Larsen & Toubro Infotech Ltd offers extensive range of IT services like application development, maintenance and outsourcing, enterprise solutions, infrastructure management services, testing, digital solutions, and platform-based solutions to the clients in diverse industries. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

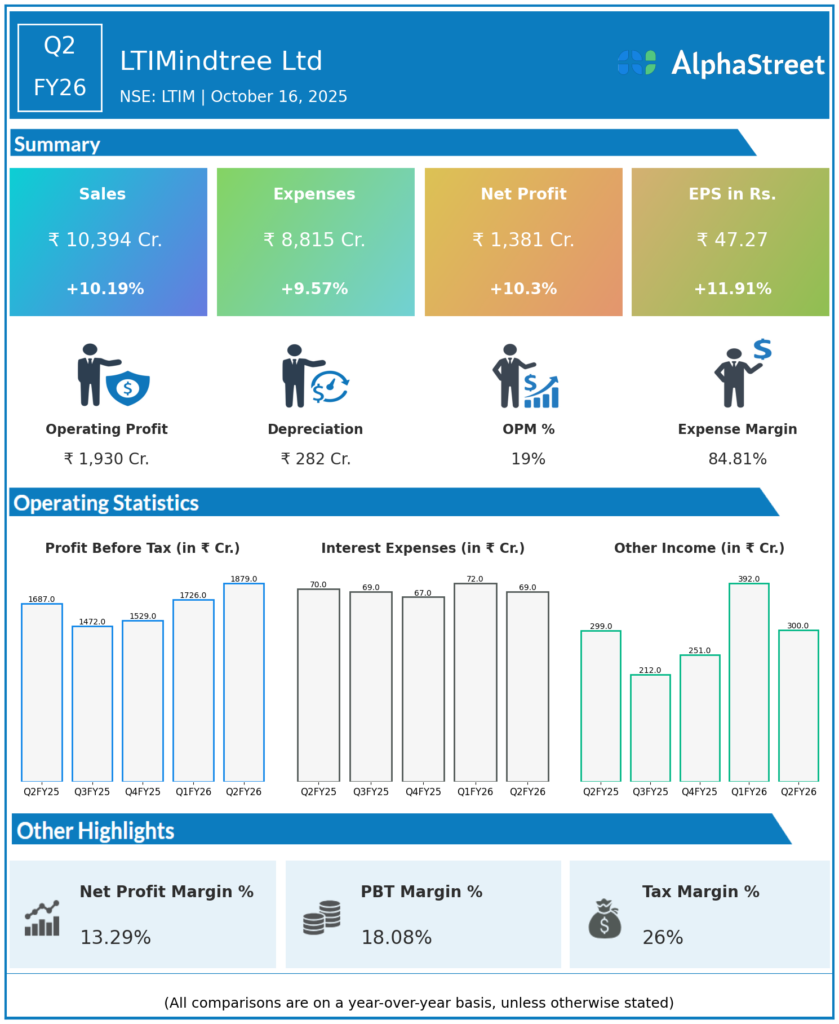

Revenue from Operations: ₹10,394.7 crore, up 10.19% YoY from ₹9,731.8 crore and up 4.9% QoQ from ₹10,232.7 crore.

-

Net Profit (PAT): ₹1,381 crore, up 10% QoQ from ₹1,254.6 crore and up 10% YoY from ₹1,251.6 crore.

-

EBIT: ₹1,648.1 crore, up 17% QoQ from ₹1,406.5 crore; EBIT margin expanded to 15.9% from 14.3% QoQ.

-

Operating Margin: 15.9%, highest in the past seven quarters due to cost optimization and delivery efficiencies.

-

EPS: ₹47.27 vs ₹42.8 QoQ.

-

Large Deal Wins: $530 million TCV, including its largest-ever multi-year strategic deal with a top global media and entertainment company for digital transformation under an AI delivery model.

-

Client Metrics: 749 active clients; 14 new large clients added during the quarter.

-

Headcount: 86,447 employees as of September 30, 2025 (net addition of 2,558 employees QoQ).

-

Revenue Growth (Constant Currency): 4.8% QoQ, 8.9% YoY.

-

Interim Dividend: ₹22 per share declared; record date October 24, 2025, payout within 30 days.

Management Commentary and Strategic Outlook

-

Venu Lambu, CEO & MD:

“Q2 FY26 has been a strong quarter marked by broad-based performance and margin expansion. We remain committed to transforming LTIMindtree into an AI-centric organization through our BlueVerse ecosystem that integrates automation, data, and next-gen delivery”. -

LTIMindtree executed its largest-ever strategic deal with a global entertainment client, reflecting strong credibility in cloud modernization, AI deployment, and vendor rationalization.

-

The company continues to target double-digit revenue growth and 100-bps margin expansion in H2 FY26 through vendor consolidation, AI/ML investments, and enhanced project delivery structures.

-

Key Focus Areas: Strengthening operational excellence, expanding AI and data analytics offerings, and maintaining high utilization and offshore leverage.

-

Management reaffirmed profitability and free cash flow focus while increasing investments in talent and automation.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹9,840.6 crore, up 0.7% QoQ and 5.2% YoY.

-

Net Profit: ₹1,254.6 crore, up 11.2% QoQ; beat street estimates.

-

EBIT: ₹1,406.5 crore, margin at 14.3%, up 50 bps YoY.

-

Large Deal Wins: $476 million TCV across BFSI, manufacturing, and retail verticals.

-

Digital Business Share: Over 61% of total revenue.

-

Dividend: ₹20 per share announced earlier in FY26.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.