Stock Data:

| Ticker | NSE: LTTS |

| Exchange | NSE |

| Industry | TECHNOLOGY SERVICES |

Price Performance:

| Last 5 Days | -1.72 % |

| YTD | +23.00 % |

| Last 12 Months | +27.52 % |

Company Description:

L&T Technology Services (LTTS) is a leading global engineering and digital technology solutions company. With a rich heritage of innovation spanning over eight decades, LTTS offers cutting-edge engineering services, research, and development expertise across various industries. Specializing in areas such as automotive, healthcare, telecom, and industrial products, LTTS is at the forefront of delivering transformative solutions to help organizations navigate the complexities of a rapidly evolving technological landscape.

Critical Success Factors:

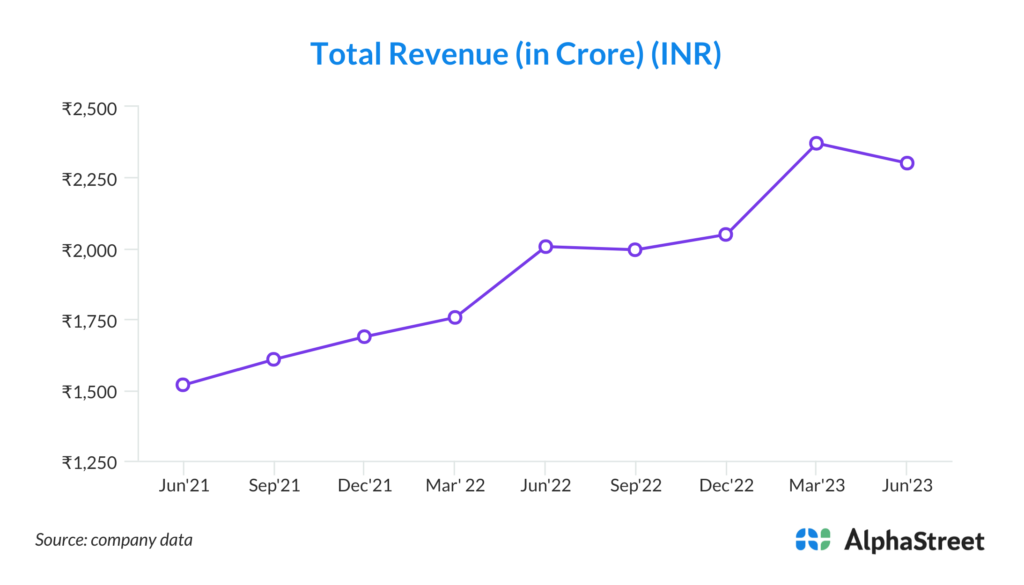

1. Consistent Growth: Despite macro challenges and slowdowns in certain sectors, LTTS has demonstrated impressive resilience by achieving a 10% year-over-year (YoY) growth in constant currency during the reported quarter. This consistent growth showcases the company’s ability to navigate through challenging economic conditions and maintain a positive revenue trajectory.

2. Diversified Revenue Streams: One of LTTS’s key strengths lies in its diversified revenue streams. The company operates across multiple sectors, including Transportation, Medical, Industrial Products, Telecom & Hitech, and Plant Engineering. This diversification minimizes the risks associated with overreliance on a single industry. It allows LTTS to leverage opportunities in different markets and adapt to changing customer demands.

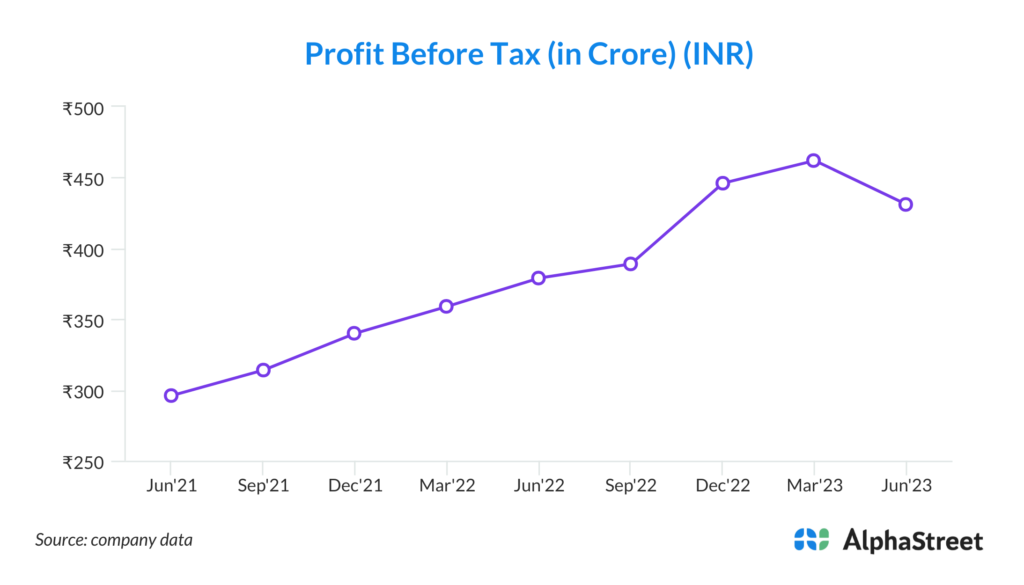

3. Operational Excellence: LTTS has maintained strong operational performance, evident from its impressive EBIT (Earnings Before Interest and Taxes) margin of 17.2%. Even after the integration of Smart World & Communication (SWC), the company has effectively managed costs and ensured profitability. This operational efficiency reflects the company’s commitment to financial discipline and sustainable growth.

