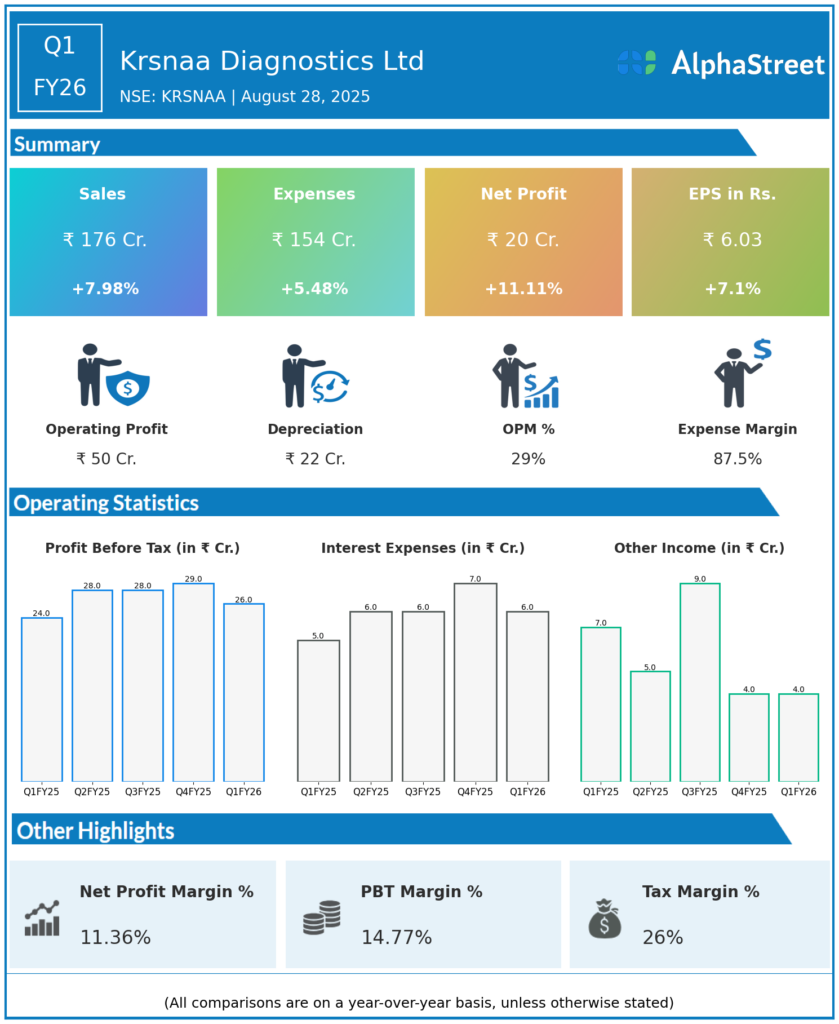

Krsnaa Diagnostics Ltd provides a range of technology-enabled diagnostic services such as imaging, clinical laboratory, and teleradiology services to hospitals, medical colleges, and community health centers across India with an extensive network across non-metro and lower-tier cities and towns. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹176 crores, up 8% YoY (Q1 FY25: ₹170.2 crores).

-

EBITDA: ₹52.4 crores, up 19% YoY, with EBITDA margin improving to 27% (Q1 FY25: 26%).

-

Profit After Tax (PAT): ₹20.5 crores, up 11% YoY (Q1 FY25: ₹17.9 crores), PAT margin of 11%.

-

Earnings Per Share (EPS): ₹6.03, up 7% YoY.

-

Retail Touchpoints: Increased significantly from 362 to 2,414 in one year, with retail now contributing ~6% of total revenue.

-

Patient Served & Tests Conducted: 5 million patients served, 16 million tests performed in Q1.

-

Major Contract Win: Secured a large 5-year PPP pathology contract in Rajasthan involving 42 mother labs, 135 satellite labs, and 1,300+ collection centers; expected annual revenue of ₹300–350 crores on maturity, with ₹200–250 crores CapEx planned and phased implementation over 6–9 months.

-

Expansion: Added 3 labs, 2 CT scanners, and 3 MRI machines during the quarter.

Management Commentary & Strategic Highlights

-

MD Yash Mutha expressed optimism about the transformative Rajasthan PPP contract, which will significantly expand Krsnaa’s footprint and revenue base from FY27.

-

The company continues to focus on scaling retail diagnostics, improving operational efficiencies, and digital initiatives to sustain growth and margins.

-

Working capital has improved with overdue receivables from states like Himachal Pradesh and Karnataka beginning to clear, aiding cash flow stability.

-

Retail business projected to reach EBITDA breakeven by FY26 end, with revenue contribution expected to increase to 5–8% by FY26 and 18–20% within two years.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹175 crores.

-

EBITDA: ₹44 crores; margin ~28%.

-

PAT: ₹21 crores.

-

EPS: ₹6.53.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.