LMW Limited (LMW.NS) reported largely unchanged revenue and weaker profitability for the third quarter ended December 2025, as subdued textile machinery demand and one-time regulatory costs continued to weigh on earnings. Market capitalization was about ₹155.6 billion, reflecting share price trends and investor sentiment around cyclical demand in capital goods.

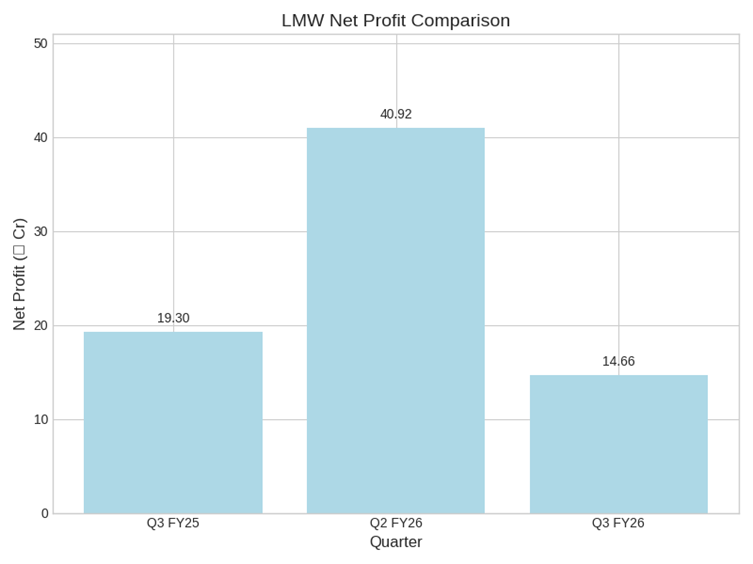

Revenue from operations for the quarter stood at ₹767 crore, compared with ₹776 crore in the preceding quarter. Profit before tax declined to ₹56 crore from ₹59 crore in the September quarter, reflecting higher employee-related expenses and exceptional compliance-related charges.

Financial Performance

For the nine months ended December 2025, the textile machinery and engineering equipment maker posted revenue of ₹2,228 crore, up from ₹2,120 crore in the corresponding period last year. Profit before tax for the period rose to ₹149 crore from ₹93 crore a year earlier, supported by stronger performance in the machine tools and foundry segment.

During the quarter, LMW recorded exceptional expenses of about ₹11.5 crore related to new labor regulations, along with ₹1.29 crore toward voluntary retirement schemes. These one-time items reduced reported profitability and limited margin expansion during the period.

On a consolidated basis, revenue for the nine-month period increased to ₹2,274 crore from ₹2,008 crore a year earlier, while consolidated profit rose to ₹104 crore from ₹90 crore.

Segment and Operational Performance

The Textile Machinery Division (TMD), the company’s largest business, reported quarterly revenue of ₹440 crore, down from ₹461 crore in the previous quarter. For the nine months ended in December, TMD revenue declined about 2% year over year to ₹1,316 crore, reflecting weak capital spending by textile manufacturers.

The division posted a quarterly loss of ₹3 crore, though cumulative losses narrowed from the prior year due to cost controls and restructuring measures. However, lower capacity utilization continued to weigh on operating efficiency, prompting the company to maintain a five-day workweek at several facilities.

Overseas operations delivered mixed results. LMW Global recorded nine-month revenue of ₹128 crore, up from ₹75 crore a year earlier, but posted a quarterly loss of ₹25 crore due to soft export demand and limited operating leverage. Operations in China reported stable revenue but higher losses, reflecting persistent pricing and demand pressures.

The Machine Tool and Foundry Division remained the main growth driver, with nine-month revenue rising to ₹853 crore from ₹728 crore in the prior year. About 12% of this came from the foundry segment. The ATC business also reported higher turnover of ₹150 crore, supported by steady industrial demand.

As of December 2025, LMW’s order book stood at about ₹2,600 crore, including confirmed orders of around ₹1,500 crore. Domestic customers accounted for 65% of nine-month sales, while exports contributed 9% and spares made up 26%.

Cost and Margin Drivers

Profitability during the quarter was affected by labor cost inflation following regulatory changes, restructuring expenses, and lower utilization in the textile machinery segment. Stable input prices and energy costs provided limited support to margins.

The company continued to emphasize cost rationalization, productivity improvements, and operational efficiency to mitigate margin pressures.

Management Commentary

Management said it remains focused on strengthening the order pipeline, improving execution capabilities, and expanding selectively in overseas markets. Investments in automation, digitalization, and advanced manufacturing platforms remain key priorities.

Executives highlighted the need to monitor domestic textile demand closely while maintaining service networks in export markets. Disciplined capital allocation and working capital management continue to guide strategic decisions.

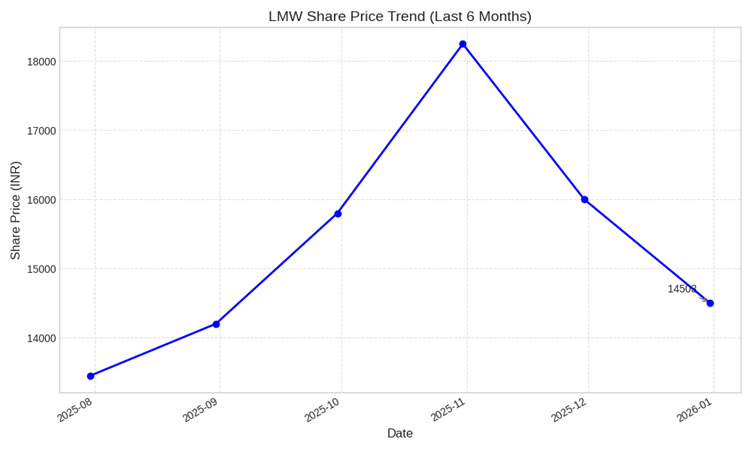

Market Reaction and Outlook

LMW shares traded modestly lower following the results announcement, reflecting investor caution over profitability pressures in the textile machinery business. The company said it will continue to prioritize order execution, margin recovery, and capacity utilization improvement in the coming quarters. Management reiterated its focus on strengthening the order book and managing regulatory and demand-related risks.