Lupin is an innovation-led transnational pharmaceutical company headquartered in Mumbai. Lupin develops and commercializes a wide range of branded and generic formulations, biotechnology products, and APIs in over 100 markets in the U.S., India, South Africa, and across the Asia Pacific (APAC), Latin America (LATAM), Europe, and Middle East regions.

Q2 FY26 Earnings Results:

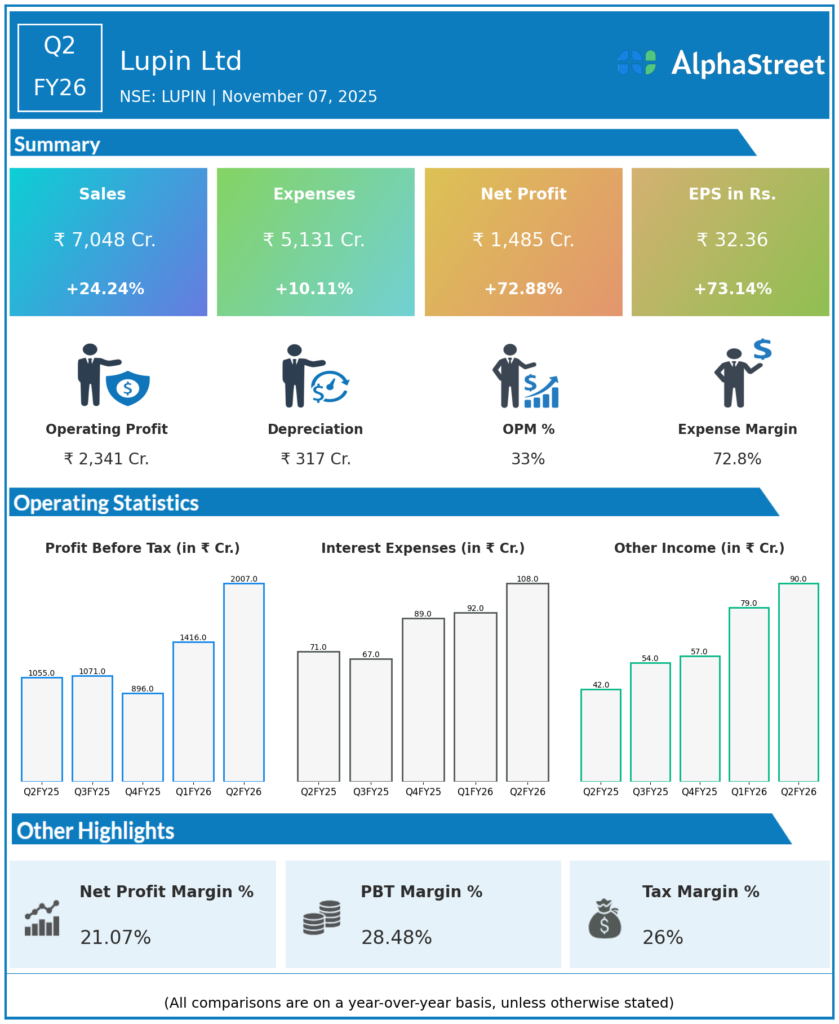

- Revenue from Operations: ₹7,047.51 crore, up 24.2% YoY and 12.4% QoQ from ₹6,268 crore in Q1 FY26.

- EBITDA: ₹2,137.6 crore, EBITDA margin 31.3% (up 750 bps YoY).

- Profit After Tax (PAT): ₹1,485 crore, up 73% YoY from ₹852.6 crore in Q2 FY25.

- PAT margin: Approx. 21%.

- North America segment: Grew 46% YoY to ₹2,762 crore (USD 315 million).

- India: Continued strong performance contributing 35% of revenue.

- Emerging markets sales: ₹922.8 crore, up 45.3% YoY, around 14% of global revenue.

- Gross profit: ₹5,006.6 crore, gross margin 73.3%.

- Personnel costs: ₹1,105.6 crore, 16.2% of sales.

- Manufacturing and other expenses: ₹1,979.6 crore (29% of sales).

- Employee count: Not specifically stated for Q2 FY26.

Management Commentary & Strategic Decisions

- Managing Director Nilesh Gupta stated this was “one of our strongest performances ever,” highlighting robust growth across the U.S., emerging markets, other developed markets, and India.

Strong operational efficiencies and sustained investments supported the margin expansion.

Strategic moves included new product launches like Liraglutide and Risperidone injections in the U.S. - Global expansion was boosted by VISUfarma acquisition (ophthalmology) and an out-licensing partnership with Sandoz for Ranibizumab biosimilar.

- Regulatory approvals were received in Taiwan, Brazil, and Mexico.

- Ongoing focus on R&D with investment of ₹509.1 crore during the quarter to support pipeline and capacity expansion.

- The company aims to leverage the first-half momentum for a strong full-year FY26.

Q1 FY26 Earnings Results:

- Revenue from Operations: ₹6,268.34 crore, up 11.9% YoY from ₹5,600.33 crore in Q1 FY25.

- EBITDA: Around ₹1,329 crore (calculated from EBITDA margin 20.9%).

- Profit After Tax (PAT): ₹1,219.03 crore, up 52.13% YoY from ₹801.31 crore.

- North America sales: ₹2,404.1 crore, up 24.3% YoY, 39% of total revenue.

- India sales: ₹2,089.4 crore, up 7.8% YoY, 34% of total revenue.

- Other developed markets: ₹774.8 crore, up 17.4% YoY, 13% of revenue.

- Emerging markets: ₹652.4 crore, up 5.2% YoY.

- R&D expenses: ₹356 crore (6.9% of sales).

- Management highlighted sustained market demand, stable U.S. generics portfolio, and Indian business growth, with focus on inhalation, injectables, biosimilars, and complex generics.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.