LTTS is an engineering services provider incorporated in 2012, offers engineering, research and development (ER&D) and digitalization solutions to companies in the areas such as Transportation, Industrial Products, Telecom and Hi-Tech, Medical Devices and Plant Engineering. LTTS’ customer base includes 69 Fortune 500 companies and 53 of the world’s top ER&D companies. The business also provides digital engineering advisory services. The company went public on September 23, 2016. LTTS has 296 global clients in 25+ countries.

Financial Results:

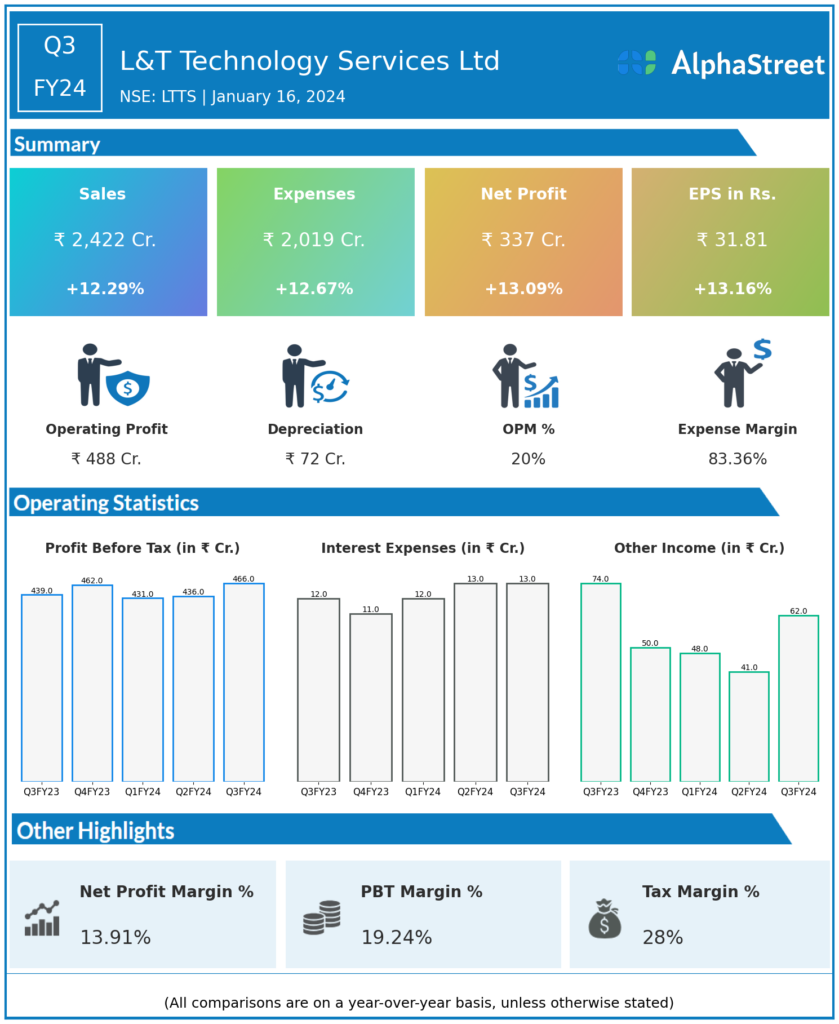

L&T Technology Services Ltd reported Revenues for Q3FY24 of ₹2,422.00 Crores up from ₹2,157.00 Crore year on year, a rise of 12.29%.

Total Expenses for Q3FY24 of ₹2,019.00 Crores up from ₹1,792.00 Crores year on year, a rise of 12.67%.

Consolidated Net Profit of ₹337.00 Crores up 13.09% from ₹298.00 Crores in the same quarter of the previous year.

The Earnings per Share is ₹31.81, up 13.16% from ₹28.11 in the same quarter of the previous year.

*It is important to note that the way the results have been accounted for are slightly different than the ones the companies may choose to publish.

*The presented data is automatically generated. It may occasionally generate incorrect information.