Maharashtra Scooters Ltd. (MSL) is a manufacturing & and an unregistered core investment company. It is engaged in the business of manufacturing dies, Jigs, fixtures and die casting components primarily for the automobiles industry, etc.

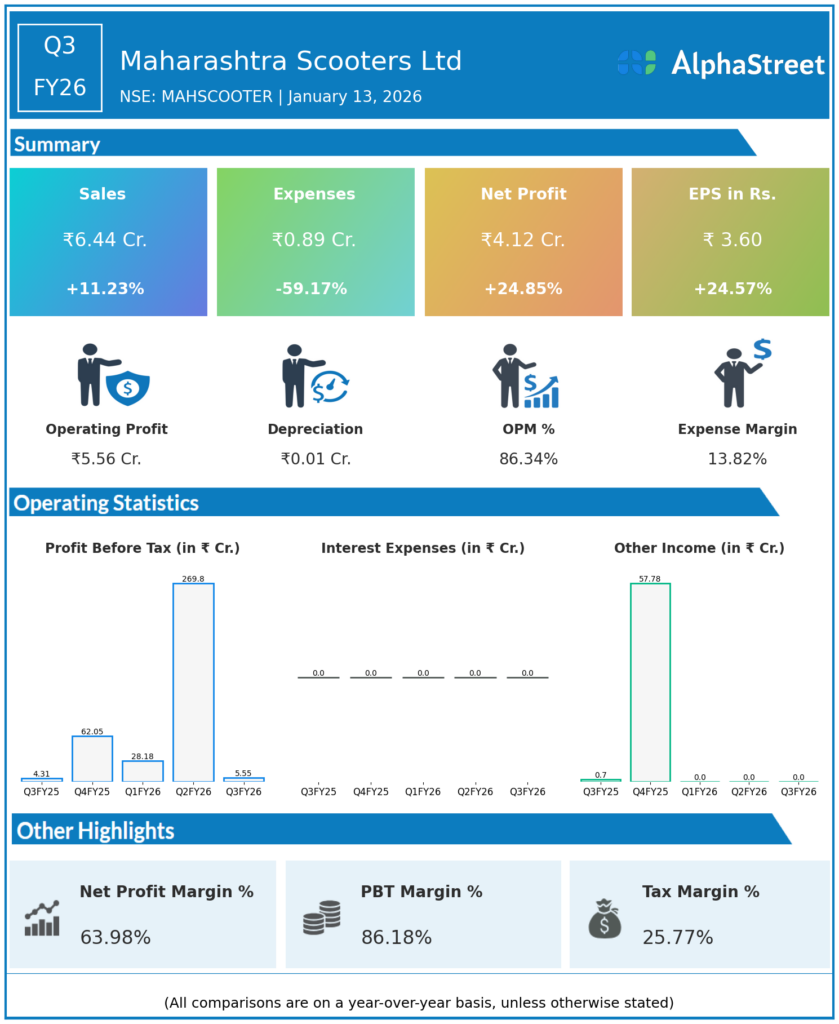

Q3 FY26 Earnings Results

- Revenue from Operations / Total income: ₹6.44 crore, broadly flat YoY versus about ₹6.49 crore in Q3 FY25 (down ~0.8% YoY).

- Profit Before Tax (PBT): ₹5.55 crore, up about 28.8% YoY from ₹4.31 crore in Q3 FY25.

- Profit After Tax (PAT): ₹4.12 crore, up 24.8% YoY from ₹3.30 crore in Q3 FY25.

- PAT margin: Approximately 64% in Q3 FY26 versus about 51% in Q3 FY25, reflecting sharp operating leverage on a lean cost base.

- Total expenses: ₹0.89 crore, down 59.2% YoY from ₹2.18 crore in Q3 FY25, driven largely by a decline in other expenses.

- Employee benefit expenses: About ₹0.24 crore, up ~9% YoY.

- Other expenses: Around ₹0.64 crore, down ~56% YoY.

- Interest / dividend & treasury income: Interest income contributed about ₹6.18 crore to Q3 FY26 total income of ₹6.44 crore, underscoring the investment‑holding nature of the business.

Management Commentary & Strategic Decisions

- Management commentary around Q3 FY26 focuses on Maharashtra Scooters’ position as a core investment holding company of the Bajaj group, with earnings driven primarily by dividend and treasury income from investments in Bajaj Auto and other group entities.

- The YoY improvement in profitability despite flattish revenue is attributed to disciplined cost control, lower other expenses and better treasury performance, which together expanded margins significantly.

- Sequentially, the quarter reflects a “normalised” run‑rate after an exceptionally strong Q2 driven by large, one‑off monetisation and dividend flows; management and market commentary emphasise that such income is inherently lumpy in a holding‑company structure.

- Strategic focus continues to be on:

- Maintaining a lean operating structure with very low operating costs.

- Prudent deployment of surplus funds in low‑risk instruments to preserve capital while generating stable treasury returns.

- Leveraging its status as a core investment company within the Bajaj group to participate in value creation of underlying operating entities over the medium term.

Q2 FY26 Earnings Results

- Revenue from Operations / Net sales: ₹271.02 crore, up 825.9% QoQ from ₹29.27 crore in Q1 FY26 and up about 66.1% YoY versus ₹163.17 crore in Q2 FY25, driven by a very large dividend and monetisation inflow.

- Operating profit / PBDIT (excluding other income): ₹269.8 crore, implying an operating margin of about 99.6%, one of the highest in the company’s recent history.

- Profit After Tax (PAT): ₹267.07 crore, up 76.7% QoQ from ₹35.36 crore in Q1 FY26; PAT margin stood at about 98.5%.

- Effective tax rate: Around 1.0%, materially lower than the prior quarter and prior year, reflecting favourable tax treatment on dividend and certain investment incomes.

- H1 FY26 performance: Net sales of ₹300.29 crore and net profit of ₹302.43 crore, meaning H1 FY26 profit already exceeded FY25 full‑year net profit of ₹214 crore by over 41%.

Management Commentary & Structural View on Q2 FY26

- Q2 FY26 was characterised by a sizeable “dividend windfall” and gains from monetisation / realisation of investments and assets, which led to extraordinary revenue and profit numbers that are not indicative of a sustainable quarterly run‑rate.

- Commentary from market and analyst reports highlights:

- Extreme revenue and earnings volatility as an inherent feature of Maharashtra Scooters’ business model as a holding company, with quarterly numbers swinging sharply based on timing of dividends and realisation events.

- Very high margins (operating and PAT) supported by minimal employee and overhead costs, but accompanied by structurally weak return on equity due to a large passive investment book.

- Strategically, management’s stance remains to:

- Continue acting primarily as an investment and dividend‑receiving vehicle for Bajaj‑group holdings rather than an operating manufacturing business.

- Optimise capital allocation within regulatory constraints of a core investment company, while periodically monetising non‑core assets (as seen around the period with land, building and machinery sales) to unlock value.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.