Lodha Developers Ltd is primarily engaged in the business of real estate development. It is among the largest real estate developers in terms of presales and development pipeline in India with a presence in MMR, Pune and entered in Bengaluru market in Nov’23. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

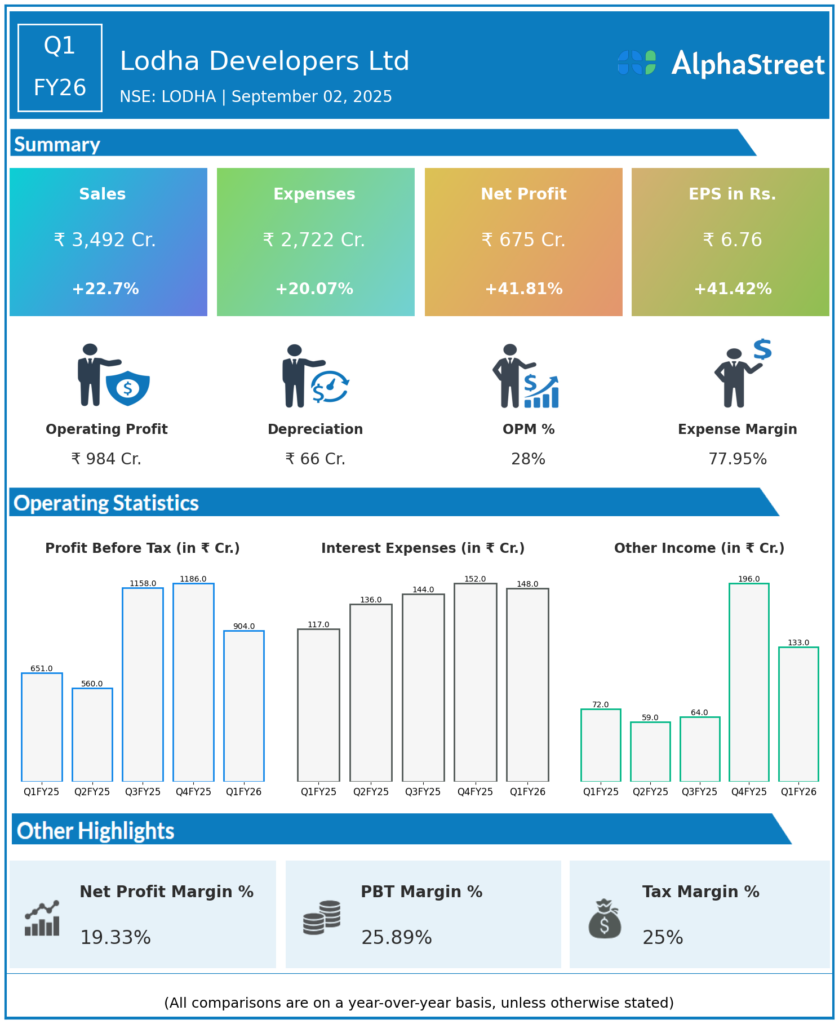

Revenue from Operations: ₹3,492 crores, up 22.7% YoY (Q1 FY25: ₹2,847 crores), down 11.4% QoQ (Q4 FY25: ₹3,941 crores).

-

Profit After Tax (PAT): ₹675 crores, up 42% YoY (Q1 FY25: ₹475.9 crores), nearly flat QoQ (Q4 FY25: ₹667 crores).

-

Adjusted EBITDA: ₹1,200 crores, up 25% YoY, margin at 34.4% (Q1 FY25 margin: 26.6%).

-

Pre-sales: ₹4,450 crores, a 10% YoY increase, reflecting strong consumer demand despite two weeks of geopolitical uncertainty impacting sales.

-

Collections: ₹2,880 crores, up 7% YoY.

-

Gross Development Value (GDV) Added: Five new projects with combined GDV of ₹22,700 crores spread across Mumbai Metropolitan Region, Pune, and Bengaluru, taking total GDV since IPO to over ₹1 trillion.

-

Net Debt: ₹5,080 crores; net debt-to-equity ratio at 0.24x, well below guided ceiling of 0.5x. Cost of debt reduced by 40 bps to 8.3%.

-

Earnings Per Share (EPS): ₹6.76.

Management Commentary & Strategic Highlights

-

Abhishek Lodha, MD & CEO, emphasized that Q1 FY26 was Lodha’s best-ever first-quarter pre-sales performance, highlighting strong brand appeal and execution of the strategic land acquisition ‘supermarket’ approach.

-

Industry tailwinds include low homeownership levels, rising household incomes, strong affordability, and low mortgage rates, which all support sustainable topline growth.

-

Management maintains FY26 guidance for 20% topline growth, 17% increase in operating cash flow, and net project additions of around ₹25,000 crores.

-

The company continues to focus on geographic expansion, product portfolio diversification, and sustainability initiatives as pillars for future growth.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹4,224 crores.

-

Profit After Tax (PAT): ₹923 crores.

-

EPS: ₹9.24.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.