Lumax Auto Technologies Ltd was incorporated in 1981 and is a part of the D.K. Jain Group of companies. It is engaged in the business of manufacturing and supplying of Automotive Lamps, Plastic Moulded Parts, and Frame Chassis to two, three, and four-wheeler segments. It has Partnerships with 7 Global players like Yokowo(Japan), JOPP(Germany), and few others.

Q2 FY26 Earnings Results:

-

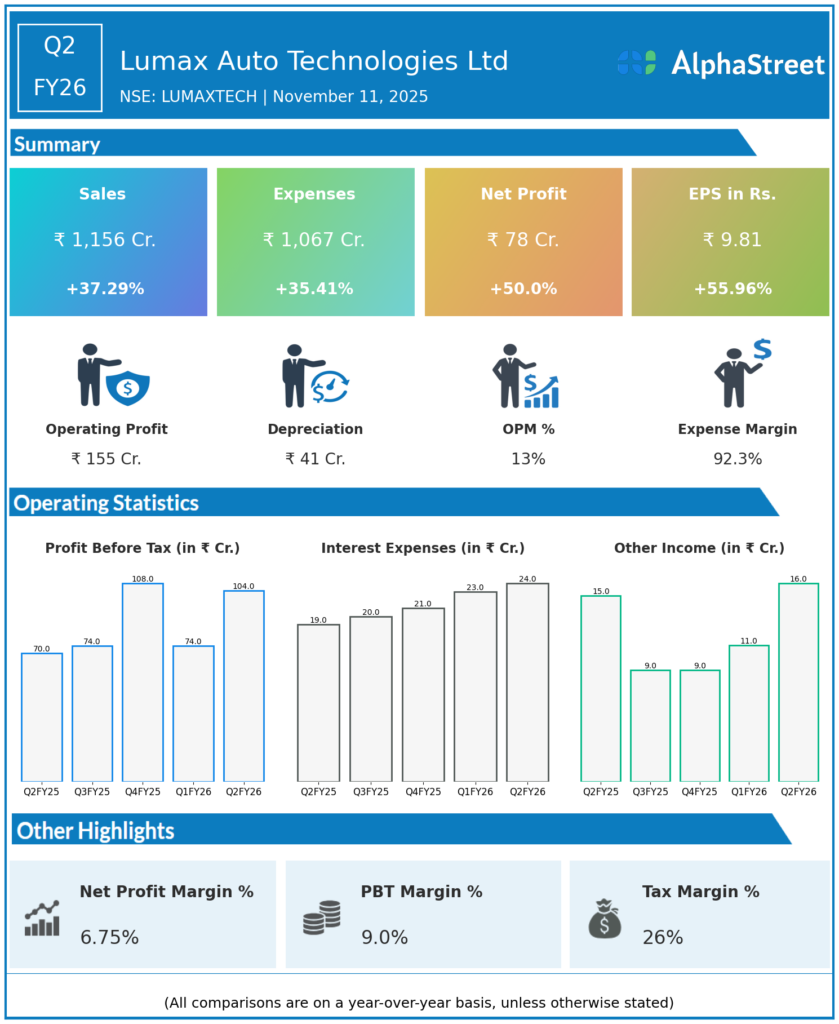

Revenue from Operations: ₹1,156.36 crore, up 37.3% YoY and 12.7% QoQ from ₹1,026.37 crore in Q1 FY26

-

EBITDA: ₹170 crore, up from ₹155 crore in Q2 FY25, with margins improving to 14.7% from 14.0% YoY

-

Profit After Tax (PAT): ₹78 crore, up 50% YoY, with Earnings Per Share (EPS) rising to ₹9.81 from ₹6.29

-

H1 FY26 revenue stood at ₹2,183 crore, up 37% YoY

-

H1 FY26 consolidated net profit ₹132 crore, up 41% YoY

-

Operating margin improvements reflect strong cost management despite inflationary pressures on raw materials and employee expenses

-

Passenger vehicle segment contributed 55% of Q1 FY26 revenue with aftermarket segment growing 12% in Q2 FY26

-

The company reported highest-ever quarterly revenue and net profit in Q2 FY26

-

Working capital intensity remains a factor with current liabilities at ₹1,420 crore

-

No promoter pledged shares with a stable promoter holding of 55.98%

-

Increase in institutional holdings observed, reflecting growing investor confidence

Management Commentary & Strategic Insights

-

Management attributed strong results to sustained demand momentum across product portfolio

-

Strategic focus on high-value products and operational efficiency

-

Continued investments into new technology, including electric vehicle (EV) parts and platform integration

-

Expectation of continued growth supported by healthy order book and improved customer pricing

-

Margin recovery driven by delayed realization of customer price corrections from Q1 FY26

Q1 FY26 Earnings Results

-

Revenue: ₹1,026 crore, up 36% YoY

-

EBITDA: ₹136 crore, up 29% YoY, margin at 13.2%

-

Profit After Tax (PAT): ₹54 crore, up 30% YoY

-

Price corrections by customers impacted margins but expected to be realized in Q2 FY26

-

Strong growth across OEM and aftermarket segments

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.