LTTS is an engineering services provider incorporated in 2012, offers engineering,, research and development (ER&D) and digitalization solutions to companies in the areas such as Transportation, Industrial Products, Telecom and Hi-Tech, Medical Devices and Plant Engineering. LTTS’ customer base includes 69 Fortune 500 companies and 53 of the world’s top ER&D companies. The business also provides digital engineering advisory services. The company went public on September 23, 2016. LTTS has 296 global clients in 25+ countries.

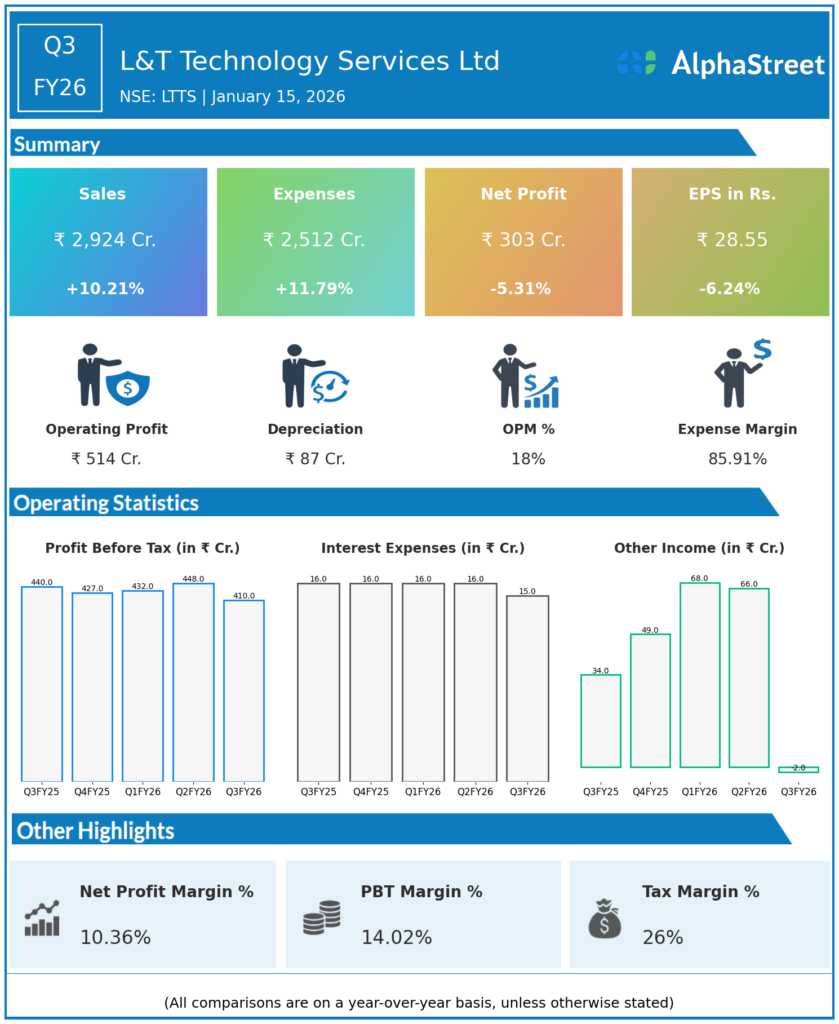

Q3 FY26 Earnings Results

- Revenue from Operations: ₹2,923.5 crore, up 10.2% YoY from ₹2,653 crore; down 1.8% QoQ from ₹2,979.5 crore in Q2 FY26.

- USD Revenue: USD 326.3 million, up 4.6% YoY.

- EBIT: ₹426.7 crore, up about 7% QoQ from ₹397.8 crore in Q2 FY26; EBIT margin 14.6%, expanding 120 bps QoQ from 13.4%.

- Profit After Tax (reported): ₹302.6 crore, down ~6–8% YoY from ₹322.4 crore and down 7.9% QoQ from ~₹329 crore, due to a labour‑code related exceptional charge of about ₹35.4 crore (₹354 million).

- Profit After Tax (underlying / ex‑labour code): Around ₹329 crore, up roughly 2% YoY, indicating underlying profit growth when adjusted for the one‑off provision.

- Order book / deals: Q3 marked the fifth consecutive quarter with large‑deal TCV above USD 200 million, underlining sustained deal‑win momentum.

- Headcount: 23,639 employees as of Q3 FY26.

Management Commentary & Strategic Decisions – Q3 FY26

- Management noted that revenue grew double‑digit YoY while EBIT margin expanded to 14.6%, supported by a better mix, operating efficiencies and disciplined cost control, even as reported PAT was impacted by the New Labour Codes provision.

- The CEO highlighted continued strength in large deals, with average quarterly TCV of ~USD 200 million for five straight quarters, reflecting strong client confidence in LTTS’s engineering and digital offerings.

- Segment trends:

- Mobility: Showing early signs of turnaround despite a seasonally soft quarter.

- Sustainability: Continued to grow at double‑digit rates YoY for yet another quarter, remaining a key growth pillar.

- Tech & Platforms: Remained resilient, backed by demand in software, platforms and digital engineering.

- Strategic focus areas reiterated:

- Doubling down on value‑accretive, high‑growth, high‑margin areas such as Sustainability, Mobility, AI/Gen‑AI and digital engineering, as part of the multi‑year “Lakshya” plan.

- Sharpening focus on “Engineering Intelligence” – integrating physical engineering with AI and analytics to drive full‑stack solutions for clients.

- Continued emphasis on margin expansion through better pyramid, offshore leverage, SG&A discipline and portfolio mix, even as the company guides for mid‑single‑digit overall growth in FY26.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹2,979.5 crore, up 15.8% YoY and 4.0% QoQ.

- USD Revenue: USD 337 million, up 10.4% YoY and 1.3% QoQ in constant currency.

- EBIT: ₹3,995 crore equivalent in ₹ million terms (₹3,995 million), with EBIT margin at 13.4%, up 10 bps QoQ.

- Profit After Tax (PAT): ₹328.7 crore, up 2.8% YoY from ~₹320 crore and up 4.1% QoQ from ~₹316 crore in Q1 FY26.

- Headcount: Around 23,678 employees; LTM attrition ~14.8%, indicating stabilising workforce metrics.

- Large deals: Record high large‑deal TCV of nearly USD 300 million in Q2, including one deal above USD 100 million.

Management Commentary & Strategic Directions – Q2 FY26

- Management pointed to broad‑based revenue growth across verticals, with INR revenue up ~16% YoY and 4% QoQ, supported by steady traction in digital and engineering‑led transformation deals.

- EBIT margin at 13.4% was supported by operating leverage, contained SG&A at ~11.5% of revenue, and stable gross margins, despite continued investment in growth and talent.

- Strategic themes stressed in Q2:

- Strong momentum in AI‑powered engineering, EV, sustainability and digital engineering solutions across industrial, automotive, telecom and software & platform clients.

- Reinforcing the “Go Deeper to Scale” and multi‑segment strategy to deepen client relationships and drive larger, multi‑year deals.

- Maintaining a positive outlook for FY26 with a focus on double‑digit growth over the medium term and a medium‑term revenue aspiration of around USD 2 billion.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.