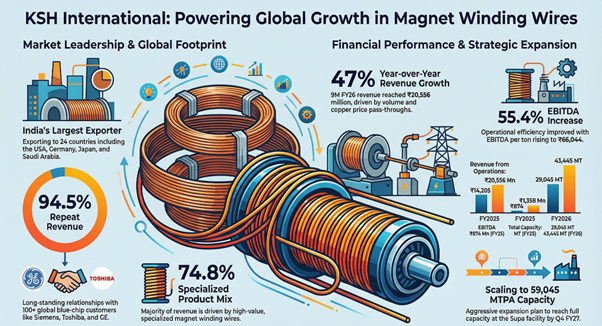

KSH International Limited (NSE: KSHINTL) India’s largest magnet wire exporter increases annual capacity to 43,445 MTs following Supa facility operationalization and debt reduction of Rs 2,259.77 million.

The company reported its highest-ever quarterly revenue and EBITDA for the period ended December 31, 2025. The results were driven by the commencement of sales from the new Supa manufacturing facility and a structural demand cycle in the transformer industry. While revenue grew 59% year-over-over, net profit for the third quarter declined 9.3% due to non-recurring exceptional items and increased interest expenses related to expansion.

Capacity Expansion

The quarter’s performance was primarily driven by the commissioning of Phase I at the new Supa facility, which added 14,400 MT of capacity and increased the company’s total annualised capacity to 43,445 MT. Following its IPO in December 2025, the company used proceeds to repay ₹2,259.77 million of short- and long-term debt. The repayment reduced the debt-to-equity ratio to 0.42x, excluding IPO proceeds pending deployment.

Product Highlights

KSH International began supplying specialized magnet winding wires for a cumulative order of 37 HVDC transformers during the third quarter, including a significant order from BHEL. Specialized winding wire revenue growth accelerated to 61% year-over-year in Q3 FY2026, supported by demand for Continuously Transposed Conductors (CTC). The company is also pursuing growth in electric vehicle (EV) traction motors and high-value specialized rectangular enamelled wires to adapt to emerging industry trends.

Financial Performance

For the third quarter of FY2026, revenue from operations reached ₹8,177.7 million, a 58.5% increase compared to ₹5,158.2 million in the prior year period. EBITDA grew 22.8% to ₹493.7 million, though the EBITDA margin contracted to 6.04% from 7.80% a year ago. Profit After Tax (PAT) stood at ₹233.3 million, down from ₹257.2 million in Q3 FY2025.

The decline in quarterly PAT was attributed to non-recurring items, including a ₹16.2 million exceptional charge to comply with new Labor Code laws and ₹27.2 million in interest expenses related to the Supa expansion. For the nine-month period ended December 31, 2025, revenue grew 47% to ₹20,886.2 million, and PAT increased 52.6% to ₹756.0 million. Export revenue for the quarter rose 36.9% to ₹2,125.0 million.

Key Personnel Change

Pursuant to the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the Company informs that Mr. Sandesh Suryakant Bhagwat has resigned as Chief Executive Officer (Key Managerial Personnel) to pursue an opportunity outside the organisation, vide his letter dated January 12, 2026.

The Board of Directors, at its meeting held on February 7, 2026, took note of and accepted his resignation. He will be relieved from the Company’s services with effect from the close of business hours on March 31, 2026.

EV Tailwinds

Electric vehicle (EV) growth remains a key demand driver, supported by rising adoption, rapid market expansion and a structural shift toward specialised components. EV penetration in India is projected at 10–12% by FY2026 and 30–35% by FY2030, with the domestic EV market expected to expand at a 66.58% CAGR between 2022 and 2029.

The transition to electric mobility is set to lift consumption of magnet winding wires, particularly for traction motors and automotive electrical systems that require both standard and specialised variants. Product development, including rectangular enamelled magnet wires tailored for EV applications, is aligned with evolving industry requirements.

KSH International plans to allocate a higher share of incremental capacity at its Supa facility to the EV segment and has already secured purchase orders from EV customers in FY2024–25, positioning the company to benefit from anticipated demand growth.

Investment Thesis: (Bull vs. Bear)

Bull Case

- Capacity Expansion: Total capacity is slated to reach 59,045 MTPA by Q4 FY2027, positioning the company to capture rising demand.

- De-leveraging: Significant debt repayment has strengthened the balance sheet and reduced recurring interest costs.

- Sector Tailwinds: Structural demand from renewable energy, AI data centers, and EV traction motors provides a multi-year growth outlook.

- Export Leadership: As India’s largest magnet wire exporter, KSH is benefiting from a “China + 1” global procurement strategy.

Bear Case

- Margin Pressure: EBITDA margins declined in Q3 FY2026 due to higher upfront costs associated with the new Supa facility.

- Lower Utilization: Operational utilization dropped to approximately 70% in Q3 as new capacity came online, indicating a temporary lag in volume absorption.

- Commodity Sensitivity: While the company uses a back-to-back ordering model to mitigate copper price volatility, revenue remains tied to fluctuating raw material costs.

Growth Strategy

Management’s strategy centers on increasing the share of higher value-added specialized products and expanding the company’s international presence, which currently covers 24 countries. Operational priorities include scaling up the Supa facility to drive economies of scale and pursuing backward integration into in-house copper rod manufacturing to enhance input cost efficiency. The company also plans to invest in captive rooftop solar capacity to lower long-term energy costs.

Sector Tailwinds

The magnet winding wire industry is supported by a structural investment cycle in India’s power transmission sector, with planned investments of about ₹9.16 trillion. Global demand is also being driven by the expansion of AI-led data centers and the shift toward electric mobility, with EV penetration in India projected at 10–12% by FY2026. KSH International operates in a high-entry-barrier segment, given stringent pre-qualification and quality requirements from global OEMs.