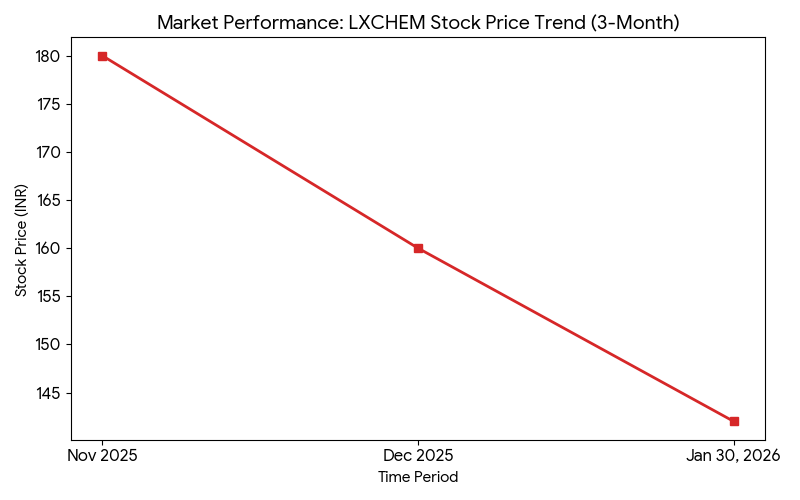

Laxmi Organic Industries Ltd (LXCHEM) shares traded on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) at ₹142.00, closing with a 1.52% intraday movement following the release of its third-quarter financial results. The stock recorded a 52-week low of ₹135.62 during recent sessions, reflecting a sustained downward trend in market valuation.

Market Capitalization

As of January 30, 2026, the market capitalization of Laxmi Organic Industries Ltd stands at INR 3,932 Crore.

Latest Quarterly Results

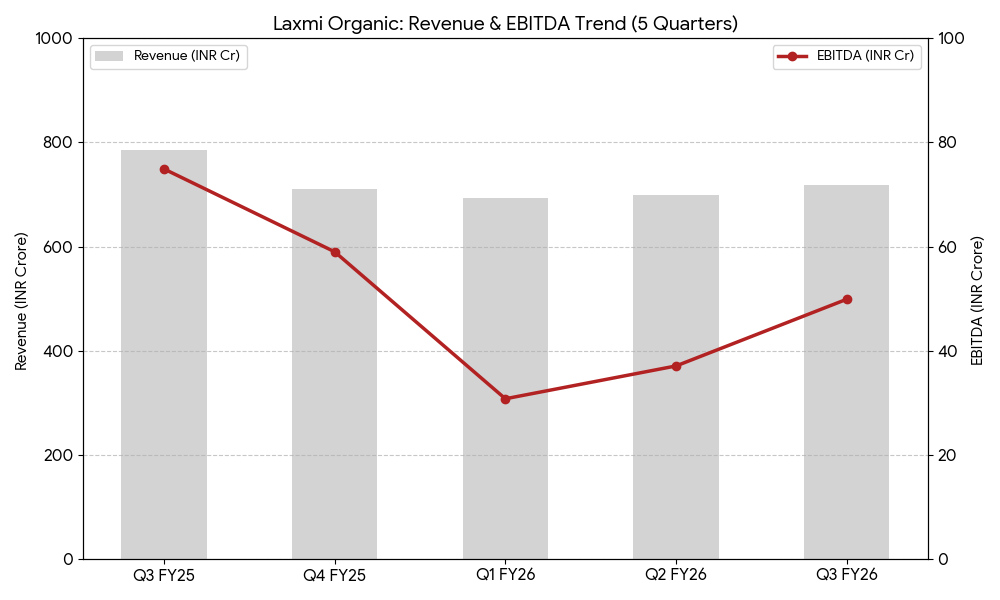

For the quarter ended December 31, 2025 (Q3 FY26), the company reported the following consolidated financial figures:

- Consolidated Revenue: ₹718.68 Crore (Down 8.6% year-over-year)

- Net Profit After Tax: ₹25.40 Crore (Down 13.3% year-over-year)

- EBITDA: ₹49.93 Crore (Down 33.2% year-over-year)

Segment Performance Highlights:

- Acetyl Intermediates (Essentials): Performance was impacted by narrowed spreads in ethyl acetate.

- Specialty Intermediates: Revenue and margins were influenced by product phase-outs and a shift in product mix.

Financial Trends

Full-Year Results Context

Laxmi Organic reported a total revenue of ₹2,985 Crore and a net profit of ₹114 Crore for the full fiscal year ending March 31, 2025. Cumulative data for the first nine months of the current fiscal year (9M FY26) indicates a 7.2% contraction in revenue and a 37.0% decline in net profit compared to the corresponding period in the previous year.

Business & Operations Update

The company confirmed that Phase 2 of its manufacturing facility in Dahej is on schedule for completion by the end of the fourth quarter of FY26. Operations at the Lote facility, focusing on fluorine chemistry, are currently in the ramp-up stage. During the quarter, the company recognized a reversal of accrued electricity-related liabilities totaling ₹40.73 Crore following a favorable regulatory order. Additionally, management implemented a change in the depreciation method from written down value to the straight-line method, resulting in a ₹28.9 Crore reduction in depreciation expenses for the period.

M&A or Strategic Moves

No new mergers or acquisitions were announced during the reporting period. The company continues to utilize remaining proceeds from its previous capital raises for debt repayment and facility expansion, as confirmed by its latest monitoring agency report.

Equity Analyst Commentary

Institutional research coverage indicates a cautious outlook on the stock, with a majority of analysts maintaining a “Sell” equivalent rating. Institutional reports attribute the recent performance to margin compression and high fixed costs associated with the commissioning of new manufacturing sites. The average institutional target price for the stock is cited at ₹192.67.

Guidance & Outlook

Management has identified volume-driven growth in the essentials segment and the operationalization of the Dahej site as key priorities. Market observers are monitoring the stabilization of feedstock prices and the potential margin recovery in specialty chemicals as new product lines reach full capacity.

Performance Summary

- Stock Move: Shares hit multi-year lows before closing at ₹142.00.

- Financial Results: Revenue declined 8.6% while EBITDA fell 33.2% year-over-year.

- Segment Signals: Margin pressure persists in Acetyl Intermediates due to unfavorable product spreads.