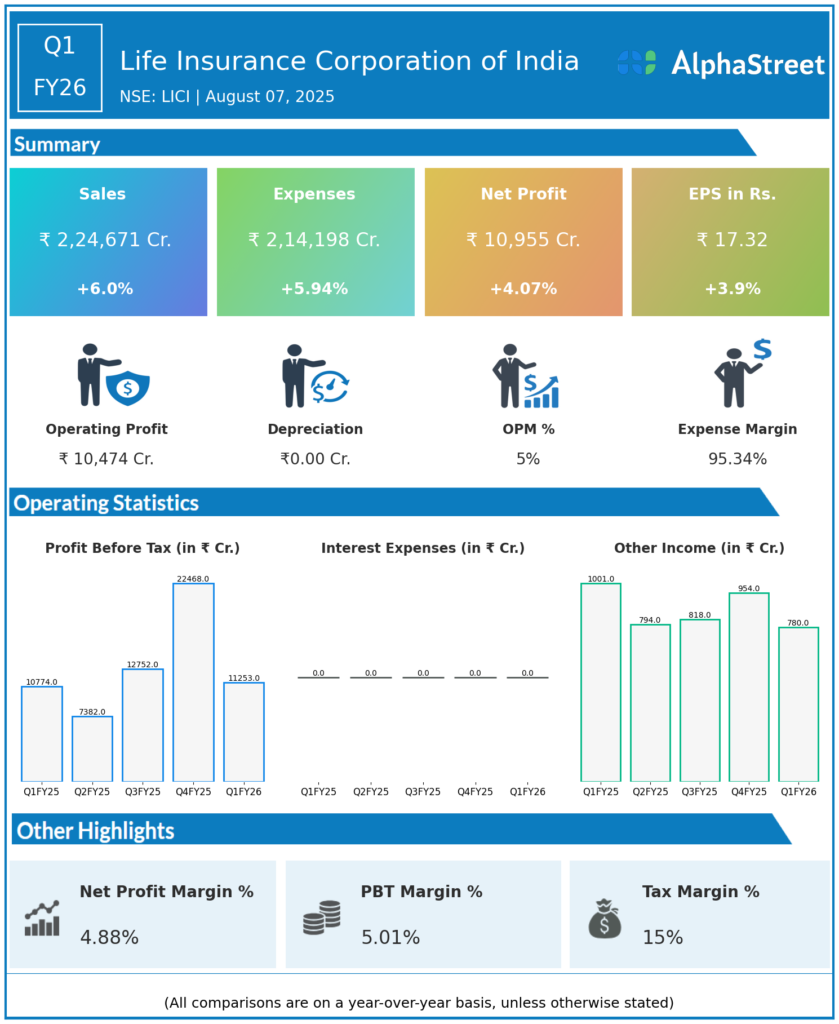

Life Insurance Corporation (LIC) is the largest insurance provider company in India. It has a market share of above 66.2% in new business premium. The company offers participating insurance products and non-participating products like unit-linked insurance products, saving insurance products, term insurance products, health insurance, and annuity & pension products. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Net Profit (PAT): ₹10,955 crore, up 4.07% year-over-year (YoY) from approximately ₹10,461 crore in Q1 FY25.

-

Net Premium Income: ₹2.24 lakh crore, up about 6% YoY from ₹1.14 lakh crore in Q1 FY25.

-

Value of New Business (VNB): ₹1,944 crore, a strong 20.7% increase from ₹1,610 crore in Q1 FY25.

-

VNB Margin: Expanded to 15.4% from 13.9% YoY.

-

Annual Premium Equivalent (APE): ₹12,652 crore, up 9.5% YoY from ₹11,560 crore.

-

Renewal Premium Collection: Increased by about 6%, which helped boost overall premium income.

-

Solvency Ratio: Improved to 2.17 from 1.99 a year earlier, indicating strong financial health.

-

EPS: ₹17.32, up by 3.9% on the YoY basis.

Key Management Commentary & Strategic Highlights

-

Management highlighted that the profit growth was driven by strong renewal premium collections and steady overall premium income growth.

-

New business sales were subdued due to regulatory changes implemented the previous October, which reduced charges for policy surrenders, impacting new business volumes temporarily.

-

The insurer remains focused on improving profitability through value-based product offerings, enhanced customer renewals, and operational efficiencies.

-

The strengthened solvency ratio supports sustainability and long-term obligations.

-

Strategic focus includes expanding product mix, improving persistency ratios, and leveraging digital initiatives to enhance customer engagement and efficiency.

Q4 FY25 Earnings Results

- Life Insurance Corporation of India reported Revenues for Q4FY25 of ₹2,43,134.00 Crores up from ₹2,38,717.00 Crore year on year, a rise of 1.85%.

- Total Expenses for Q4FY25 of ₹2,21,621.00 Crores down from ₹2,37,152.00 Crores year on year, a fall of 6.55%.

- Consolidated Net Profit of ₹19,039.00 Crores up 37.55% from ₹13,842.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹30.10, up 37.57% from ₹21.88 in the same quarter of the previous year.

To view the company’s previous earnings, click here