LTTS is an engineering services provider incorporated in 2012, offers engineering,, research and development (ER&D) and digitalization solutions to companies in the areas such as Transportation, Industrial Products, Telecom and Hi-Tech, Medical Devices and Plant Engineering. LTTS’ customer base includes 69 Fortune 500 companies and 53 of the world’s top ER&D companies.The business also provides digital engineering advisory services.The company went public on September 23, 2016. LTTS has 296 global clients in 25+ countries. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

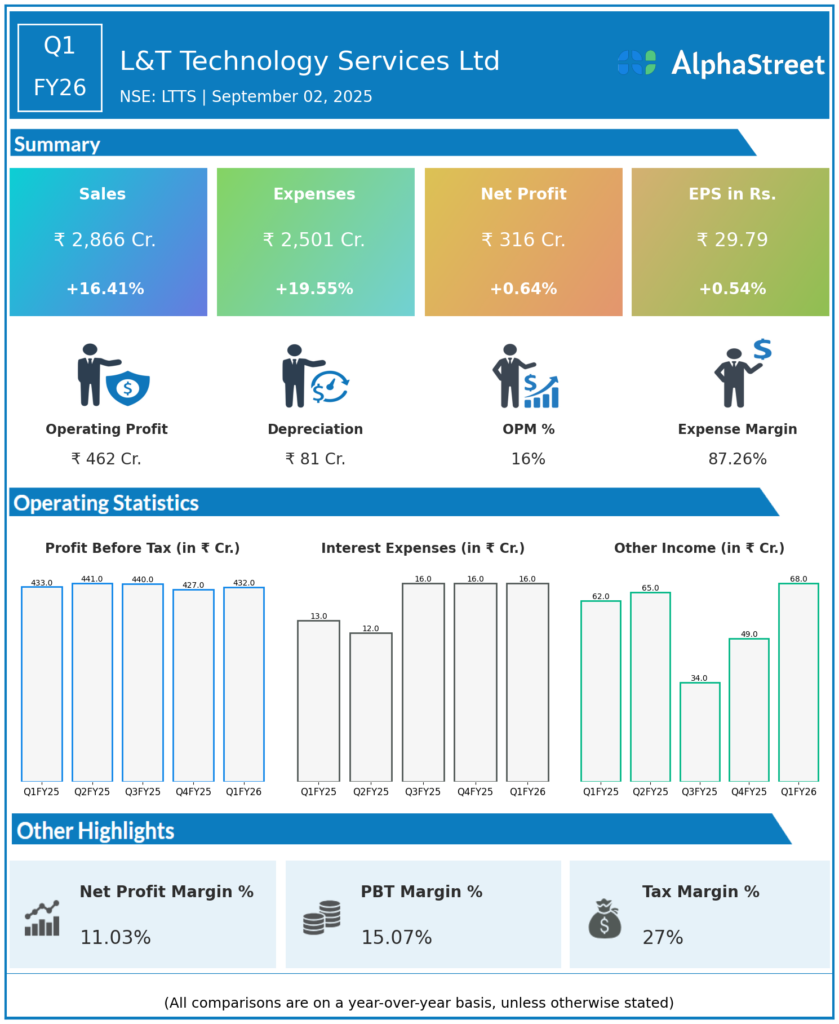

Revenue: ₹2,866 crores, up 16.4% YoY (Q1 FY25: ₹2,464 crores) and up 1.6% QoQ (Q4 FY25: ₹2,819 crores).

-

Net Profit (PAT): ₹316 crores, up 0.7% YoY (Q1 FY25: ₹314 crores) and stable QoQ.

-

EBIT Margin: 13.3% (Q1 FY25: 14%), slight compression due to wage hikes.

-

USD Revenue: $335.3 million, up 13.6% YoY and 2% QoQ.

-

Deal Wins: Several large deal bookings in USD 10M+ range including a USD 50M deal, supporting strong pipeline.

-

Order Book: Increased significantly, enhancing medium-term revenue visibility.

-

Growth Drivers: Sustained momentum from diverse verticals, notably sustainability achieving double-digit growth.

-

Investments: Focus on AI, automation, and advanced technologies with new design center opened in Plano, Texas for cybersecurity and AI specialization.

Management Commentary & Strategic Highlights

-

CEO Amit Chadha highlighted strong start to FY26 driven by large deal momentum and multi-segment diversification.

-

Company’s Fit4Future program and sales transformation improved operational efficiency and margins.

-

AI deployment is central to future growth, with multiple programs launched and proprietary PLxAI product accelerating product development lifecycle.

-

Confidence expressed in doubling revenue to USD 2 billion medium-term target supported by robust client demand and order book.

Q4 FY25 Earnings Results

-

Revenue: ₹2,982 crores.

-

Net Profit (PAT): ₹310 crores.

-

EBIT Margin: Approximately 14%.

- EPS: ₹29.38

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.