La Opala RG is a leading manufacturer and marketer of tablewares (opal and glass) in India.

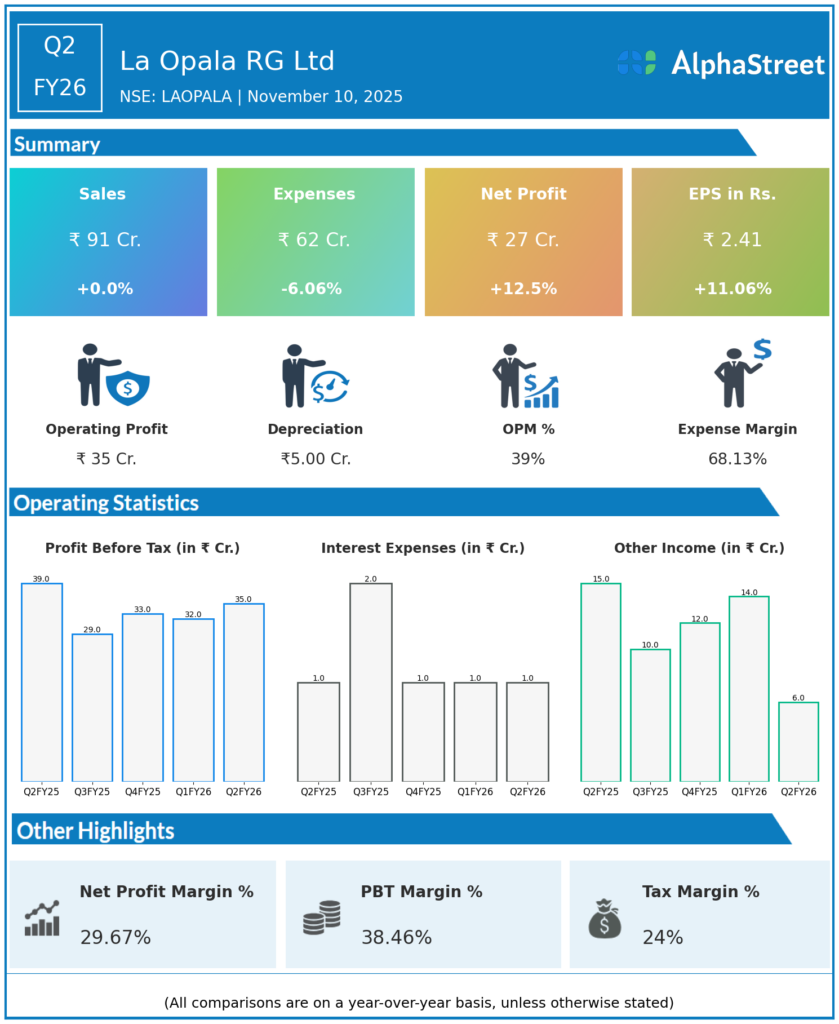

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹90.9 crore (₹9,090.17 lakh), up 39% YoY from ₹65.3 crore in Q2 FY25

-

Total Income: ₹97.33 crore, up 22.4% QoQ

-

EBITDA: ₹41.6 crore; EBITDA margin ~42.7% (down from 49.9% YoY, but sequentially strong)

-

Net Profit (PAT): ₹26.78 crore, up 15.5% YoY from ₹23.2 crore; up 5.6% QoQ from ₹25.35 crore in Q1 FY26

-

PAT margin: 27.8%, a 120 bps improvement YoY

-

Earnings Per Share (EPS): ₹2.41, up from ₹2.28 in Q2 FY25 and ₹2.17 in Q1 FY26

-

Operating cash flow (H1 FY26): ₹23.7 crore, lower YoY due to higher dividend outflows

-

Company remains debt free with minimal interest cost

Management Commentary & Strategic Insights

-

Management emphasized a strong focus on operational efficiency and product mix rationalization, driving margin resilience amidst industry headwinds

-

Despite persistent softness in broader demand, La Opala achieved a strong revenue comeback and sustained margin leadership

-

Strategic priorities include expanding product distribution, launching new high-margin SKUs, and leveraging the peak festive period for sales growth

-

Company highlighted its healthy ROCE (~28%) and robust balance sheet for future capex flexibility

-

Outlook remains cautious on persistent demand challenges but optimistic on margin sustainability and gradual recovery

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹77.10 crore, down 6.6% YoY

-

EBITDA: ₹24.13 crore, down 11.9% YoY

-

Profit After Tax (PAT): ₹25.35 crore, up 4.1% YoY

-

PAT margin: 31.9% (Q1 FY25: 28.3%)

-

EPS: ₹2.17, up from ₹2.13 in Q1 FY25

-

Management attributed weak Q1 topline to demand softness and competition, but cost control drove margin outperformance

-

Continued focus on SKU expansion, brand investments, and strengthening digital channels for medium-term growth

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.