A month ago, a friend walked into a reputed private hospital for what he thought was a routine knee scan. Half an hour in a spotless waiting room, one MRI, and an unnecessary “quick consult” later, ₹28,000 had quietly left his bank account. His knee still hurt but now so did his wallet.

Ask around, and you’ll hear variations of the same story everywhere. Bills padded with tests no one remembers asking for. Multiple departments insisting on “just a quick check.” Corporate hospitals that feel less like places of care and more like finely tuned revenue machines.

It leaves you wondering, are hospitals treating patients, or optimizing balance sheets?

A System Built for Too Few

To understand what’s really going on, imagine a railway station designed for 10,000 commuters, but forced to handle 40,000 every morning. That’s India’s hospital system today.

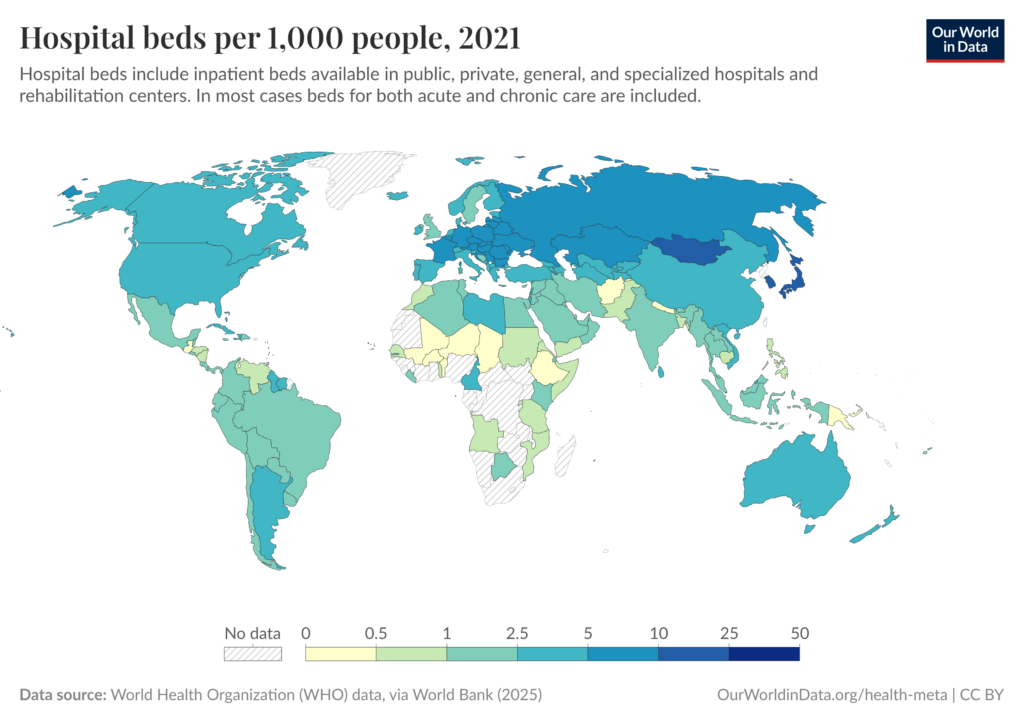

India has roughly 1.6 hospital beds per 1,000 people. The World Health Organization recommends nearly double that. In practice, it means one hospital bed for every thousand Indians competing for it. The gap is so wide that healthcare stops being a medical issue and becomes a financial one. Nearly two thirds of healthcare spending in India still comes directly out of people’s pockets.

For years, this shortage didn’t trigger a massive expansion. Instead, hospitals squeezed more money out of what they already had.

How Hospitals Grew Without Building

Until recently, growth in India’s private hospital sector didn’t come from adding capacity. It came from pushing up ARPOB (Average Revenue Per Occupied Bed). In simple terms, hospitals earned more by charging more per patient, not by treating more patients.

That model has limits. You can only raise bills so much before pushback begins.

And that’s where the shift is happening.

Why the Expansion Is Finally Happening

India’s corporate hospital chains are now entering their largest expansion phase in over a decade. After years of consolidation following 2017 and the disruption of COVID, the sector is pivoting hard toward volume led growth.

Over the next three to five years, leading hospital operators plan to increase bed capacity by 35–40%. Around 13 major hospital groups, both listed and unlisted are expected to add nearly 14,500 beds by FY27. That expansion will require capital expenditure of roughly ₹32,000 crore.

The reason this expansion looks viable now is because three forces have aligned at the same time.

First, health insurance coverage is finally scaling. Second, patients are increasingly willing to pay for quality care. And third, hospitals are generating enough internal cash to fund growth without straining their balance sheets.

The Uncomfortable Reality of India’s Healthcare Gap

India’s healthcare infrastructure has failed to keep up with its economic progress. Over the past decade, GDP per capita has nearly doubled. Healthcare spending has not.

India spends just under 4% of its GDP on healthcare, far below countries like Brazil, Mexico, or Russia. And a majority of that spending still comes from the private sector.

