Larsen & Toubro Ltd is a multinational conglomerate which is primarily engaged in providing engineering, procurement and construction (EPC) solutions in key sectors such as Infrastructure, Hydrocarbon, Power, Process Industries and Defence, Information Technology and Financial Services in domestic and international markets.

Q2 FY26 Earnings Results

-

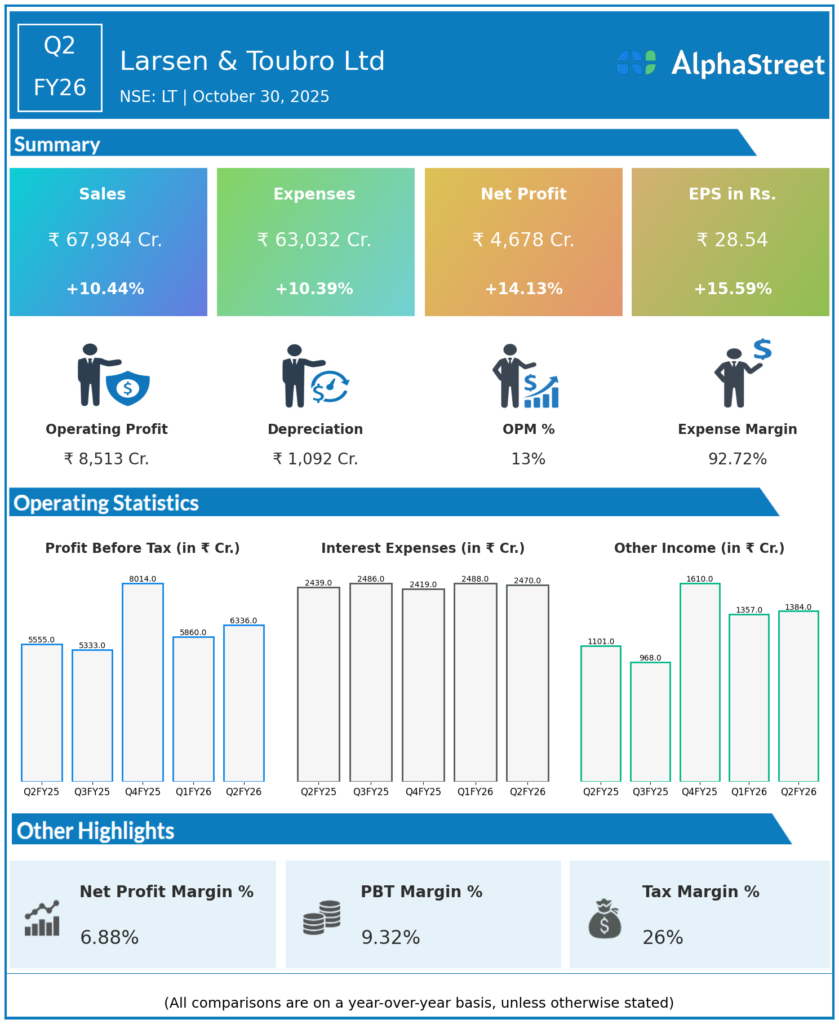

Revenue from Operations: ₹67,984 crore, up 10.44% YoY from ₹61,555 crore in Q2 FY25.

-

Consolidated Net Profit (PAT): ₹4,678 crore, up 14.13% YoY from ₹3,395 crore.

-

EBITDA: ₹6,807 crore, up 7% YoY; EBITDA margin steady at around 10.1%.

-

Orders secured: ₹1,15,784 crore, a 45% YoY increase.

-

Total order book: ₹6,67,047 crore as of 30 September 2025, up 15% from March 2025.

-

Other income grew 25.7% to ₹1,384 crore.

-

Employee expenses up due to talent investment, totaling approximately ₹12,986 crore.

-

Domestic orders up 34%, with strong contributions from infrastructure, renewables, and hydrocarbons.

Management Commentary & Strategic Insights:

-

CMD S.N. Subrahmanyan said the performance highlights L&T’s leadership across engineering, procurement, and construction (EPC) sectors.

-

Emphasis on winning large orders worldwide and consistent execution despite global challenges.

-

Growth driven by infrastructure projects and capex cycles in India and the Middle East.

-

Focus on technology-driven businesses to complement core EPC operations.

-

Optimistic about future order growth supported by rising capex spends.

-

Continued commitment to sustainability and green technologies.

Q1 FY26 Earnings Results:

-

Revenue from Operations: ₹63,679 crore, up 15.5% YoY.

-

Consolidated PAT: ₹3,617 crore, up 29.8% YoY.

-

EBITDA: ₹6,318 crore, up 13%, with a slight decline in margin to 9.9%.

-

Record order inflows of ₹94,453 crore in Q1 FY26, a 33% YoY rise.

-

International revenue accounted for 52% of total topline.

-

Strong execution in Projects & Manufacturing segment fueled growth.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.