Maan Aluminium Ltd (NSE: MAANALU, BSE: 532906) closed at 148.02 on the National Stock Exchange today, representing an intraday increase of 0.25%. The stock fluctuated between an intraday low of 145.14 and a high of 149.79.

Market Capitalization

The market capitalization of Maan Aluminium Ltd stood at INR 887.90 crore (approximately USD 106.8 million) as of the market close on February 17, 2026.

Latest Quarterly Results

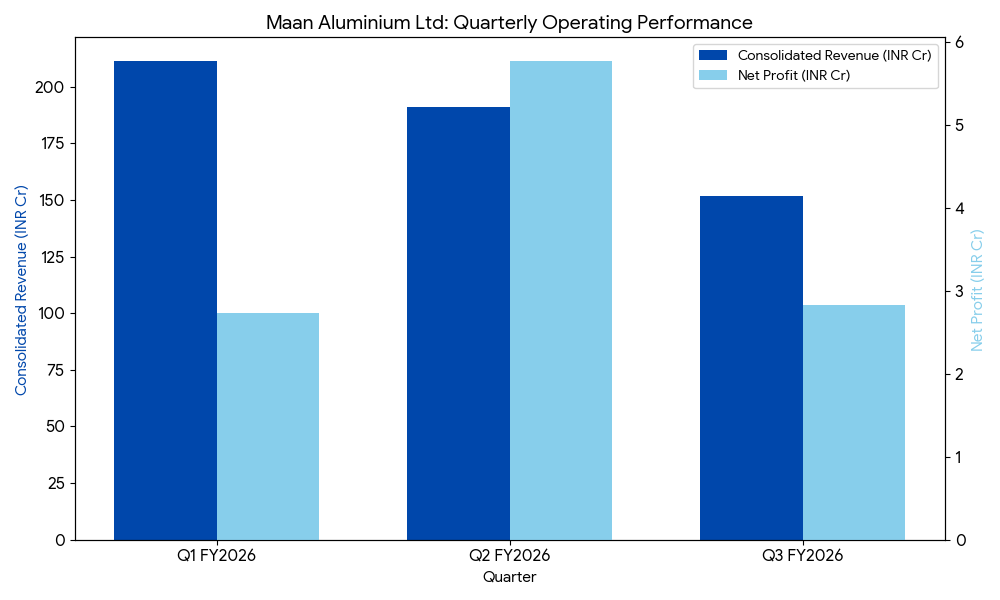

For the third quarter ended December 31, 2025 (Q3 FY2026), Maan Aluminium reported a consolidated net revenue of INR 151.87 crore, a 16.60% decrease from INR 182.09 crore in the corresponding quarter of the previous year. Net profit for the period was INR 2.83 crore, reflecting a 7.21% year-over-year decline from INR 3.05 crore.

The company operates primarily in the manufacture and sale of aluminum extruded products. Revenue from operations in this single business segment saw a sequential contraction of 20.52% compared to the September 2025 quarter. Operating profit (EBITDA) for the quarter was reported at INR 5.55 crore, up 15.15% from INR 4.82 crore year-over-year, while operating profit margins expanded to 3.65%.

FINANCIAL TRENDS

Nine-Month Overview

For the nine-month period ending December 31, 2025, Maan Aluminium’s financial performance showed a directional contraction in top-line revenue compared to the same period in the previous fiscal year. Total revenue for the first nine months of FY2026 stood at INR 554.14 crore. Cumulative net profit for the nine-month period reached INR 11.33 crore. The company’s inventory turnover ratio was recorded at 12.88 times for the half-year period, representing a downward trend in stock movement efficiency.

Business & Operations Update

Maan Aluminium recently completed an expansion of its installed extrusion capacity, increasing it from 10,000 metric tons to 24,000 metric tons per annum. This expansion involved the installation of new microprocessor-controlled hydraulic extrusion presses. Additionally, the company allotted 5,800,000 equity shares on a preferential basis on January 16, 2026, to fund capital expenditure and working capital requirements.

M&A or Strategic Moves

The company has focused on the acquisition of assets in Dewas to bolster its production capabilities. There have been no other major announced mergers or acquisitions during the current reporting period. Official filings indicate a recent shift in shareholding, with promoter holding recorded at 55.82% in January 2026, down from previous levels.

Q&A Focal Points

During the discussions following the results, the primary focus rested on the high contribution of non-operating income, which accounted for 42.37% of the profit before tax in Q3. Inquiries addressed the 20.52% sequential revenue decline and the impact of fluctuating raw material prices, specifically the 10.88% increase in the Billet Index over the last month. Management also addressed the utilization levels of the newly expanded 24,000 TPA capacity and the strategy for import substitution in the 7-series alloy segment.

Guidance & Outlook

The company’s outlook is centered on the stabilization of its expanded production capacity and the management of raw material cost volatility. Key factors to watch include the recovery of domestic demand for aluminum extrusions in the automobile and construction sectors, and the impact of the recent preferential share allotment on the company’s debt-to-equity ratio.

Performance Summary

Maan Aluminium shares rose 0.25% to 148.02 today. The company reported a 16.60% year-over-year decline in quarterly revenue to INR 151.87 crore and a 7.21% drop in net profit to INR 2.83 crore. Operating margins showed expansion despite the top-line contraction.