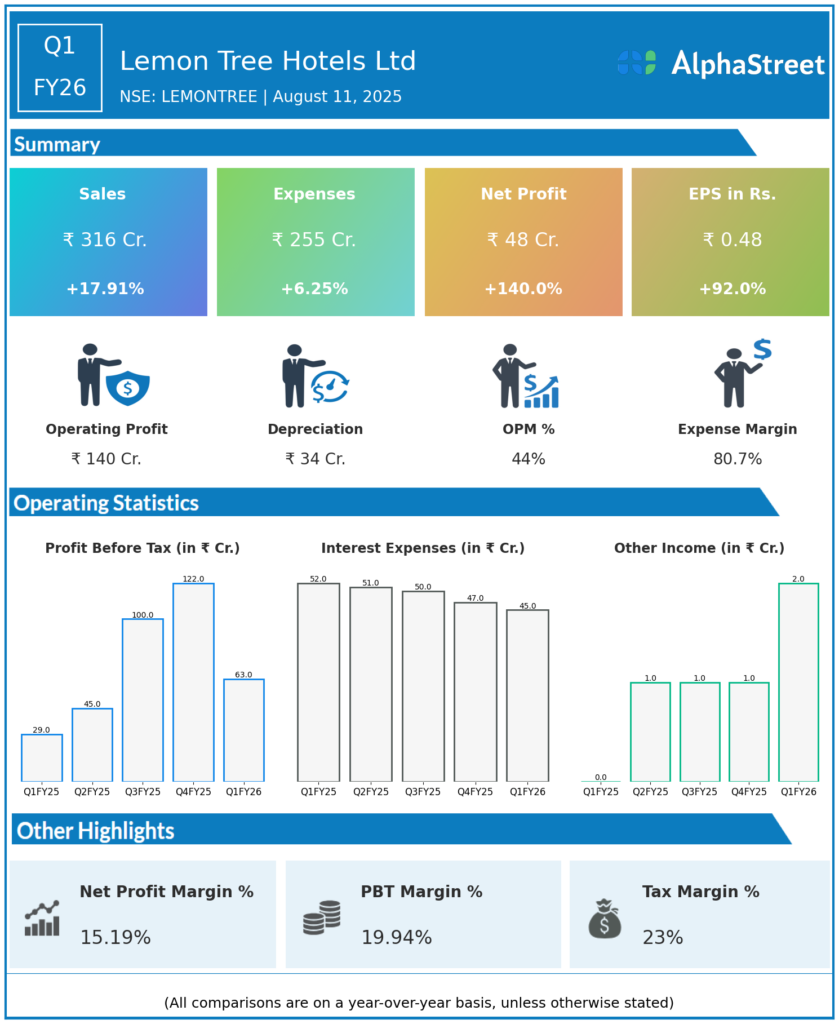

Lemon Tree Hotels Ltd is largest mid-priced and the third largest overall hotel chain in India. It operate in the upscale segment and in the mid-priced sector, consisting of the upper-midscale, midscale and economy segments. It delivers differentiated yet superior service offerings, with a value-for-money proposition. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Revenue: ₹316 crore, up 17.9% year-over-year (YoY) from ₹270.9 crore in Q1 FY25, but down 4.9% quarter-on-quarter (QoQ) from ₹333.8 crore in Q4 FY25.

-

Net Profit (PAT): ₹48.3 crore, increased 140% YoY from ₹19.8 crore in Q1 FY25, yet down 42.7–54.7% QoQ from ₹84 crore in Q4 FY25.

-

EBITDA: ₹142.2 crore, up 23% YoY from previous year’s quarter, with the EBITDA margin improving to approximately 44.8% from 43.0% in Q1 FY25, though down from a higher Q4 FY25 margin of ~45%.

-

Profit Before Tax: ₹63.3 crore, more than doubled YoY (+117%) but declined 29% QoQ.

-

Total Expenses: ₹254.2 crore, rose 5.1% YoY and 3.9% QoQ.

-

Earnings Per Share (EPS): ₹0.48, up 92% YoY but down 37.5% QoQ.

-

Segment & Business Update: Fees from Fleur Hotels increased 29% YoY to ₹21.3 crore, contributing to overall management fees of ₹37.4 crore.

-

Operational Trends: Sequential dip reflects seasonality and possibly some cost pressures, but strong YoY performance indicates steady recovery.

Key Management Commentary & Strategic Highlights

-

The company continues enhancing operational efficiencies and expanding its footprint in the mid-priced and upscale hotel segments.

-

Focus remains on driving higher-margin revenue streams and improving asset utilization amid a recovering hospitality market.

-

Management is optimistic about leveraging robust demand recovery and increased travel activity, especially in key Indian cities.

-

Strategic investment in branding, digital channels, and customer experience is underway to sustain growth momentum.

Q4 FY25 Earnings Results

-

Revenue was higher at ₹333.8 crore.

-

Net Profit stood at ₹84 crore.

-

EBITDA margin peaked around 45%, reflecting strong seasonal performance.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.