M M Forgings Limited (NSE: MMFL/BSE: 522241), a leading Indian manufacturer of forged and machined components, reported a steady financial performance for the nine-month period (9M) ended December 31, 2025, navigating a volatile global economic landscape marked by geopolitical shifts and trade uncertainties.

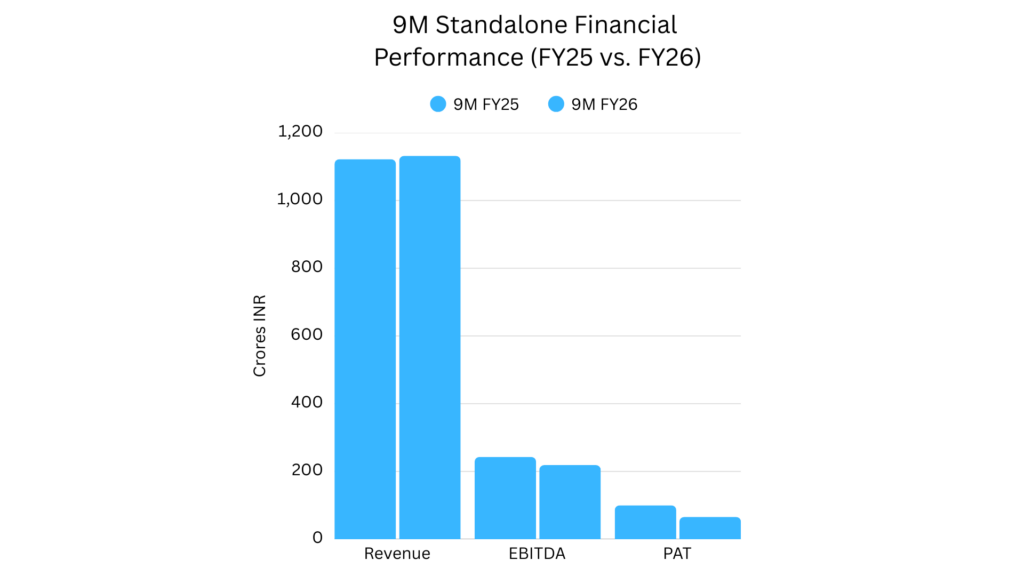

Standalone Financial Metrics (YTD Dec FY’26)

- Revenue from Operations: ₹1,131.83 crore

- EBITDA: ₹218.69 crore

- Profit Before Tax (PBT): ₹91.30 crore

- Profit After Tax (PAT): ₹65.80 crore

- Earnings Per Share (EPS): ₹13.63

- Total Income: ₹1,153.19 crore

- Operating Expenses: ₹934.50 crore

- Domestic Sales: ₹693.44 crore

- Export Sales: ₹422.45 crore

Consolidated Financial Metrics (YTD Dec FY’26)

- Revenue from Operations: ₹1,160.22 crore

- EBITDA: ₹214.12 crore

- Profit Before Tax (PBT): ₹78.83 crore

- Profit After Tax (PAT): ₹53.33 crore

- Earnings Per Share (EPS): ₹11.05

- Total Income: ₹1,175.16 crore

- Operating Expenses: ₹961.04 crore

On a consolidated basis, which includes the performance of subsidiaries such as DVS Industries, Suvarchas Vidyut, and Abhinava Rizel, 9M revenue reached ₹1,160.22 crore with an EBITDA of ₹214.12 crore.

