Founded in 2005, Laurus Labs is a research-driven pharmaceutical and biotechnology company having a global leadership position in select Active Pharmaceutical Ingredients (APIs) including anti-retroviral, oncology drugs (incl High Potent APIs), Cardiovascular, and Gastro therapeutics. They also offer integrated CMO and CDMO services to Global Innovators from Clinical phase drug development to commercial manufacturing. Laurus employs 6500+ people, including around 1050+ scientists at more than 11 facilities approved by global agencies USFDA, WHO-Geneva, Japan-PDMA, UK-MHRA, EMA, TGA etc.

Q1 FY26 Earnings Summary (Jan–Mar 2025)

-

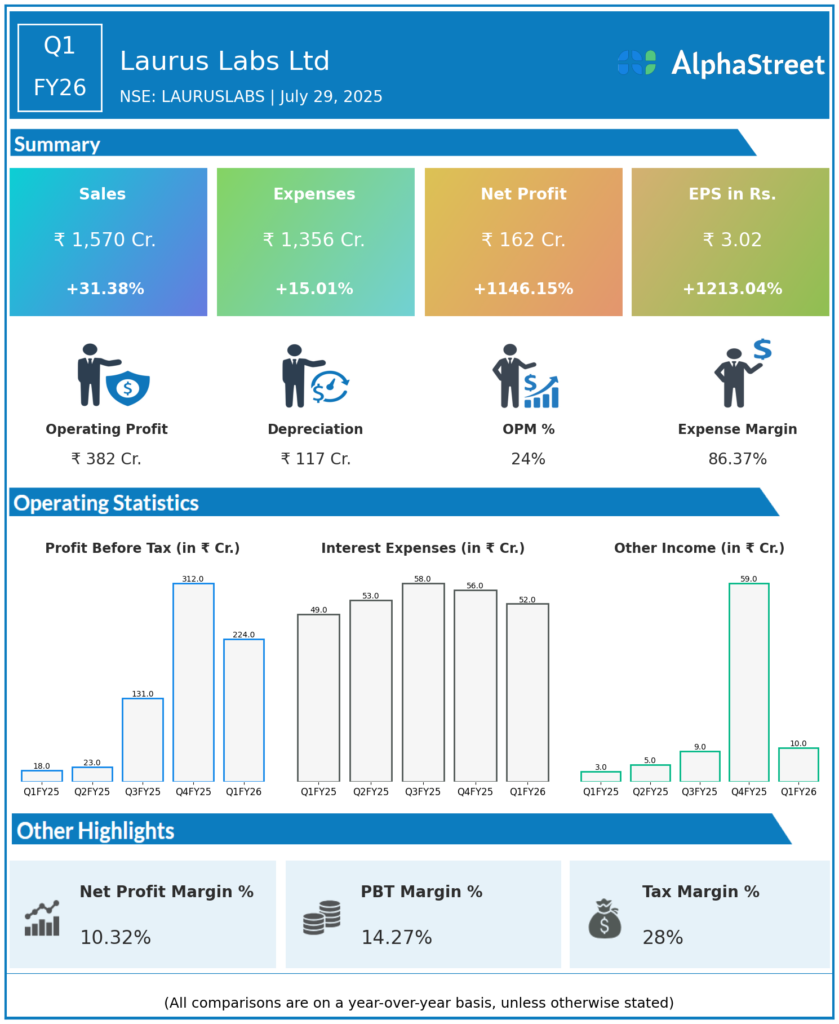

Revenue: ₹1,570 crore, a strong 31% increase YoY (Q1 FY25 revenue was ₹1,195 crore).

-

EBITDA: ₹389 crore, up 127% YoY.

-

EBITDA Margin: Improved markedly to 24.8% from 14.3%.

-

Profit Before Tax (PBT): ₹224 crore, up over 11 times (1,146%) YoY.

-

Net Profit (PAT): ₹163 crore, a remarkable 1,154% increase YoY (Q1 FY25 PAT was ₹13 crore).

-

Earnings Per Share (EPS): Diluted EPS of ₹3.0, up significantly from ₹0.2 YoY.

-

Gross Margins: Expanded to 59.4% from 55.1% a year ago.

-

Key Business Growth: Stronger CDMO contribution and advancement of pipeline projects along with sustained generic formulation sales.

-

Operational Investments: Construction commenced for new facilities across CDMO, generics, and finished dosage formulations (FDF), positioning for future growth in advanced therapies.

Key Management & Strategic Decisions

-

CDMO Focus: Increasing scale and technological capabilities in contract development and manufacturing services to global innovators.

-

Facility Expansions: New greenfield projects underway to support growth, including R&D and manufacturing units.

-

Pipeline Advancement: Continued development of advanced therapies and generic markets for sustainable revenue.

-

Commercial Execution: Management highlighted strong focus on realizing pipeline potential and business development opportunities.

-

Confidence in Strategic Direction: CEO Satyanarayana Chava emphasized commitment to sustainable value creation and scaling business operations.

Q4 FY25 Earnings Summary (Oct–Dec 2024)

-

Revenue: ₹1,720 crore, up approximately 19% year-over-year (YoY).

-

EBITDA: ₹477 crore, surged 84% YoY.

-

Net Profit (PAT): Details specific to Q4 PAT are not explicitly reported, but strong profitability growth is implied given the EBITDA surge.

-

Key Drivers: Growth reflected continued robust sales in active pharmaceutical ingredients (APIs), generic formulations, and increasing contributions from CDMO (Contract Development and Manufacturing Organization) business.

-

Operational Highlights: Expansion of manufacturing capacities and pipeline advancement supported revenue and margin growth.