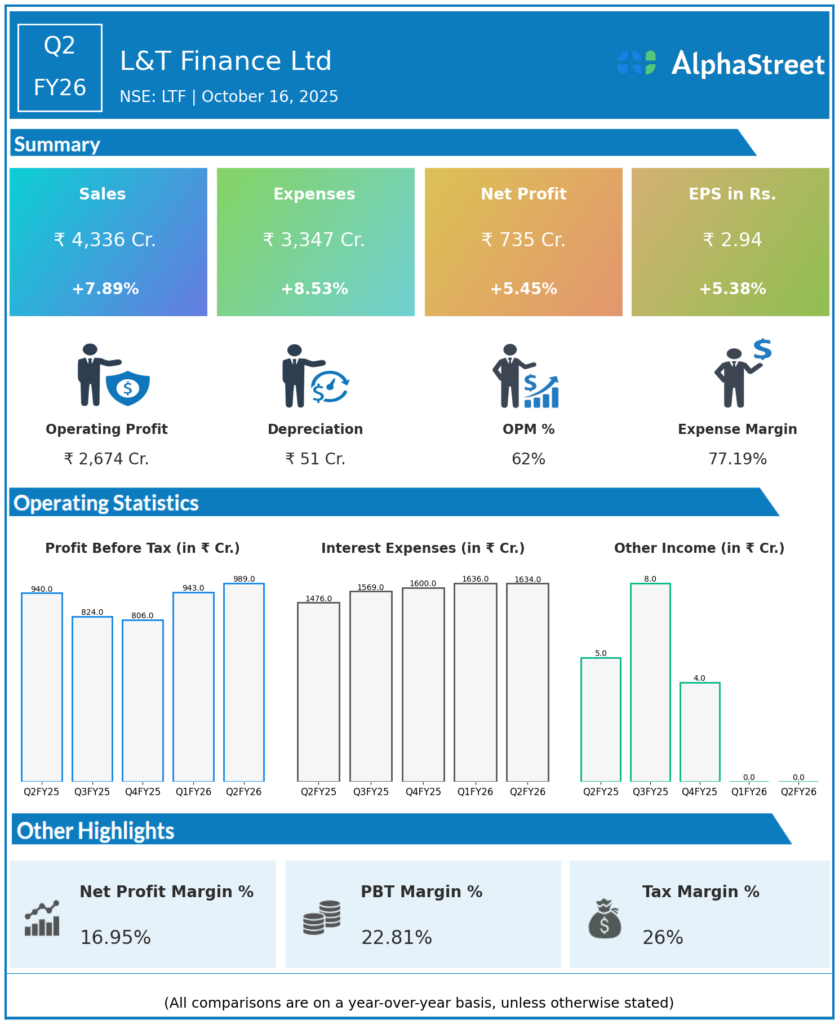

L&T Finance Ltd. is a NBFC, offering a range of financial products and services. Company has filed requisite application for necessary registration as Systemically Important Non- Deposit Accepting Core Investment Company (NBFC-CIC). Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

Consolidated Net Profit (PAT): ₹735 crore, up 5.4% YoY from ₹696 crore in Q2 FY25.

-

Total Income: ₹4,336 crore, up 7.8% YoY from ₹4,024 crore.

-

Assets Under Management (AUM): ₹1,07,096 crore, up 15% YoY from ₹93,015 crore.

-

Retail Loan Book: ₹1,04,607 crore, up 18% YoY from ₹88,975 crore; retailization stands at 98% of portfolio.

-

Quarterly Retail Disbursements: ₹18,883 crore, up 25% YoY from ₹15,092 crore.

-

Credit Cost: Reduced to 2.41% from 2.59% YoY.

-

Return on Assets (RoA): 2.41% and Return on Equity (RoE): 11.33%.

-

Segment Highlights:

-

Rural Business Finance disbursed ₹6,316 crore, up 16% YoY.

-

Personal Loans disbursed ₹2,918 crore, up 114% YoY (key growth driver).

-

Two-wheeler finance saw 5% YoY growth to ₹2,512 crore.

-

SME Finance grew 18% YoY to ₹1,468 crore disbursements.

-

Gold Loans segment grew to ₹1,475 crore with ₹983 crore disbursed.

-

-

Digital Initiatives: Launch of ‘Project Nostradamus’ AI portfolio management and big-tech partnership with Google Pay for personal loans origination.

-

Branch Expansion: Plans to increase gold loan branches from current ~130 to 330 by FY26 end.

Management Commentary

-

CEO Sudipta Roy highlighted the strong retail lending momentum, digital transformation, and expanded product portfolio as drivers of growth.

-

Emphasis on improving asset quality, credit cost control, and maximizing technology-driven efficiencies across loan disbursement and collection processes.

-

Expressed optimism for growth acceleration in H2 FY26, supported by anticipated festive demand and GST reforms.

Q1 FY26 Earnings Results

-

Net Profit: ₹696 crore.

-

Total Income: ₹4,024 crore.

-

Retail Loan Book: ₹88,975 crore.

-

RoE: 11.65%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.