Key Operational-Financial Metrics

- Sales per ton: ₹1.93 lakhs (increased from ₹1.80 lakhs in FY25)

- Product Mix (by Sales): 53% Forged & Machined components and 47% Forged components

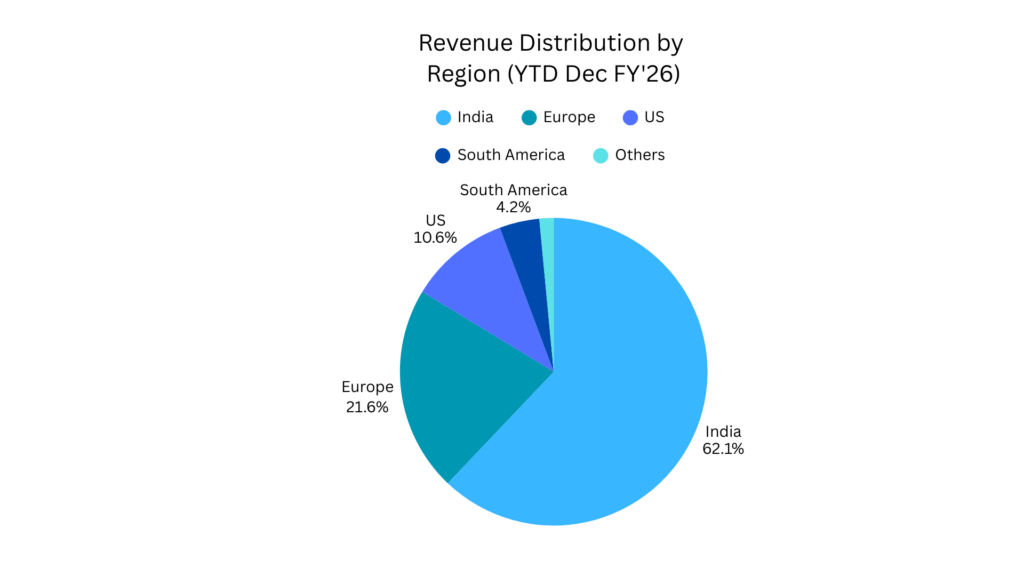

- Geographic Revenue Split: India accounts for 62.1% of overall sales, followed by Europe at 21.6% and the US at 10.6%.

Business Model

MMFL manufactures forged and machined components, primarily for the commercial vehicle segment (75.5% of revenue). Its business model emphasizes value-addition, with machined products comprising 53% of sales. MMFL operates globally across India, Europe, and the US, adhering to strict IATF and ISO standards.

Operational Highlights & Business Mix

- The company showed significant progress in its product value, with sales per ton increasing to ₹1.93 lakhs, compared to ₹1.80 lakhs in FY25 .

- MMFL’s business mix continues to shift toward higher-value offerings; forged and machined components now account for 53% of sales, while pure forged products make up the remaining 47%.

- Domestic sales emerged as a point of strength, growing to ₹693.44 crore in the 9M period. Conversely, export activity remained measured, totaling ₹422.45 crore, as global markets reacted to macroeconomic headwinds.

Geographic Presence & Target Segments

- India remains the cornerstone of MMFL’s operations, contributing 62.1% of overall revenue.

- International presence is led by Europe (21.6%), followed by the United States (10.6%) and South America (4.2%).

- The company is heavily geared toward the Commercial Vehicle segment, which generates 75.5% of its overall revenue.

- Other key target segments include:

- Agri and Off-Highway: 14.9%

- Passenger Vehicles: 8.2%

- Others: 1.4%

Management Commentary & Guidance

Chairman and Managing Director Shri. Vidyashankar Krishnan noted that the Indian automotive industry, particularly exports, has operated under global moderation. Also specifically cited “tariff-related uncertainties, notably involving the United States” as a factor in measured export activity during Q3. Despite these challenges, Krishnan expressed confidence in the company’s “robust balance sheet” and “disciplined cost management”.

Management guidance suggests the company is well-positioned to capitalize on emerging structural improvements in the industry and deliver sustainable value.

Key Takeaway

While global trade tensions have tempered export growth, M M Forgings’ strong domestic performance and successful transition toward machined components have preserved its margins. The company remains a dominant player in the commercial vehicle forging space, supported by high operational resilience and a strategic long-term outlook.