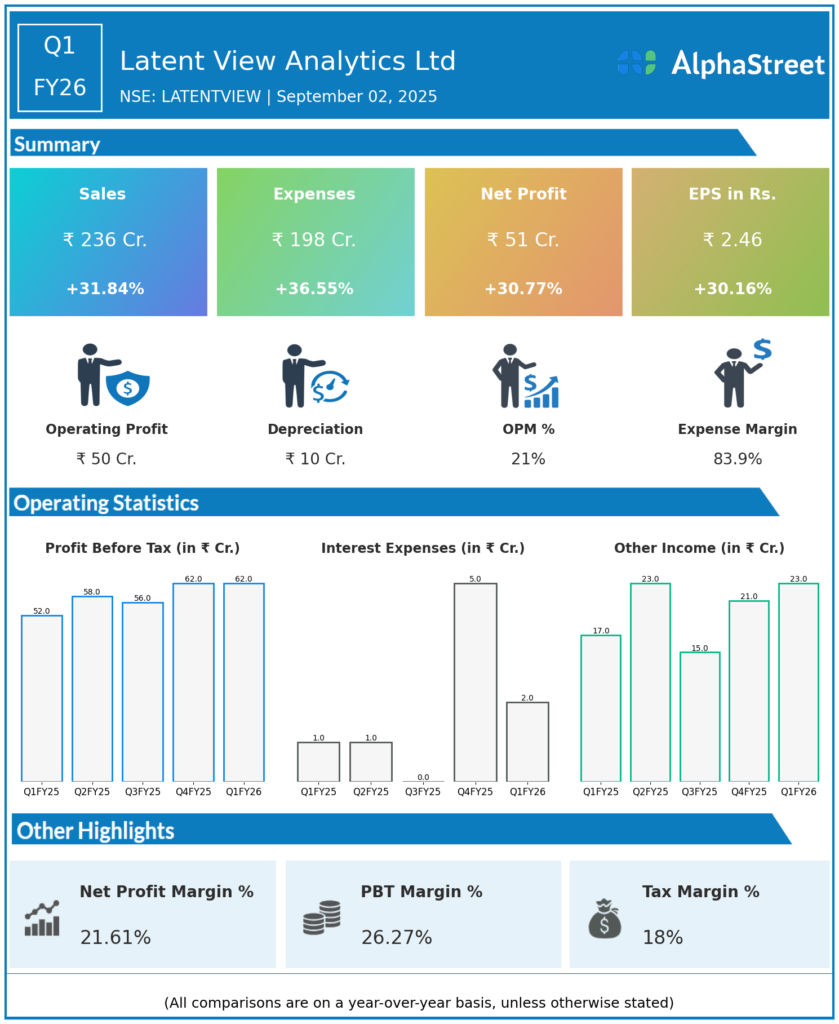

Latent View Analytics Ltd provides analytics services such as data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions. The company provides services to blue-chip companies in Technology, BFSI, CPG & Retail, Industrials, and other industry domains. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Operating Revenue (Consolidated): ₹236 crores, up 31.8% YoY (Q1 FY25: ₹179 crores) and up 1.6% QoQ (Q4 FY25: ₹232 crores).

-

Adjusted EBITDA: ₹52.3 crores, up 31.7% YoY; EBITDA margin 21.4% (Q1 FY25: 21.3%).

-

Profit Before Tax (PBT): ₹62 crores, up 18.9% YoY; margin 23.9%.

-

Profit After Tax (PAT): ₹50.6 crores, up 30.7% YoY (Q1 FY25: ₹39 crores); margin 19.5%.

-

Earnings Per Share (EPS): ₹2.46, up 30.16% YoY (Q1 FY25: ₹1.87).

-

Expenses: ₹197.5 crores, up 37% YoY, mainly due to wage hikes and scaling investments.

-

Financial Services Vertical: Revenue up 48.4% YoY, 21.3% sequentially; GenAI practice now ~12–14% of total revenue, set to double by year-end.

-

Attrition Rate: Increased to 23% in Q1 FY26 (Q4 FY25: 22%), industry-led but managed via hiring and culture initiatives.

-

Geography: 89% of revenue from the US, with APAC, LATAM, and Europe making up the rest.

Management Commentary & Strategic Highlights

-

CEO Rajan Sethuraman cited broad-based vertical growth, especially Financial Services, and strong GenAI momentum as major drivers for record revenues and profits.

-

Company realized significant cost synergies from the Decision Point acquisition and is investing in GTM (go-to-market) initiatives to further scale its offerings.

-

CFO Rajan Venkatesan noted the margin impact from wage hikes but emphasized ongoing focus on execution excellence, client deepening, and capability building for sustained growth.

-

Latent View continues to invest in AI, data engineering, and strategic client partnerships for long-term expansion.

Q4 FY25 Earnings Results

-

Operating Revenue: ₹232 crores.

-

PAT: ₹51 crores.

-

EPS: ₹2.59

-

EBITDA: ₹45.9 crores; margin 19.8%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.