The consequences are severe. Every year, healthcare expenses push millions of Indians below the poverty line. Even flagship schemes like Ayushman Bharat rely heavily on private hospitals to function at scale.

Data from the National Health Authority makes this clear. Although private hospitals form less than half of empanelled facilities, they account for over half of hospitalisations and nearly two-thirds of total healthcare spending under government schemes.

In short, the system now depends on private players, whether policymakers like it or not.

Why New Beds Won’t Hurt Profits

One might expect such aggressive expansion to pressure margins. But that hasn’t been the case.

Demand is strong enough to absorb new capacity quickly. Insurance penetration is rising. Incomes are improving. India’s population is ageing. All of this points to structurally higher healthcare usage.

As a result, hospitals can add beds without sacrificing EBITDA margins. Unlike earlier cycles, this expansion isn’t speculative. The demand already exists.

Insurance Has Changed Everything

A decade ago, most hospital bills were paid directly by patients. Today, that dynamic is changing rapidly.

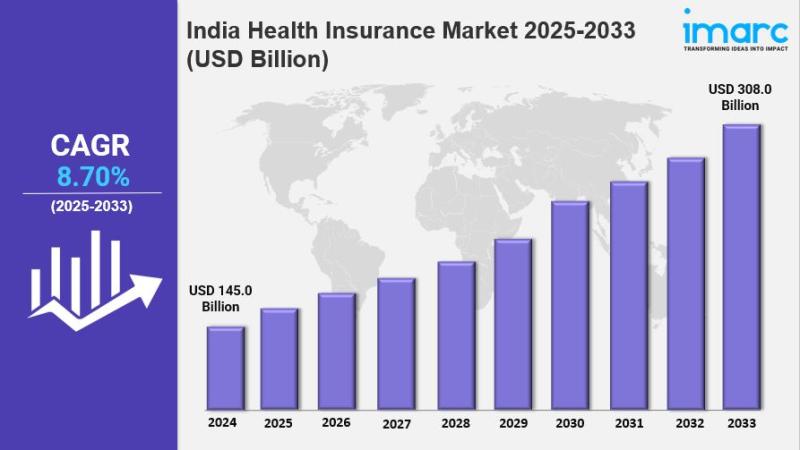

Health insurance coverage has expanded from roughly 20 crore Indians in FY14 to around 55 crore by FY23. Even now, less than half the country is insured which tells hospitals and insurers alike that growth has plenty of runway.

Premium collections are rising even faster than coverage, especially after COVID. Insurers have repriced risk, and consumers are opting for higher coverage limits. For hospitals, this means better paying patients and fewer unpaid bills.

As insurance spreads, hospitals don’t need to manufacture demand. It arrives organically.

Medical Tourism: High Margins, No Extra Beds

Another quiet tailwind is medical tourism.

India has become a preferred destination for global patients, thanks to a rare mix of affordability, quality, and accessibility. Procedures cost a fraction of what they do in developed markets, and India is geographically well connected to Southeast Asia, Africa, and the Middle East.

Medical tourists pay three to five times the domestic ARPOB. They prefer accredited, metro based hospitals. And crucially, they improve margins without increasing bed count.

Estimates suggest medical tourist inflows could rise from about 7 lakh patients today to nearly 30 lakh by 2030 with most of that demand captured by large private hospital chains.

Who’s Pulling Ahead

Not all hospitals benefit equally.

Large players like Apollo Hospitals, Max Healthcare, Fortis, Medanta, and Narayana Health are steadily widening the gap. Over the past three years, their revenues have grown at a 14–22% CAGR, well ahead of overall healthcare spending.

Their advantage lies in geography and case mix. These hospitals are concentrated in metro cities where incomes are higher, insurance coverage is deeper, and treatments are more complex.

That translates into pricing power. Max Healthcare earns nearly ₹78,000 per occupied bed per day. Fortis, Medanta, and Apollo aren’t far behind. These figures are significantly higher than the industry average.

The market has taken notice. These companies trade at premium valuations not because healthcare is growing, but because scale, predictability, and operating leverage are hard to replicate.

So, Who Really Benefits?

India’s hospital sector sits at a strange crossroads.

On one side are obvious failures overcrowding, high out-of-pocket spending, uneven access, and underfunded public infrastructure.

On the other side, something has genuinely changed. Corporate hospitals are financially stronger. Insurance is transforming healthcare from a distress purchase into a planned expense. Medical tourism is rising. Capital is flowing. And for the first time in years, capacity is being added at scale.

This expansion won’t magically make healthcare affordable for everyone. It won’t fix public hospitals overnight.

But it does mark a shift. India is finally building healthcare capacity instead of rationing it.

The real question isn’t whether hospitals will grow instead they will. The question is who that growth ultimately serves. Will it narrow the gap between demand and access? Or will it create a world-class healthcare system that only some can afford?

The answer will shape India’s healthcare story over the next five years and it will affect every Indian, whether as a patient, policymaker, or investor watching one of the country’s most critical sectors transform in real time. For more such stories follow Alphastreet