Incorporated in 1998, Landmark Cars Limited is the leading premium automotive retail business in India with dealerships for Mercedes-Benz, Honda, Jeep, Volkswagen, and Renault. The company also caters to the commercial vehicle retail business of Ashok Leyland in India. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

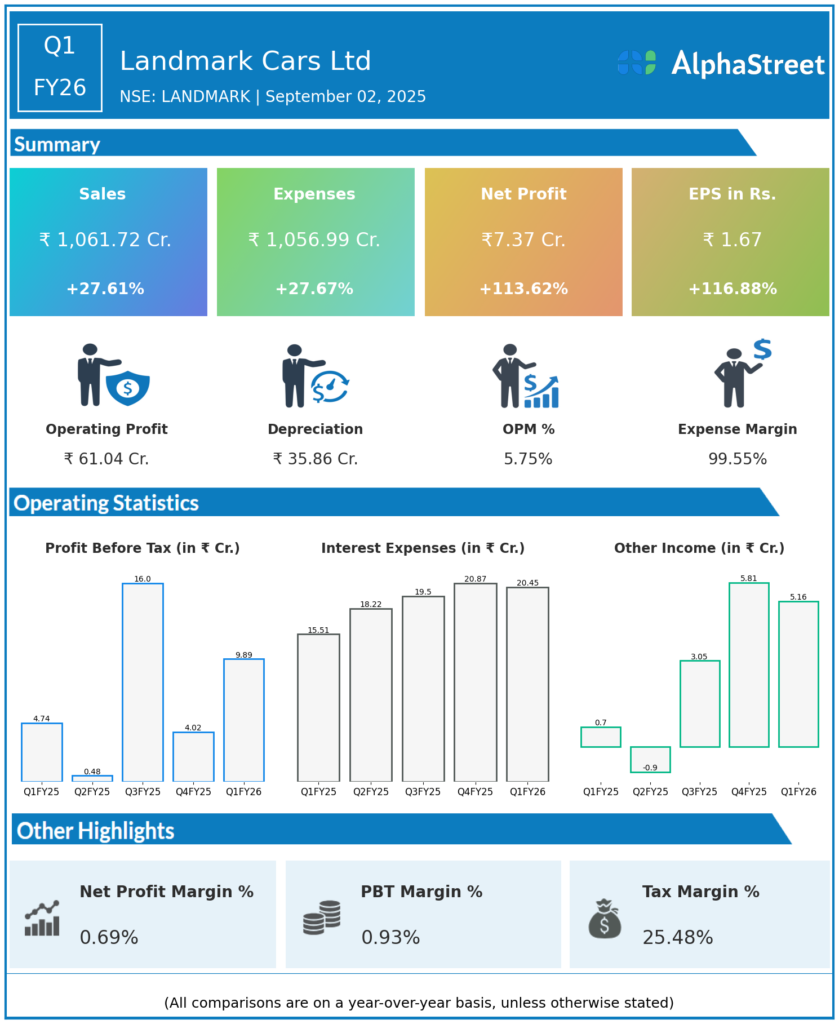

Total Income: ₹1,066.88 crores, up 23.1% QoQ (Q4 FY25: ₹866.68 crores) and 28.0% YoY (Q1 FY25: ₹833.28 crores).

-

Revenue from Operations: ₹1,061.72 crores, up 27.6% YoY.

-

Operating Expenses: ₹1,056.99 crores in Q1 FY26 versus ₹851.24 crores in Q4 FY25, up 24.2% QoQ and 27.7% YoY.

-

Operating Profit (EBITDA): ₹66.2 crores, up 32.9% YoY (Q1 FY25: ₹49.8 crores); margin at 6.23% (Q1 FY25: 5.99%).

-

Profit Before Tax (PBT): ₹9.89 crores, down 35.9% QoQ but up 108.6% YoY (Q1 FY25: ₹4.74 crores).

-

Profit After Tax (PAT): ₹7.37 crores, down 32.8% QoQ (Q4 FY25: ₹10.97 crores), but up 113.6% YoY (Q1 FY25: ₹3.45 crores).

-

EPS: ₹1.70, down 37% QoQ (Q4 FY25: ₹2.70), up 112.5% YoY (Q1 FY25: ₹0.80).

-

Other Income: ₹4.40 crores, up 27.17% YoY.

-

Operating Profit: ₹21.11 crores, up 13.92% YoY.

-

Operating Profit Margin: 2.47%, showing improved cost management and sales mix.

Management Commentary & Strategic Highlights

-

Double-digit growth in revenue, profit, and operating profit reflects strong demand and operational efficiency across Landmark’s multi-brand dealership network.

-

Improved cost control and higher other income contributed to net profit growth and margin expansion.

-

Management remains focused on expanding business operations, new showrooms, and sustaining momentum in premium and mass-market passenger vehicles.

-

The company continues to innovate in after-sales service, pre-owned sales, and third-party insurance/finance products to drive further growth.

Q4 FY25 Earnings Results

-

Total Income: ₹1,091.22 crores.

-

Profit After Tax (PAT): ₹1.75 crores.

-

EPS: ₹0.34.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.