Lux Industries Limited was incorporated in 1995 having a market share of 15% of the organised industry. It is the largest mid-segment hosiery enterprise in India.Company is engaged in the manufacturing and marketing of innerwear, thermals, and casuals under various brands, with ‘LUX’ being its flagship brand.

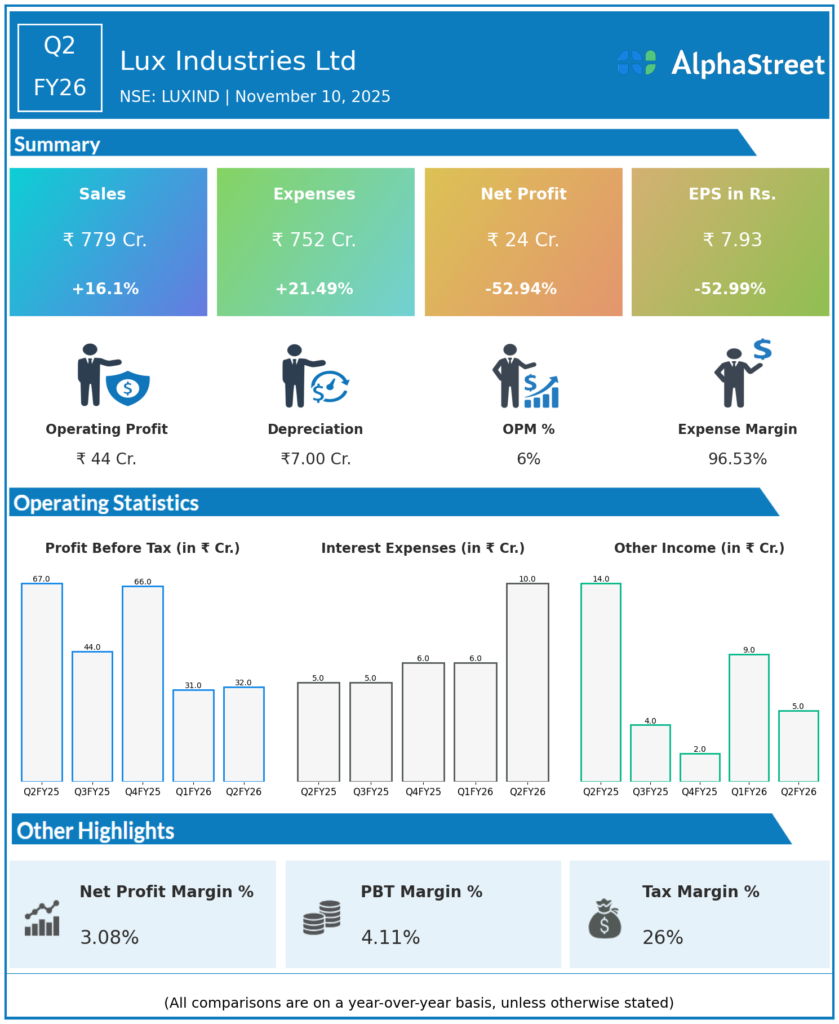

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹778.76 crore, up 14.95% YoY

-

Operating Profit (EBITDA): ₹43.90 crore, margin at 5.66%, down from 9.59% YoY

-

Profit After Tax (PAT): ₹23.65 crore, down 54.18% YoY from ₹51.18 crore

-

EPS: ₹7.80, down 54.17% YoY

-

Half Year Ended FY26: Total Income ₹1,397.39 crore, PAT ₹47.02 crore, down 44.79% YoY

-

Gross profit margin down to 5.01% from 10.88% YoY

-

Employee costs increased 11.58% YoY, rising from ₹40.33 crore to ₹45.00 crore

-

Working capital pressures caused by inventory and receivable build-up, leading to higher interest expenses

-

Interest expense doubled YoY to ₹10.27 crore

Management Commentary & Strategic Insights

-

Revenue growth at risk due to cost pressures and margin compression

-

Focus on cost rationalization and pricing power improvements

-

Emphasis on working capital optimization and debt reduction

-

Strategic priority on market share gains in premium segments with better margins

-

Company maintains cautious outlook given structural challenges but sees potential catalysts from operational improvements

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹604 crore, up 7% QoQ, down 11% YoY

-

Operating EBITDA: ₹35 crore, margin at 5.8%, nearly flat YoY

-

PAT: ₹24 crore, down 14% YoY

-

EPS: ₹7.95, down YoY

-

Profitability pressured by higher costs and margin compression

-

Management working on SKU expansion, brand investments, and digital channel expansion.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.