Current Status Overview

Mahanagar Gas Ltd operates in city gas distribution in Maharashtra. The company reported higher revenue in Q3 FY26. Profit after tax declined year-on-year. Operational volumes remained stable. The company declared an interim dividend.

Share Price Performance

MGL shares last traded near ₹1,181. Recent movement showed volatility. The stock is below its 52-week high. Market capitalization is around ₹11,600 crore.

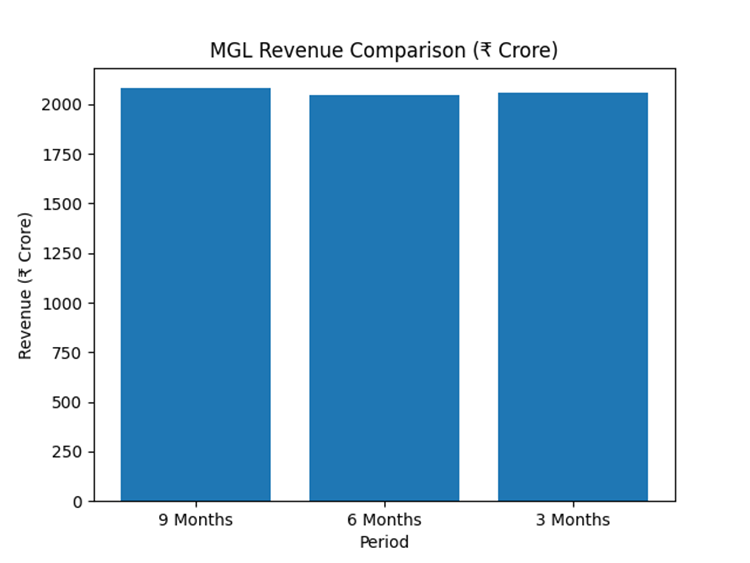

Revenue Performance

Revenue for last 3 months stood near ₹2,058 crore.

Revenue for last 6 months was around ₹2,049 crore.

Revenue for last 9 months was approximately ₹2,081 crore.

Market Analysis

MGL operates in a competitive city gas distribution market. Peers include Gujarat Gas and Indraprastha Gas. Margins remain sensitive to LNG prices. Demand trends are mixed across regions.

Analyst Commentary

Analyst opinions remain mixed. Some highlight margin pressure. Others see stable long-term demand. No clear consensus reported.

Mergers & Acquisitions

None reported.

Outlook

No formal forward guidance was issued. Earnings outlook remains uncertain. Cost trends will be monitored closely.

Revenue Chart