Larsen & Toubro Infotech Ltd offers extensive range of IT services like application development, maintenance and outsourcing, enterprise solutions, infrastructure management services, testing, digital solutions, and platform-based solutions to the clients in diverse industries. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

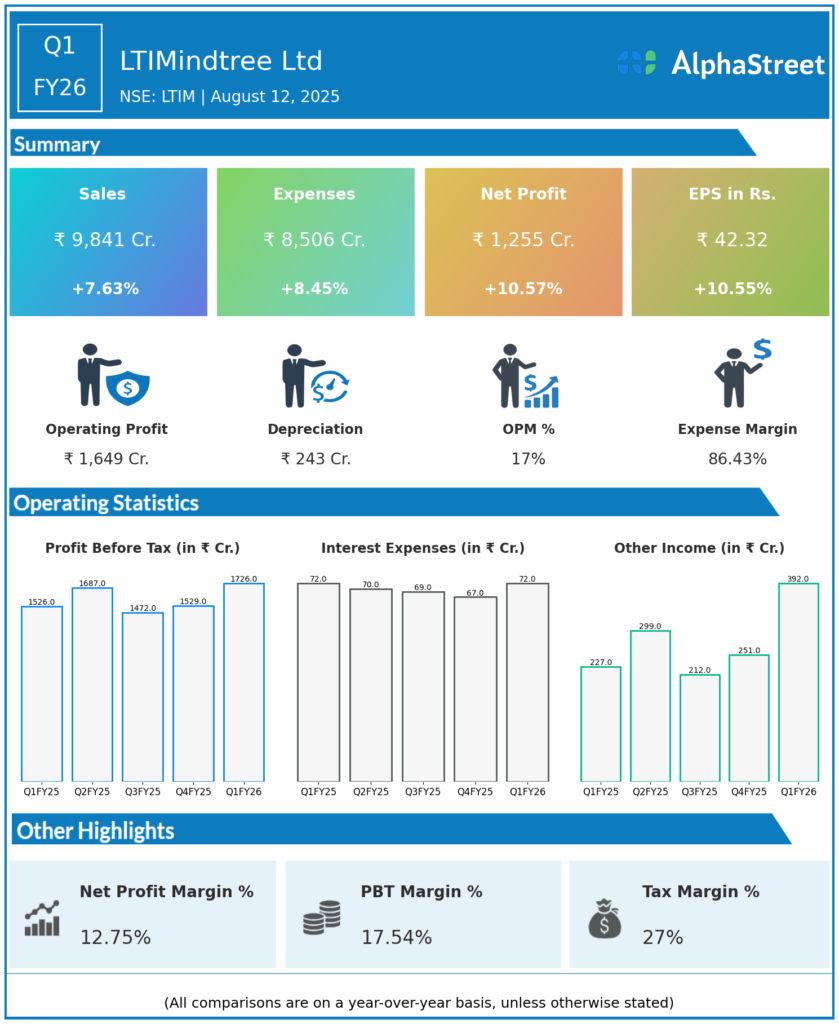

Consolidated Revenue: ₹9,840.6 crore, up 7.6% year-over-year (YoY) from ₹9,143 crore in Q1 FY25 and up 0.7% quarter-on-quarter (QoQ).

-

Net Profit (PAT): ₹1,255 crore, up 10.6% YoY from ₹1,135 crore and up 11.2% QoQ.

-

Operating Profit (EBIT): ₹1,406.5 crore, a 2.6% YoY and 4.5% QoQ increase; EBIT margin improved to 14.3% vs. 13.8% in Q4 FY25.

-

Dollar Revenue: $1,153.3 million, up 5.2% YoY and 2% QoQ.

-

Order Inflow: $1.63 billion, up 16.43% YoY and 2% QoQ.

-

EPS: ₹42.3, up 11% YoY.

-

Client Metrics: 741 active clients; 404 contribute $1mn+ in revenue; top 5 clients generate 27.3% of revenue (vs 28.8% YoY).

-

Free Cash Flow: ₹761 crore (down YoY); cash and equivalents at ₹12,835 crore.

Key Management Commentary & Strategic Highlights

-

CEO Venu Lambu: “We had a promising start to the year, delivering broad-based growth, expanding margins, and making significant progress on our strategic priorities. Our Fit4Future program, sales transformation, and pivot to AI have enhanced agility and strengthened our ability to scale for the future. While the macro environment remains challenging, disciplined execution and unwavering client focus will continue to drive our performance.”

-

Strategic Initiatives:

-

Fit4Future program and sales transformation support operational efficiency and margin expansion.

-

Strong emphasis on AI in both operations and client solutions is driving deal wins and productivity upsides.

-

Order book at record highs, further improving medium-term growth visibility.

-

-

Industry/Segment Performance:

-

BFSI led revenue with 37%, followed by Technology, Media & Communications (23%) and Manufacturing & Resources (20%).

-

North America contributed 74.4% of revenue; Europe 14.7%; RoW 11%.

-

Q4 FY25 Earnings Results

-

Revenue: ₹9,771.7 crore

-

Net Profit (PAT): ₹1,129 crore

-

EBIT Margin: 13.8%

-

Order Inflow: $1.60 billion

-

Results served as a strong base for Q1, which saw margin expansion and profit outperformance despite ongoing macro challenges.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.