Laxmi Organic Industries Limited was established in 1989 and is in the business of specialty chemicals. The Company primarily manufactures Ethyl Acetate, Acetic Acid and Diketene Derivative Products (DDP). DDP is a specialty chemical group, the technology and business of which has been acquired by the company from Clariant Chemicals India Limited. The company’s business operations are carried in over 30 countries including 11 offices located in India.

Q2 FY26 Earnings Results:

-

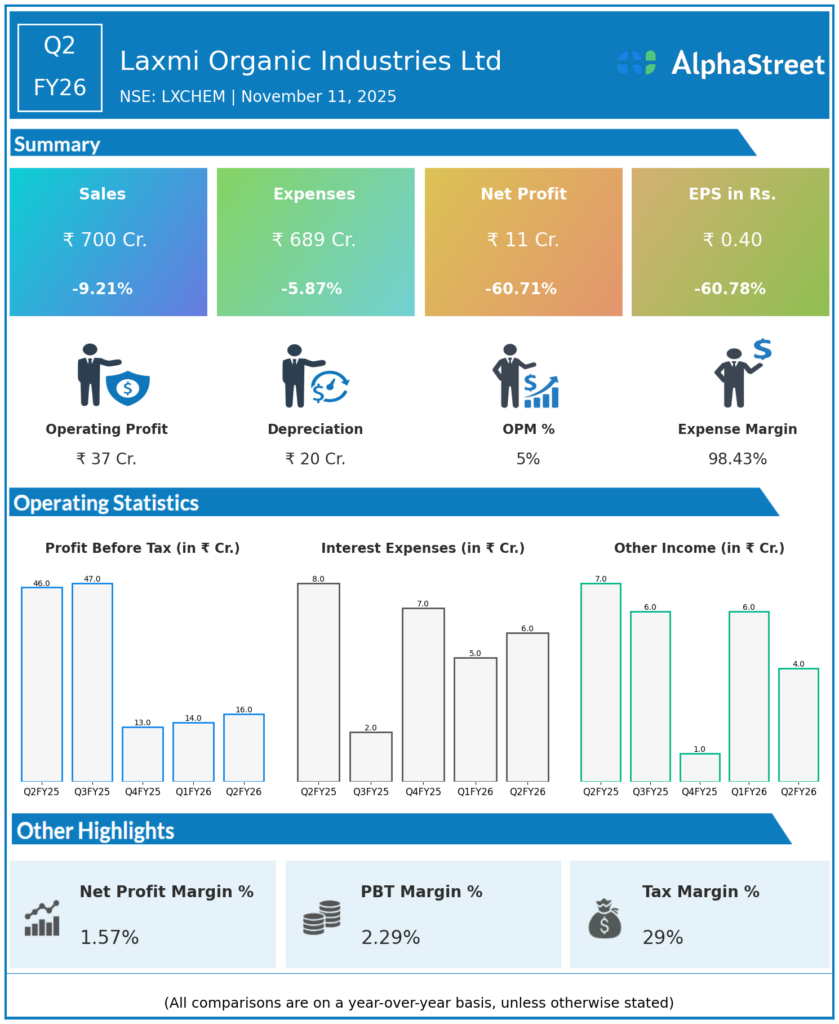

Revenue from Operations: ₹700 crore, down 9% YoY mainly due to a 20% decline in the specialty chemicals segment driven by product phase-out, price moderation, and deferred orders.

-

EBITDA: ₹37 crore, down 50% YoY from ₹74 crore, with EBITDA margin dropping 440 bps to 5.3%.

-

Profit After Tax (PAT): ₹11 crore, a sharp decline of 61% YoY.

-

Gross margin improved sequentially to 33.1% from 30.8% in Q1 but was below last year’s 35.8% due to product mix changes.

-

Operating expenses decreased 5% YoY reflecting cost-control efforts.

-

Capex projects underway including Dahej Phase 2 and fluorination project with Hitachi partnership for eco-efficient gas.

-

Cash flow from operations remained strong at ₹153 crore.

-

Debt-to-equity ratio stable at 1.17; borrowing cycle expected to increase in H2 FY26 to support ₹400-500 crore term loans.

Management Commentary & Strategic Insights

-

The company is managing near-term margin pressure with cost controls and product mix optimization.

-

Recovery expected in second half as deferred sales materialize and new products ramp up.

-

Fluorochemicals business is a future growth driver with target revenue of ₹80 crore in FY26 and expanding further thereafter.

-

High capacity utilization in essential and specialty segments, prompting ongoing expansions.

Q1 FY26 Earnings Results

-

Revenue: ₹776 crore, up 5% YoY.

-

EBITDA: ₹57 crore, EBITDA margin about 7.3%.

-

PAT: ₹26 crore, down 39% YoY impacted by margin pressure despite sales growth.

-

Operational performance steady with focus on cost control and capacity expansion.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.