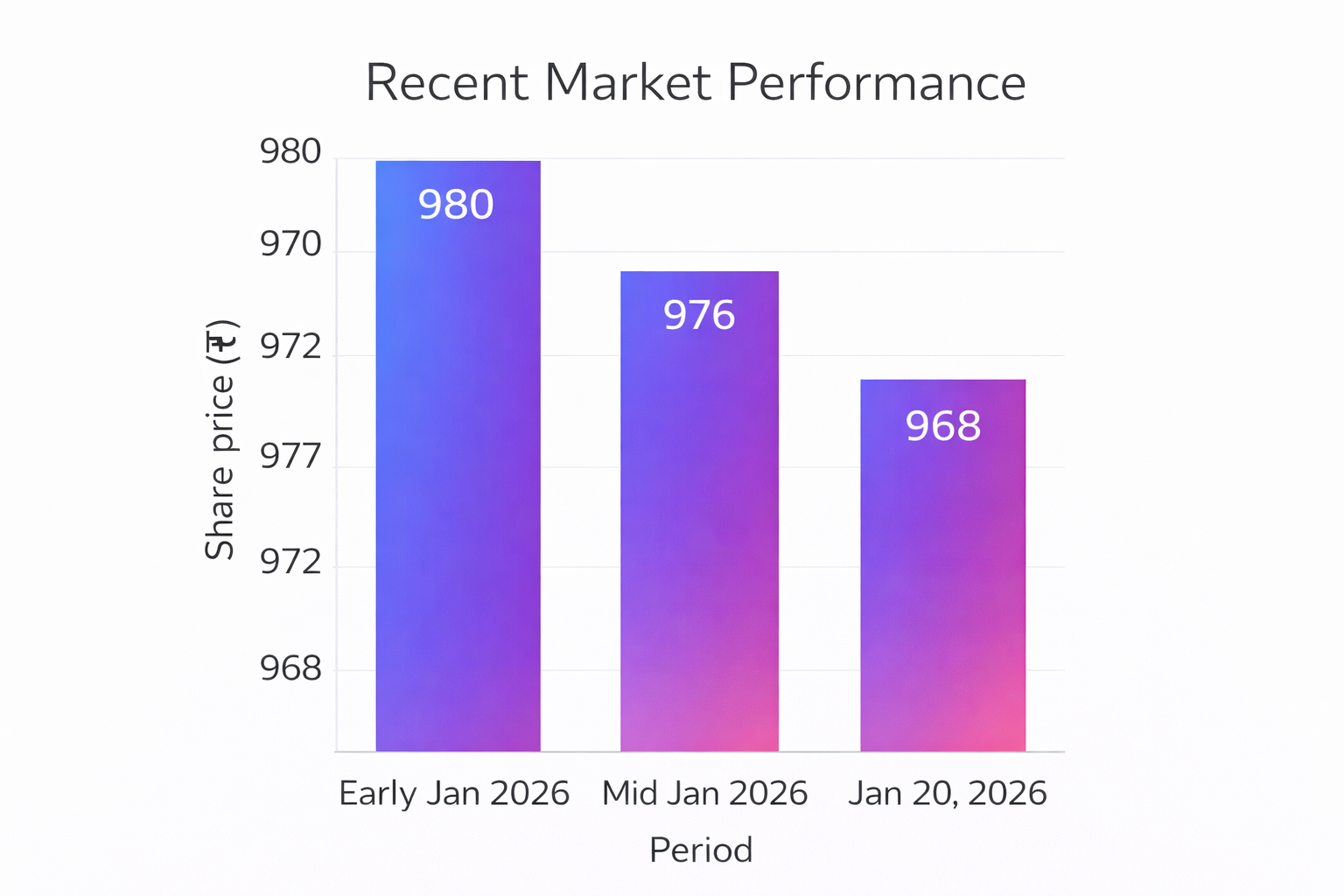

Ksolves India Limited (NSE: KSOLVES; BSE: 543599) closed at ₹965.4, down 1.25% at today’s market close.

Market capitalization

At today’s close, market capitalization stood at approximately ₹1180 crore.

