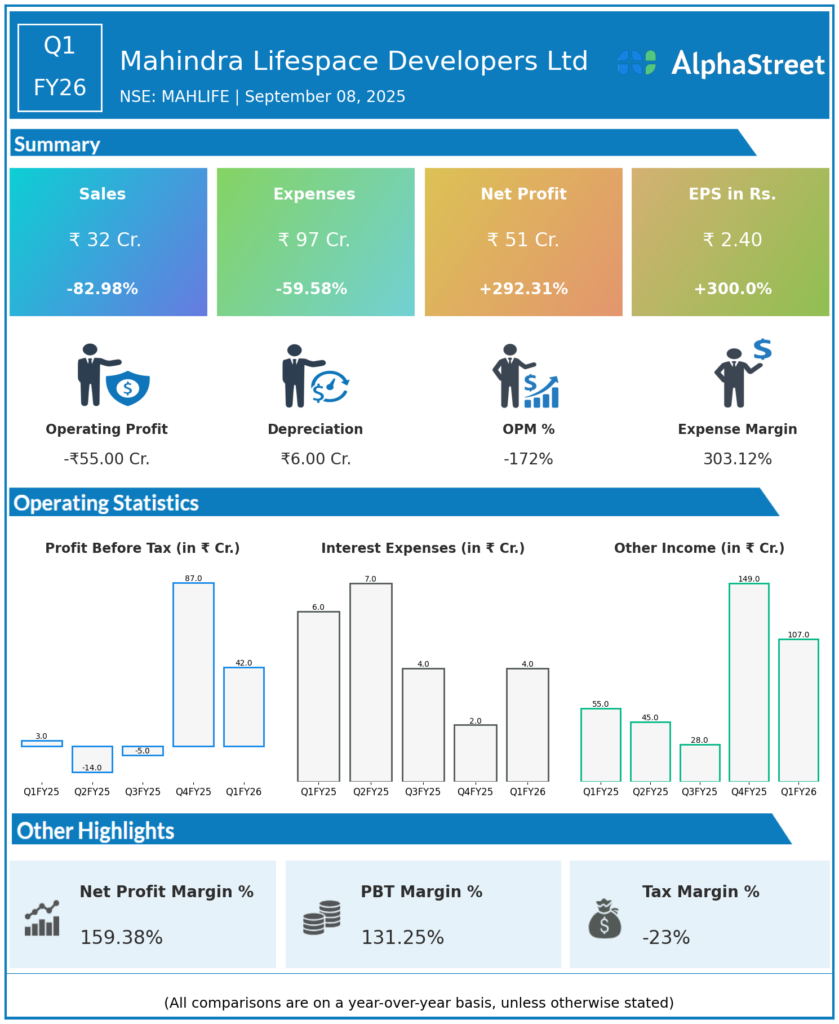

Mahindra Lifespace Developers Ltd was incorporated in 1999, it is engaged in the business of development of the real estate, residential facilities, commercial complexes and through its subsidiary companies is involved in various infrastructure projects including the development of SEZs and Industrial Clusters. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹32 crores, down 83% YoY (Q1 FY25: ₹206.70 crores), and down 25.6% QoQ (Q4 FY25: ₹54.60 crores).

-

Profit After Tax (Consolidated): ₹51.26 crores, up 292% YoY (Q1 FY25: ₹12.74 crores), down 28.3% QoQ (Q4 FY25: ₹71.48 crores).

-

Earnings Per Share: ₹2.40, up 300% YoY (Q1 FY25: ₹0.80), down 37% QoQ.

-

Profit Before Tax: -₹56.42 crores, higher loss YoY and QoQ.

-

Total Expenses: ₹97.03 crores, down 59.6% YoY (Q1 FY25: ₹240.08 crores), up 29.7% QoQ.

-

Consolidated Sales (Resi + IC&IC): ₹569 crores.

-

Residential Pre-sales: ₹449 crores (0.58 msft saleable area; RERA carpet area 0.42 msft), vs. ₹1,019 crores YoY; lower due to project approval delays, with launches planned for upcoming quarters.

-

IC&IC Revenue: ₹120 crores (up 17% YoY, total leased area 18.7 acres).

-

Gross Development Value (GDV) Added: ₹3,500 crores (vs. ₹1,400 crores Q1 FY25).

-

Residential Collections: ₹518 crores (vs. ₹540 crores YoY).

-

Balance Sheet: Net debt/equity at -0.23 (cash surplus), following a successful ₹1,495 crore rights issue during the quarter.

Key Management Commentary & Strategic Highlights

-

Managing Director & CEO Amit Kumar Sinha highlighted the successful rights issue driving a stronger balance sheet and continued business development momentum, with ₹3,500 crores GDV added in Q1.

-

Operational performance in industrial clusters was robust with healthy leasing, while residential pre-sales were soft pending approvals but expected to recover with major launches in coming quarters.

-

IC&IC business in Jaipur and Chennai achieved strong leasing activity, bolstering consolidated performance.

-

The management reaffirmed its focus on digital initiatives, innovative project delivery, and customer-centricity going forward.

-

Discipline in capital allocation and maintaining a cash surplus position continue to be medium-term priorities.

Q4 FY25 Earnings Results

-

Total Income: ₹9 crores.

-

PAT: ₹85 crores.

-

EPS: ₹3.99.

-

Residential Collections: ₹540 crores.

-

Pre-sales: Higher than Q1 FY26, with collections and launches on track.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.