Larsen & Toubro Infotech Ltd offers extensive range of IT services like application development, maintenance and outsourcing, enterprise solutions, infrastructure management services, testing, digital solutions, and platform-based solutions to the clients in diverse industries.

Q3 FY26 Earnings Results

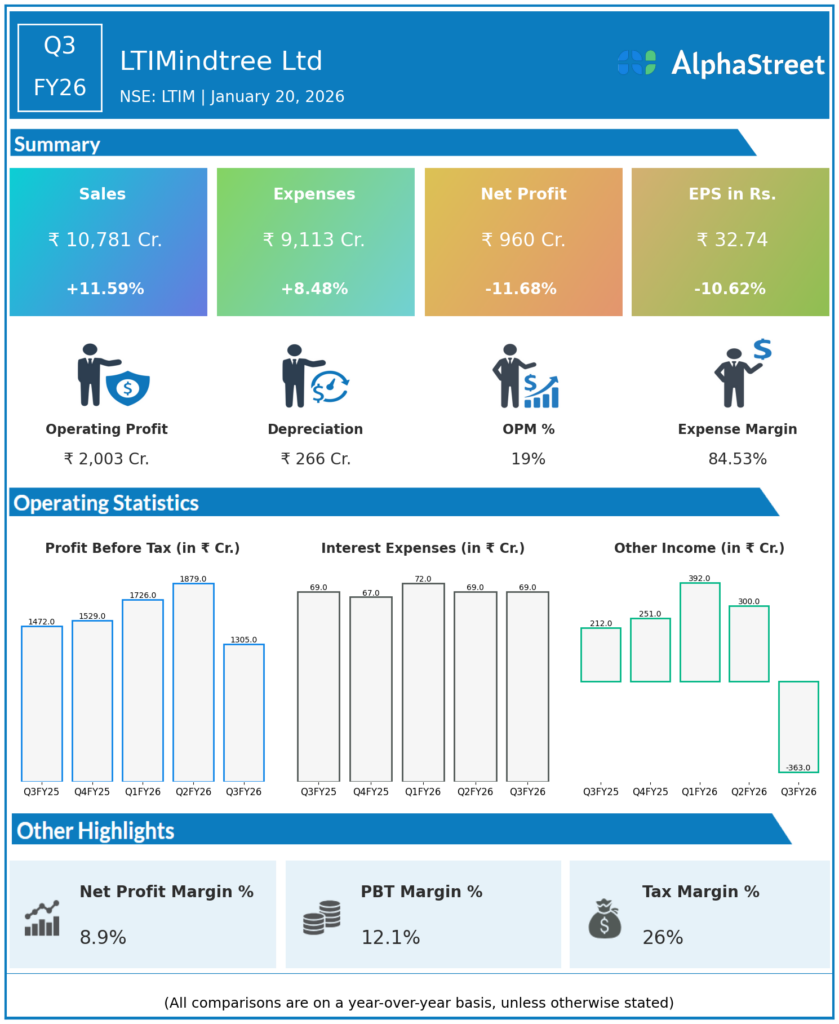

- Revenue from Operations: ₹10,781 crore, up 3.7% QoQ from ₹10,394.7 crore in Q2 FY26 and up 11.6% YoY from ₹9,660.9 crore in Q3 FY25.

- Revenue (USD): USD 1,208 million, up 2.4% QoQ and 6.1% YoY; constant currency growth 2.4% QoQ and 5.2% YoY.

- Operating EBIT (adjusted): ₹17,371 million, up 5.4% QoQ from ₹16,481 million and up 30.7% YoY from ₹13,289 million; adjusted EBIT margin 16.1%, up 20 bps QoQ and up from 13.8% in Q3 FY25.

- Operating EBIT (reported, after New Labour Codes): ₹11,468 million; reported EBIT margin 10.6%–10.7% after a one‑time New Labour Codes impact of ₹5,903 million.

- Profit After Tax (adjusted): ₹14,013 million, up 1.5% QoQ from ₹13,812 million and up 29.0% YoY from ₹10,867 million; adjusted PAT margin 13.0% vs 11.2% in Q3 FY25.

- Profit After Tax (reported): ₹960 Crore , down ~12% YoY, after accounting for a one‑time New Labour Codes hit of ₹1,087 Crores at PAT level.

- EPS (diluted): ₹32.7 vs ₹47.2 in Q2 FY26 and ₹36.6 in Q3 FY25, on an adjusted basis.

- Order inflow (TCV): USD 1.69 billion, flat YoY and up >6% QoQ; fifth consecutive quarter with TCV above USD 1.6 billion.

Management Commentary & Strategic Decisions – Q3 FY26

- Management described Q3 FY26 as a “strong” quarter with third consecutive quarter of 2%+ QoQ growth, reflecting benefits from the AI‑led pivot, large‑deal momentum and operational excellence, even though reported profit was temporarily depressed by labour‑code provisions.

- The CEO highlighted that adjusted EBIT margin reached 16.1% and adjusted PAT grew 29% YoY, driven by Fit‑for‑Future efficiency gains, AI‑driven productivity, and disciplined execution across verticals.

- Strategic focus areas:

- Deepening the AI pivot through differentiated AI‑led offerings and the “New Horizon” cost‑and‑margin programme to sustain margin expansion while funding growth investments.

- Continuing to mine large accounts and win multi‑year transformation deals, supported by a more resilient and balanced portfolio mix across geographies and sectors.

- Managing the New Labour Codes impact as a one‑time reset, with confidence in maintaining mid‑teens EBIT margins on an adjusted run‑rate basis going forward.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹10,394.7 crore, up 5.2% QoQ from ₹9,840.6 crore in Q1 FY26 and up 10.2% YoY from ₹9,731.8 crore in Q2 FY25.

- Revenue (USD): USD 1,180.1 million, up 2.3% QoQ and 4.8% YoY; constant currency growth 2.4% QoQ and 4.4% YoY.

- Operating EBIT: ₹16,481 million, up 17.2% QoQ from ₹14,068–14,065 million and up strongly YoY; EBIT margin 15.9%, expanding 160 bps QoQ from 14.3% and higher YoY.

- Profit After Tax (PAT): ₹13,812–13,81X million, up ~10% QoQ from ₹12,546 crore and up 10.4% YoY from ₹12,516 crore; PAT margin about 13.3%.

- EPS: ₹47.27 vs ₹42.8 in Q1 FY26 and lower base a year ago.

- Order inflow (large deals): USD 530 million TCV, including the company’s largest‑ever multi‑year strategic deal with a top global media and entertainment company under an AI‑centric delivery model, plus a major global financial institution partnership.

Management Commentary & Strategic Directions – Q2 FY26

- Management described Q2 FY26 as a quarter of broad‑based growth with revenue, EBIT and PAT all improving QoQ and YoY, supported by strong deal wins and expanding margins.

- EBIT margin expansion to 15.9% was driven by productivity gains, pyramid optimisation, and operating‑efficiency initiatives, even as the company continued investing in AI, cloud and industry solutions.

- Strategic themes:

- Scaling AI‑centric delivery and large, complex transformation engagements with global enterprises in media, BFSI and other verticals.

- Maintaining a strong deal pipeline and healthy TCV to support mid‑single‑digit to high‑single‑digit growth with a focus on profitable, high‑quality revenue.

- Returning more cash to shareholders via dividends (₹22 interim dividend) while sustaining investments in talent and technology platforms.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.