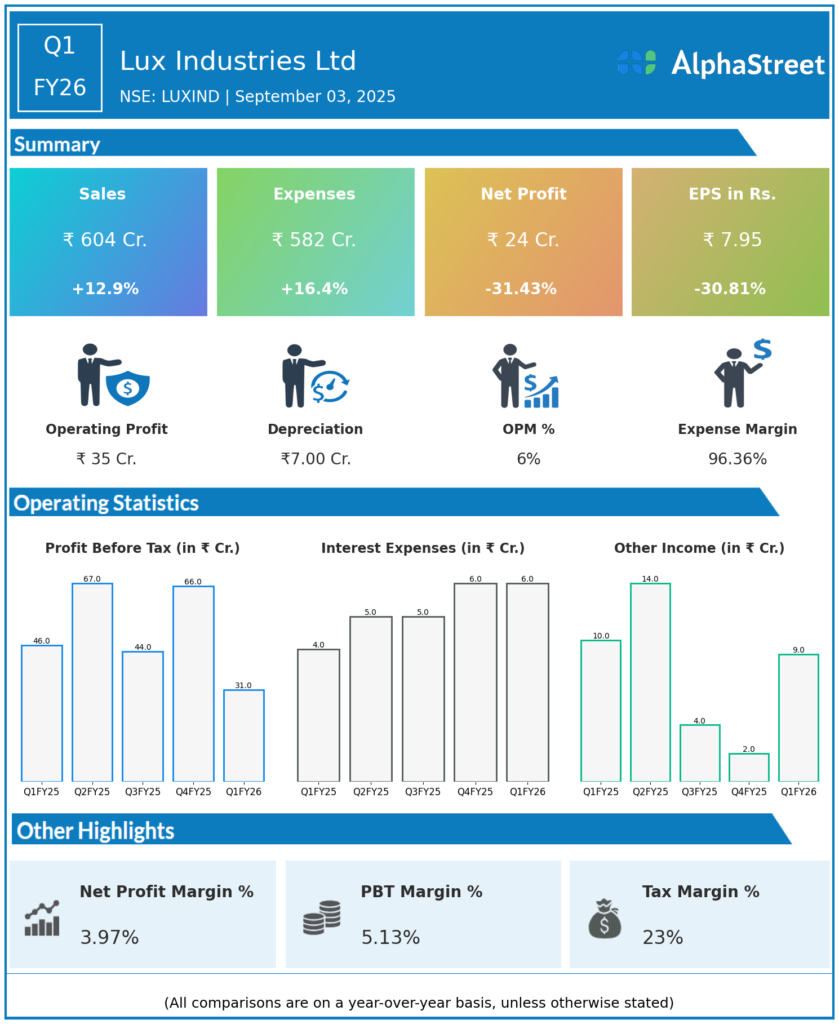

Lux Industries Limited was incorporated in 1995 having a market share of 15% of the organised industry. It is the largest mid-segment hosiery enterprise in India.Company is engaged in the manufacturing and marketing of innerwear, thermals, and casuals under various brands, with ‘LUX’ being its flagship brand. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹604 crores, up 7% QoQ, down 11% YoY.

-

Transaction Charges: ₹3,150 crores, up 7% QoQ, but down 14% YoY.

-

Consolidated Expenses: ₹582 crores, down 6% QoQ.

-

Operating EBITDA: ₹35 crores, up 12% QoQ, up 1% YoY; margin at 78% in Q1 FY26 (up from 74% in Q4).

-

Normalized Profit Before Tax (PBT): ₹31 crores, up 12% QoQ.

-

Profit After Tax (PAT): ₹24 crores, down 50% QoQ (Q4 FY25: ₹48 crores), down 14% YoY (Q1 FY25: ₹35 crores).

-

PAT Margin: 59% (Q1 FY25: 52%).

-

Earnings Per Share (EPS): ₹7.95 (Q4 FY25: ₹16.02; Q1 FY25: ₹11.49).

-

Book Value per Share: ₹134.67.

-

Return on Equity (Annualized): 9.81% (FY25: 10%).

Management Commentary & Strategic Highlights

-

Management highlighted robust profitability improvements driven by higher trading volumes across segments and lower operating costs.

-

Leadership in global derivatives and equity turnover maintained, fueling growth and investor confidence ahead of the anticipated IPO.

-

The exchange made a ₹587 crores additional contribution to its Core Settlement Guarantee Fund (SGF), raising the corpus to ₹9,726 crores as advised by SEBI.

-

Continued innovation and ecosystem expansion position NSE as a critical pillar in India’s financial infrastructure.

Q4 FY25 Earnings Results

-

Total Income: ₹819 crores.

-

PAT: ₹48 crores.

-

EPS: ₹16.02.

-

EBITDA Margin: 74%.

-

PAT Margin: 57%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.