Larsen & Toubro Ltd is a multinational conglomerate which is primarily engaged in providing engineering, procurement and construction (EPC) solutions in key sectors such as Infrastructure, Hydrocarbon, Power, Process Industries and Defence, Information Technology and Financial Services in domestic and international markets.

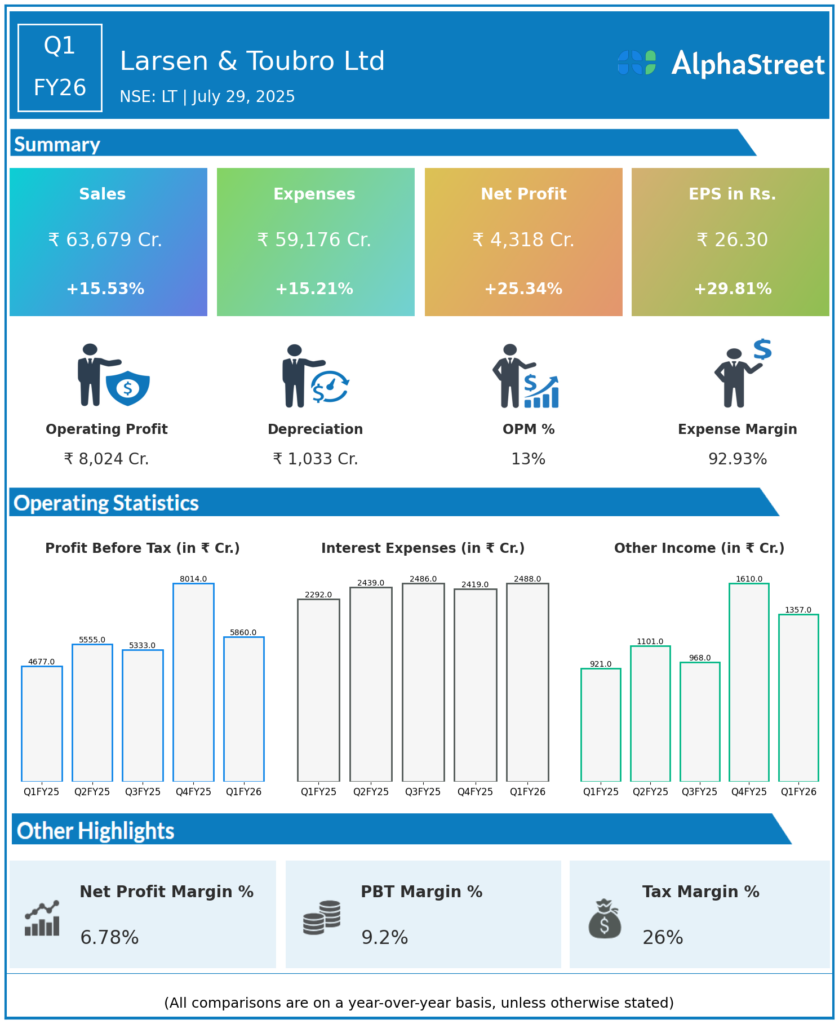

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue from Operations: ₹63,679 crore, up 16% YoY from ₹55,120 crore in Q1 FY25.

-

Net Profit (PAT): ₹4,318 crore, up 25% YoY from ₹2,786 crore in Q1 FY25.

-

EBITDA: ₹6,316 crore, up 12.5% YoY with a 9.9% margin (slightly down from 10.2% YoY).

-

Management highlighted the highest-ever quarterly order inflow for Q1.

-

New-age businesses including semiconductor, data centres, green energy, and digital platforms continue to gain traction.

-

Chairman & MD S N Subrahmanyan noted that L&T is on track to meet or surpass targets under the current Lakshya’26 five-year plan.

Key Management & Strategic Decisions

-

Continued focus on execution excellence across core EPC (engineering, procurement, construction), hi-tech manufacturing, IT & technology services, and financial services.

-

Strong order book of ₹612,761 crore as of June 30, 2025, providing revenue visibility.

-

Strategic diversification into new-age businesses like semiconductors, data centers, renewable energy, and digital platforms to ensure future growth.

-

Emphasis on sustainability and technology-driven solutions to maintain leadership in engineering and construction.

-

Management confidence in achieving ambitious financial and operational targets set under their strategic roadmap.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Revenue from Operations: ₹75,527 crore, up 11% YoY from ₹68,120 crore in Q4 FY24.

-

Net Profit (PAT): ₹6,133 crore, a 23% YoY increase from ₹5,003 crore in Q4 FY24.

-

Earnings Per Share (EPS): ₹40 (diluted), up 25% YoY.

-

EBITDA Margin: Varies by segment; notable 17.3% margin in Hi-Tech Manufacturing, slight decline in IT & Technology Services margin to 19.5%.

-

Key segments such as Hi-Tech Manufacturing grew revenues 18% YoY with 28% YoY order growth.

-

IT & Technology Services revenue rose 8% YoY with 91% from international markets but margin compressed due to subdued global IT spending.

-

Financial Services segment grew 16% YoY in income, driven by retail loan growth.

-

The quarter showed strong overall margin and profit growth benefitting from healthy execution across infrastructure, manufacturing, and services.

-

The order book as of end-March was robust, supporting future revenue visibility.