Latent View Analytics Ltd provides analytics services such as data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions. The company provides services to blue-chip companies in Technology, BFSI, CPG & Retail, Industrials, and other industry domains. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

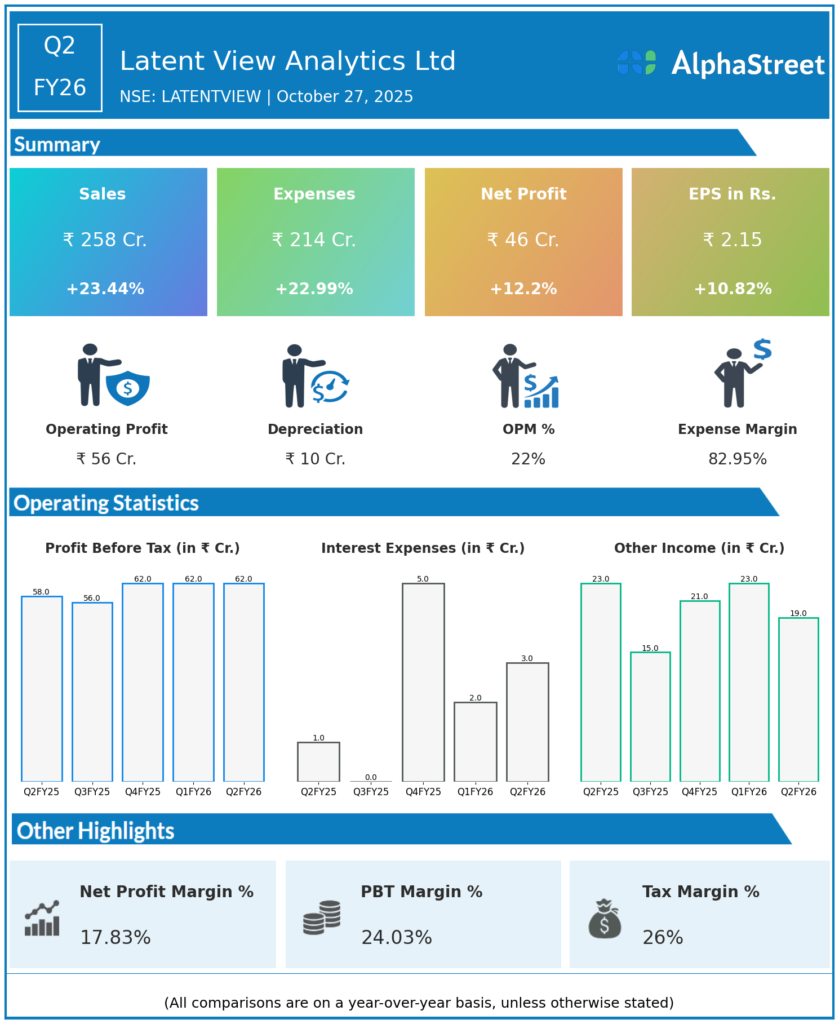

Revenue from Operations: ₹257.54 crore, up 23.2% YoY and 9.12% QoQ.

Adjusted EBITDA: ₹58.0 crore, up 23.5% YoY, margin 22.5%.

EBITDA (reported): ₹56.1 crore, up 11.4% QoQ and 23.9% YoY, margin 21.8%.

Profit Before Tax (PBT): ₹61.71 crore, up 5.9% YoY.

Profit After Tax (PAT): ₹45.73 crore, up 12.4% YoY, down 12.7% QoQ.

PAT Margin: 17.7%.

Key Verticals:

-

Financial Services: 29.9% QoQ and 94% YoY growth.

-

CPG and Retail: 23% YoY.

Operational Highlights:

-

11th consecutive quarter of revenue growth.

-

Strong client demand across financial services, CPG, and retail.

Management Commentary & Strategic Directions

CEO Rajan Sethuraman:

“We are pleased to report another strong quarter with 23.2% YoY revenue expansion and healthy margin performance, highlighting the consistency and resilience of our business model. Financial Services led growth with 94% YoY momentum, while CPG and Retail also showed robust execution and marquee client wins. Our GenAI strategy is focused on building differentiated solutions to tackle critical enterprise challenges. Investment in our Databricks practice and AI Center of Excellence continues to pay off with positive results and growing capabilities.”

CFO Rajan Venkatesan:

“Strong momentum continues, driven by operational rigor and strategic integration of Decision Point, especially in the CPG and retail verticals. We are seeing significant near-shore traction, leveraging our local presence. Looking ahead, our focus remains on R&D within AI and data engineering, critical for sustained growth and differentiated positioning in the marketplace.”

Strategic Actions:

-

Doubled down on Generative AI and Agentic AI solution development for enterprise clients.

-

Deepening Databricks partnership for cloud data engineering expansion.

-

Enhanced US/EU nearshore operations by leveraging Decision Point acquisition synergies.

-

Sustained R&D investment in AI CoE and Databricks for future-proofing service portfolio.

Q1 FY26 Earnings Results

Revenue from Operations: ₹236 crore, up 31.9% YoY.

EBITDA: ₹50.4 crore, margin 21.4%, up 31.7% YoY.

PBT: ₹62 crore, up 18.9% YoY.

PAT: ₹50.6 crore, up 30% YoY.

PAT Margin: 19.5%.

GenAI Practice: Rapid traction, expected to double and contribute 12–14% of FY26 revenue.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.