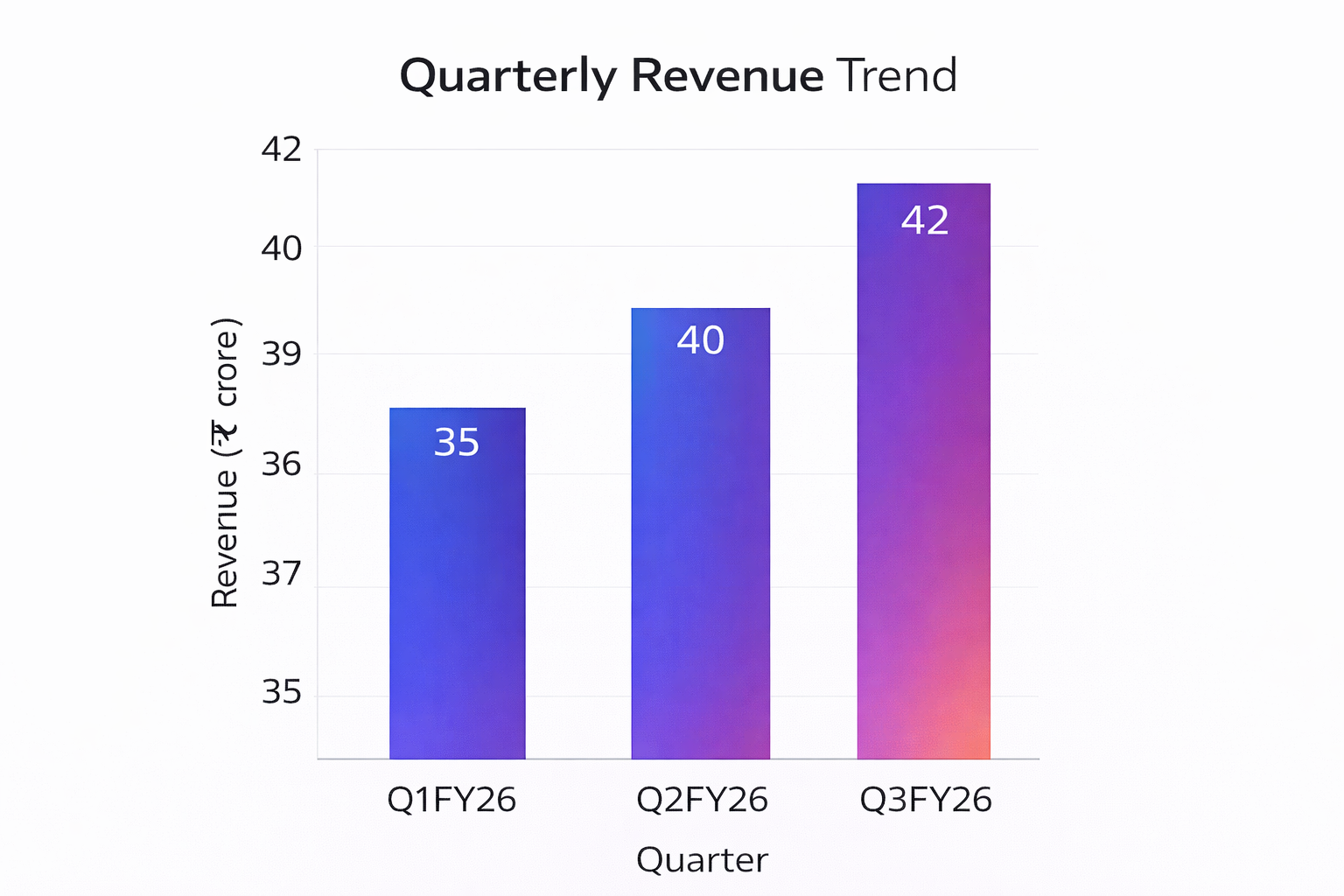

Latest quarterly results (Q3FY26)

Consolidated revenue from operations was ₹42.3 crore. Profit after tax was ₹9.8 crore. Year-on-year revenue increased 12.2%, while profit declined 5.0%.

Segment highlights (reported figures)

Technology services remained the primary revenue contributor.

Product platforms contributed on a smaller base.

Overseas markets accounted for the majority of revenue.

Operating performance

Market performance

Full-year results context

For the nine months ended December 31, 2025, revenue totaled ₹119.6 crore, reflecting year-over-year growth, while margins moderated.

Business & operations update

Declared an interim dividend of ₹5 per share.

Approved setting up a wholly owned subsidiary in Australia.

Closed the U.S. subsidiary to streamline costs.

M&A or strategic moves

No acquisitions or divestments were announced.

Equity analyst commentary (summary)

Institutional analysts highlighted revenue growth, margin trends, and shareholder returns following the results.

Guidance & outlook — what to watch for

Margin trends amid continued product investment.

Client additions across overseas markets.

Execution of international expansion plans.

Performance summary

Stock closed lower on the day.

Q3FY26 revenue reached ₹42.3 crore; PAT ₹9.8 crore.

Revenue growth continued with margin moderation.