Kross Limited (NSE: KROSS) reported a stronger December quarter, led by higher volumes and stable operating margins, while nine-month performance remained modest due to a softer first half and cost pressures.

Results Snapshot

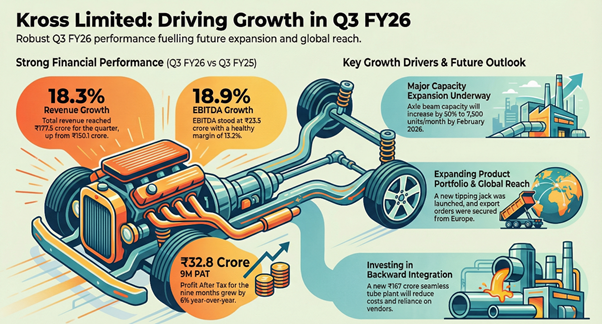

Revenue from operations rose to ₹177.5 crore, up 18.3% year on year. EBITDA increased 18.9% to ₹23.5 crore. EBITDA margin stood at 13.2%, broadly stable versus last year. Profit after tax was ₹14.0 crore, up 2.9% year on year, with PAT margin declining to 7.9% due to higher depreciation and operating costs.

Nine-month context

For 9M FY26, revenue rose 2.8% year on year to ₹447.8 crore. EBITDA was flat at ₹54.4 crore, with margin moderating to 12.1% from 12.5% last year. PAT increased 6.1% to ₹32.8 crore, aided by operating leverage in the later quarters.

Segment mix

Trailer axles and suspension contributed 41.3% of 9M FY26 revenue, while the component business accounted for 58.7%. Exports formed 3.8% of revenue for the period, growing 14% year on year.

SWOT Analysis

Strengths:

- Integrated manufacturing with forging, casting, machining, and assembly capabilities.

- Established position in trailer axles and suspension systems.

- Long-standing relationships with major OEMs and fabricators.

- Strengthened balance sheet post IPO.

Weaknesses:

- Export contribution remains low in overall revenue mix.

- PAT margin volatility due to depreciation and cost absorption.

- Working capital intensity linked to volume growth.

Opportunities:

- Capacity expansion enabling higher volumes and backward integration.

- Export scaling following supplier approvals with European Tier-1 customers.

- Product diversification into tipping jacks and seamless tubes.

Threats:

- Cyclicality in commercial vehicle and tractor demand.

- Regulatory uncertainty from labor code implementation.

- Competitive pressure in auto component pricing and customer negotiations.

Operating Drivers

Demand improved during the quarter, reflected in higher OEM schedules and improved order visibility. Tractor components recorded 16% revenue growth over 9M FY26. Five new fabricator customers were added in the trailer segment during Q3. Export traction continued with supplier approvals and initial trial orders from European Tier-1 customers.

Capacity & Capex

Commissioning trials are underway at the axle beam extrusion plant, with expected commissioning by February 2026. Axle beam capacity is set to increase to 7,500 units per month from 5,000 units. Forging capacity expanded with the commissioning of 2,000-tonne and 1,000-tonne presses, with a 1,600-tonne press scheduled next. Construction of the seamless tube facility is complete, with commercial production targeted in FY27. The seamless tube project involves a planned investment of about ₹167 crore, funded through a mix of debt and internal accruals

Balance Sheet Snapshot

As of March 2025, total equity stood at ₹434.5 crore, supported by IPO proceeds. Gross borrowings declined materially following repayments funded through IPO proceeds. Cash and cash equivalents increased to ₹82.8 crore, reflecting strong financing inflows and moderated capex execution during the period.

Near-Term Outlook

The quarter reflected improving domestic commercial vehicle and tractor demand, supported by higher OEM production schedules. Working capital cycles showed improvement, with demand conditions stabilizing toward the end of the quarter and carrying into Q4 FY26.

Management indicated that production schedules for Q4 FY26 remain healthy. Export contribution is targeted at 5% for FY26, with plans to scale exports to double-digit levels by FY27. New products, including tipping jacks, are expected to add incremental revenue from FY27 following completion of validation and scale-up.

What Investors Are Watching

- Execution and timely commissioning of the extrusion and forging capacity additions.

- Ramp-up trajectory and capital intensity of the seamless tube project.

- Margin sustainability amid higher depreciation and operating costs.

- Export order conversion from trial to repeat volumes.

- Working capital discipline as volumes scale.