Linde India Limited, a subsidiary of BOC Group,UK (owns 75% stake in the co), is primarily engaged in manufacture of industrial and medical gases and construction of cryogenic and non cryogenic air separation plants. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

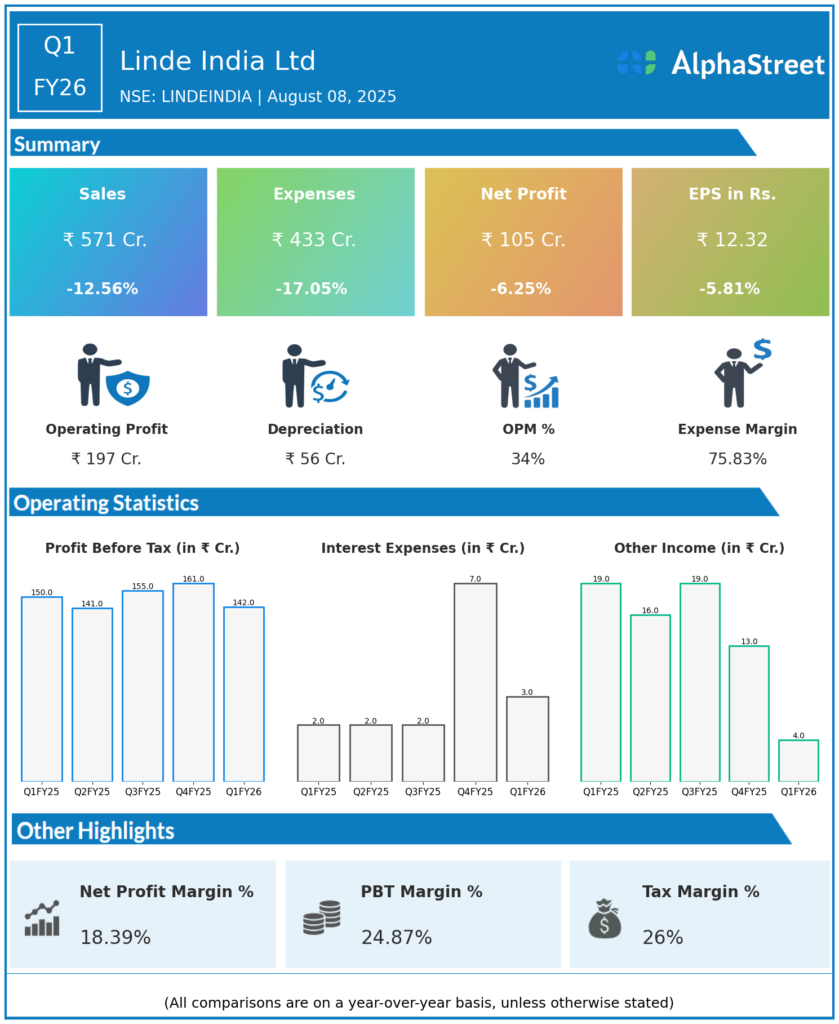

Net Profit (PAT): ₹105 crore, down 6.2% year-over-year (YoY) from ₹112 crore in Q1 FY25.

-

Revenue from Operations: ₹571 crore, a decline of 12.6% YoY (Q1 FY25: ₹653 crore).

-

EBITDA: Up 7.1% YoY, reaching ₹197 crore (estimated); margin expanded to 34.5% from 28.1% YoY.

-

Earnings Per Share (EPS): ₹12.32, slightly lower YoY (Q1 FY25: ₹13.08).

-

Key Segment Update: Industrial gases business performed steadily, cushioning the revenue impact from lower project/engineering sales.

Key Management Commentary & Strategic Highlights

-

Profitability Focus: Despite a drop in revenue driven mostly by lower engineering/project orders, Linde India maintained robust margins on the back of higher-value gas contracts and operational efficiencies.

-

EBITDA Margin Expansion: Margin improved sharply to 34.5%—highlighting strong operating leverage and ongoing gains from core gases infrastructure and efficiency investments.

-

Industry Position: Linde India reaffirmed its leadership in the merchant, bulk, and specialty gas segments, leveraging demand from manufacturing, healthcare, and steel sectors.

-

Growth Drivers: Continued CAPEX and investments in air separation units (ASUs), backed by new contracts with key steelmakers and higher medical/industrial gas utilization.

-

Regulatory Note: The company disclosed ongoing SEBI investigations, but indicated that these are not expected to materially impact core business operations.

-

Outlook: Management remains cautiously optimistic about double-digit growth from the gases business in FY26–FY27, as new capacity comes onstream and demand for industrial/medical gases rises.

Q4 FY25 Earnings Results

-

Net Profit (PAT): ₹118 crore, up 12% YoY from ₹105 crore in Q4 FY24.

-

Revenue: ₹592 crore, down 6% YoY (Q4 FY24: ₹630 crore).

-

EBITDA: ₹209.8 crore, up 17.6% YoY; EBITDA margin jumped to 35.5%, marking a record high for the company.

-

EPS: ₹13.82 (Q4 FY24: ₹12.36).

-

Cash Flow: FY25 saw strong cash flow from operations improving to ₹584 crore, supporting dividend payout and next-phase growth investments.

-

Dividend: Board recommended a total dividend of ₹12/share for FY25.

-

Strategic Projects: Incremental capex for new ASUs (notably for Tata Steel), power cost reduction, and pipeline/automation infrastructure to support future earnings resilience.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.