Linde India Limited, a subsidiary of BOC Group,UK (owns 75% stake in the co), is primarily engaged in manufacture of industrial and medical gases and construction of cryogenic and non cryogenic air separation plants.

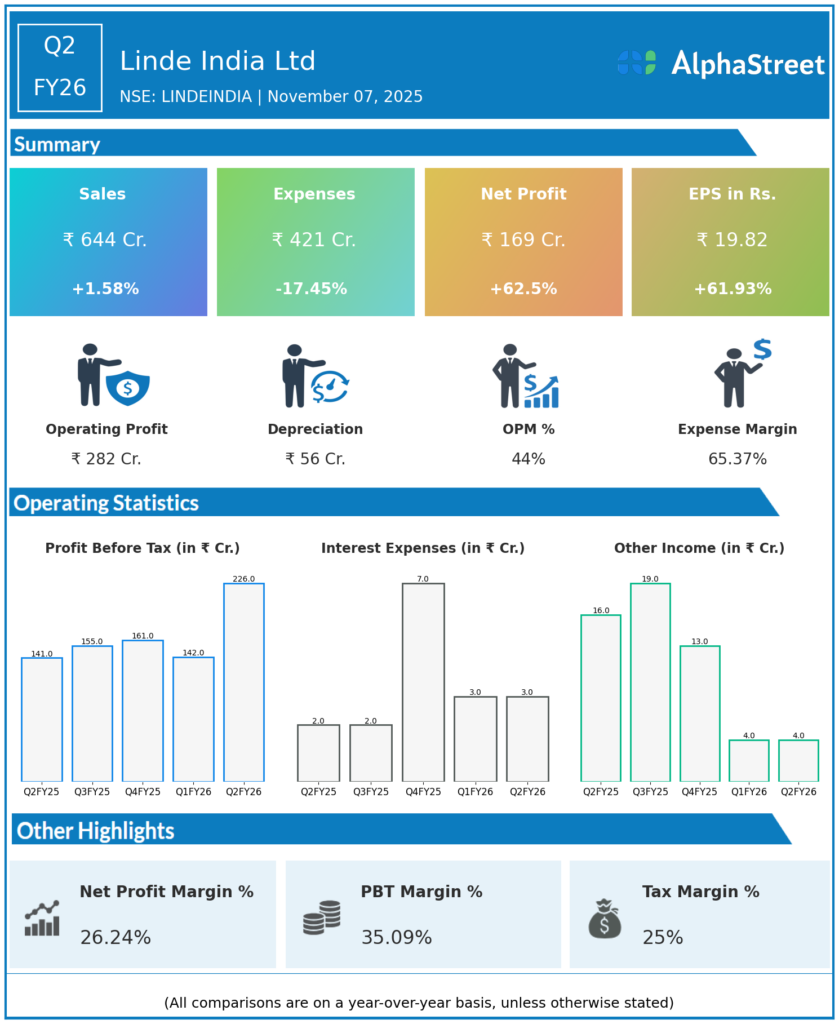

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹644.19 crore, up 1.54% YoY from ₹634.42 crore and 12.80% QoQ from ₹571.08 crore in Q1 FY26.

-

Operating Profit (EBITDA): ₹282.32 crore, margin at 43.83%—up 9.33 percentage points QoQ and 15.64 YoY, the highest in at least eight quarters.

-

Profit Before Tax (PBT): ₹228.28 crore, up 58.15% QoQ from ₹144.34 crore.

-

Profit After Tax (PAT): ₹169.00 crore, up 63% YoY from ₹106.42 crore in Q2 FY25 and 59.53% QoQ from ₹107.19 crore in Q1 FY26.

-

PAT margin: 26.54%, a significant 7.77 percentage point improvement from Q1 FY26 and 9.77 YoY.

-

Earnings per Share (EPS): ₹19.82, up 62% YoY from ₹12.24.

-

Segments:

-

Gases and Related Products

-

Project Engineering (precise numbers not reported, but both supported the result).

-

-

Interim Dividend: ₹1.00 per share declared for FY26.

-

Ongoing regulatory proceedings with SEBI regarding related-party transactions with Praxair India.

Management Commentary & Strategic Insights

-

Significant margin expansion driven by robust operational efficiency, strict cost control, and a favourable product mix.

-

The management highlighted that even as revenue growth slowed, competitive positioning and cost leadership enabled outperformance on all profitability metrics.

-

The company remains cautious on top-line growth as the broader business environment remains soft versus the five-year historical average.

-

Management is addressing ongoing legal and regulatory matters, reaffirming focus on compliance and sustainability.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹571.08 crore, down 12.58% YoY from ₹653.23 crore.

-

Profit After Tax (PAT): ₹107.19 crore, down 5.72% YoY from ₹113.69 crore.

-

PAT margin: 18.77%.

-

Earnings per Share: ₹12.60, down from ₹13.30 YoY.

-

Management highlighted a revenue dip due to demand-side pressures, but stable profitability owing to operational improvements and margin discipline

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.