4. Large Deal Wins: LTTS’s ability to secure significant deals is a notable strength. The company’s large deal engine continues to perform well, with six deals valued above $10 million, including a substantial $50 million Total Contract Value (TCV) deal signed during the reported quarter. These large deals not only contribute to revenue growth but also enhance the company’s reputation as a trusted engineering and research and development (ER&D) service provider.

5. Innovation and Patents: LTTS places a strong emphasis on innovation, as evidenced by its filing of 55 patents during the quarter. This brings the cumulative count of patents to an impressive 1,145. Innovation is crucial in the ER&D sector, and LTTS’s dedication to intellectual property creation underscores its commitment to providing cutting-edge solutions to clients. These patents can also be monetized in the future, adding to the company’s revenue.

6. Employee Satisfaction and Attrition Management: LTTS’s recognition as a Great Place to Work in both India and Poland, coupled with a significant reduction in attrition by 330 basis points to 18.9%, reflects the company’s ability to attract and retain top talent. A satisfied and stable workforce contributes to enhanced productivity and client satisfaction.

7. Strategic Customer Advisory Council: The company’s establishment of a Customer Advisory Council in Washington DC, comprising CXOs and board members of 16 customer organizations with a collective market capitalization of $2 trillion and revenue of $400 billion, indicates its strong customer relationships. This council provides valuable insights and helps tailor offerings to meet customer needs, fostering long-term partnerships.

8. Strategic Investments: LTTS is strategically investing in emerging technologies, including Artificial Intelligence (AI), Software-Defined Vehicles (SDV), and Cybersecurity. These investments align with industry trends and position the company to capitalize on future market opportunities.

9. Global Expansion: LTTS’s efforts to expand its global footprint are evident in its dedicated sales teams and leadership across regions. The company’s focus on taking SWC global, forming critical partnerships, and winning deals in the next-generation communication space demonstrates its commitment to international growth.

10. Revenue and Margin Trajectory: The company’s strong financial performance in Q1 FY24, including a 14.7% YoY revenue growth and an EBIT margin of 17.2%, reinforces its commitment to achieving sustainable growth and profitability. The margin trajectory remains favorable, with plans to offset headwinds and continue improving margins.

Key Challenges:

1. Economic Uncertainty: The global economy is subject to fluctuations and uncertainties, including recessions and economic downturns. LTTS may face challenges in maintaining growth if clients reduce spending on engineering and research and development (ER&D) services during economic contractions.

2. Industry-Specific Challenges: LTTS operates in various sectors, each with its own unique challenges. For example, the automotive industry is susceptible to market volatility, while the healthcare sector may face regulatory changes. Downturns in specific industries could impact LTTS’s revenue streams.

3. Competitive Landscape: The ER&D services sector is highly competitive, with both established players and new entrants vying for market share. Price competition, especially from offshore competitors, could lead to margin pressures for LTTS.

4. Client Concentration: While LTTS has diversified its client base, it may still face risks associated with client concentration. A significant portion of revenue from a few key clients could expose the company to financial instability if a major client reduces its business with LTTS.

5. Technology Disruption: Rapid technological advancements can disrupt existing business models. LTTS must continually invest in staying at the forefront of emerging technologies to remain competitive.

6. Geopolitical Risks: Changes in trade policies, export restrictions, or geopolitical tensions can affect LTTS’s ability to serve international clients and may lead to uncertainties in global operations.

7. Currency Fluctuations: As a global company, LTTS is exposed to currency exchange rate fluctuations. Sudden currency devaluations can impact the company’s revenue and profitability, especially in regions with volatile currencies.

8. Supply Chain Disruptions: LTTS’s operations may rely on a global supply chain for equipment and software. Disruptions in the supply chain, such as those caused by natural disasters or geopolitical events, can impact project timelines and delivery.

9. Regulatory and Compliance Risks: Different regions have varying regulatory requirements, and changes in regulations can impact the services LTTS provides. Compliance with data privacy and security regulations, for instance, is crucial, given the sensitive nature of client data.

10. Talent Acquisition and Retention: The ER&D sector is highly reliant on skilled talent. Intense competition for skilled engineers and scientists may result in increased labor costs and potential talent shortages.