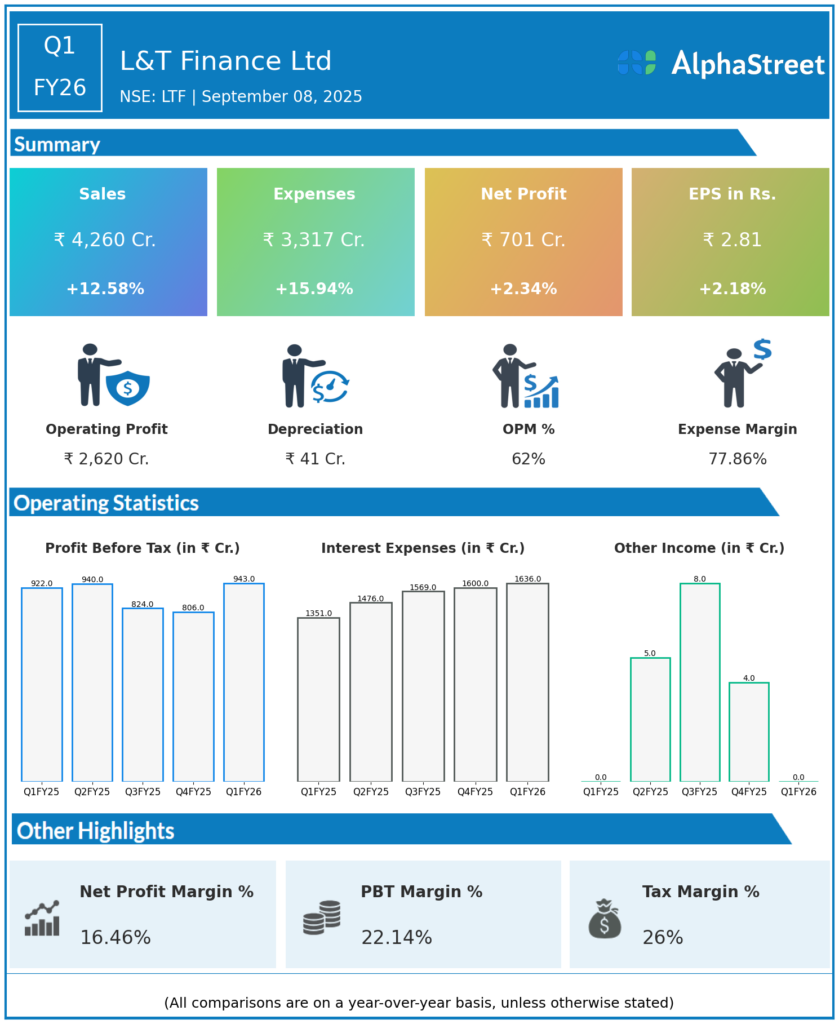

L&T Finance Ltd. is a NBFC, offering a range of financial products and services. Company has filed requisite application for necessary registration as Systemically Important Non- Deposit Accepting Core Investment Company (NBFC-CIC). Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹4,259.6 crores, up 12.6% YoY (Q1 FY25: ₹3,784.6 crores), and up 15.8% QoQ (Q4 FY25: ₹3,677.3 crores).

-

Total Expenses: ₹3,317 crores, up 15.9% YoY (Q1 FY25: ₹2,472.2 crores), and up 1.5% QoQ.

-

Profit Before Tax (PBT): ₹943.2 crores, up 2.3% YoY (Q1 FY25: ₹922.3 crores), and up 35.9% QoQ (Q4 FY25: ₹694.0 crores).

-

Profit After Tax (PAT): ₹700.8 crores, up 2.3% YoY (Q1 FY25: ₹685.3 crores), and up 26.7% QoQ (Q4 FY25: ₹553.0 crores).

-

Earnings Per Share (EPS): ₹2.81, up 2.18% YoY (Q1 FY25: ₹2.70) and up 27.3% QoQ (Q4 FY25: ₹2.20).

-

Net Interest Income (NII): ₹2,278.8 crores, up 8% YoY (Q1 FY25: ₹2,101.2 crores).

-

Net Worth: ₹25,585.5 crores.

-

Asset Quality: Gross stage 3 at 3.31% (FY25: 3.92%), Net stage 3 at 0.99% (FY25: 1.25%); CRAR at 20.68%, liquidity coverage ratio at 224%.

-

Net Profit Margin: 16.45%.

Key Management Commentary & Strategic Highlights

-

CEO Sudipta Roy cited a resilient performance on the back of robust credit sourcing, enhanced digital underwriting models, and disciplined cost controls despite challenging macro headwinds.

-

The company’s strong asset quality improvement is highlighted by a continued focus on secured retail lending and digital initiatives to drive better risk management and portfolio expansion.

-

Roy emphasized that L&T Finance remains confident of sustaining earnings momentum in FY26, with enhanced operational scalability, stable NIMs, and further product innovation on the retail side.

-

Management strategy points to sharp collection efficiency, customer selection backed by technology, and ongoing cost rationalization to improve long-term profitability.

Q4 FY25 Earnings Results

-

Total Income: ₹4,023 crores.

-

PAT: ₹636 crores.

-

EPS: ₹2.55.

-

Gross/Net Stage 3: 3.92%/1.25%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.