Mahindra Holidays & Resorts India Ltd. (MHRIL), a part of the Leisure and Hospitality sector of the Mahindra Group offers family holidays primarily through vacation ownership memberships. Started in 1996, the company’s flagship brand ‘Club Mahindra’ has over 250,000 members. The Company is the largest Vacation Ownership company outside the US and is 6th largest globally. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

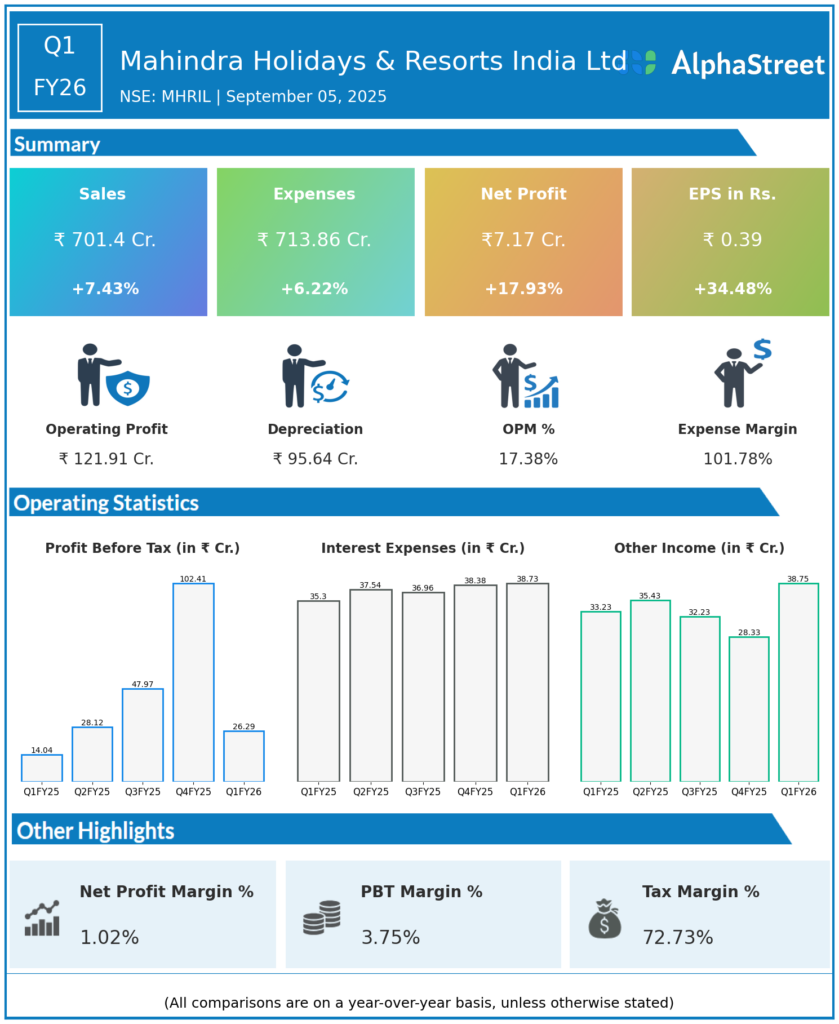

Consolidated Revenue: ₹701 crores, up 7.4% YoY (Q1 FY25: approx ₹685 crores).

-

Consolidated Profit After Tax (PAT): ₹7.17 crores, up 17.9% YoY (Q1 FY25: approx ₹6.1 crores).

-

Standalone PAT: ₹7.82 crores, up 69% YoY with strong operational performance.

-

Room Inventory: Expanded by 10% to 5,794 keys across 126 resorts.

-

Resort Revenue: Increased 10% YoY to about ₹114 crores with occupancy rate of 85.4%.

-

Membership Additions: About 3,000 members added in Q1; company targets to maintain this pace for the year.

-

Cash Position: Strong at ₹1,576 crores at June-end, representing 10% YoY increase.

-

Deferred Revenue: Around ₹5,755 crores, reflecting healthy membership fees collected.

-

Dividend & Awards: Company received 14 TripAdvisor Traveller’s Choice Awards during the quarter; dividend maintained.

Key Management Commentary & Strategic Highlights

-

Manoj Bhat, MD & CEO, expressed confidence in maintaining double-digit profit growth through FY26, driven by continued room additions and membership growth.

-

Strong domestic business performance complemented by resilience in European operations despite economic headwinds and currency fluctuations.

-

Focus on premiumization, efficient operations, and guest experience improvements underpin growth strategies.

-

Management is optimistic about stable profitability and anticipates adding 1,000 new rooms by FY26, with most growth expected in H2.

-

Emphasis placed on digital initiatives and high-quality resort expansions to further strengthen brand.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹779 crores.

-

PAT: ₹73 crores.

-

EPS: ₹3.62.

-

Room Inventory: Smaller than current quarter (~5,250 keys).

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.