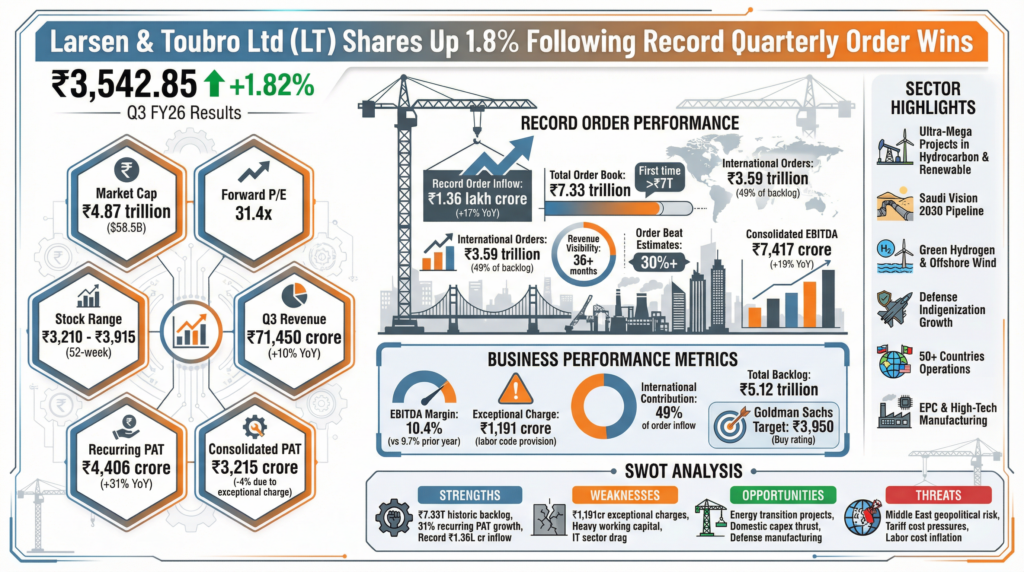

With an international order book reaching ₹3.59 trillion (49% of the total ₹7.33 trillion backlog), L&T remains highly sensitive to geopolitical developments in the GCC region. Management indicated that while Saudi Arabia’s “Vision 2030” continues to provide a robust pipeline, regional instability remains a primary risk to project execution and supply chain logistics.

The company is also navigating shifting trade dynamics. While L&T benefits from India’s production-linked incentive (PLI) schemes, it faces rising input costs from tariffs on specialized high-tech manufacturing components and imported steel. To mitigate these risks, L&T has shifted toward localizing its vendor base within the Middle East and India. This “near-shoring” strategy aims to insulate its ₹5.12 trillion total backlog from potential tariff-induced margin erosion in 2026.