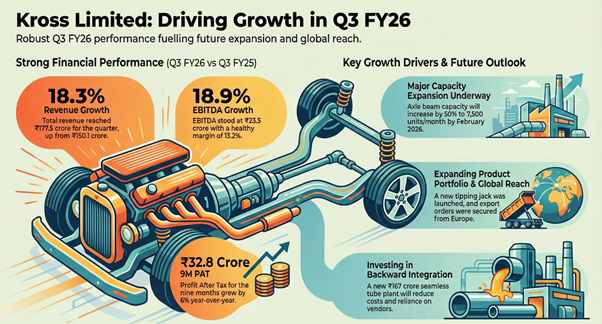

Kross Limited (NSE: KROSS) The automotive component manufacturer achieved significant revenue growth in the third quarter of fiscal year 2026, driven by a strengthening demand environment and strategic product diversification. The company is currently commissioning new facilities to materially increase forging and axle manufacturing capacities by early 2026.

Capacity & Portfolio Expansion

Kross Limited is approaching the final stages of several capacity expansion initiatives designed to scale operations by the end of FY26. Trials are currently underway at a new axle beam extrusion plant, with full commissioning expected in February 2026; this facility is projected to increase axle manufacturing capacity by 50% to 7,500 units per month.

Additionally, the company has commissioned 2,000-tonne and 1,000-tonne screw presses to enhance its forging capabilities, with a further 1,600-tonne press scheduled for February 2026. To diversify revenue streams, Kross has launched the tipping jack for the trailer segment, which is currently in the validation phase and expected to provide incremental revenue starting in FY27.

Financial Highlights

The company’s third-quarter results for the period ended December 31, 2025, show a marked acceleration in growth compared to the earlier part of the fiscal year.

• Quarterly Revenue: Stood at ₹177.5 crore, representing an 18.3% increase over the ₹150.1 crore reported in Q3 FY25.

• EBITDA and Margins: Q3 EBITDA reached ₹23.5 crore (up 18.9% YoY) with an EBITDA margin of 13.2%.

• Profit After Tax (PAT): Quarterly PAT was ₹14.0 crore, a 2.9% increase year-over-year. However, the PAT margin declined to 7.9% compared to 9.1% in the prior-year period.

• Nine-Month Context: For the 9M FY26 period, revenue reached ₹447.8 crore, a 2.8% year-over-year growth.

Business Outlook & Strategy

Management’s strategy focuses on backward integration and geographical expansion. A major project involves a ₹167 crore investment in a seamless tube plant in Jharkhand, which is intended to reduce reliance on external vendors and lower production costs for trailer parts. The company also aims to increase the revenue contribution from the tractor segment to 15% over the next two years, supported by improving production schedules from original equipment manufacturers (OEMs).

On the international front, Kross secured purchase orders from a leading Tier-1 company in Europe. Exports currently account for 3.8% of total revenue, with a target to reach 5% for the full year and double-digit levels by FY27.

Investment Thesis: Bull vs. Bear

Bull Thesis (Growth Drivers)

- Capacity Scalability: Commissioning of extrusion and forging plants in Q4 FY26 is expected to double total forging capacity and increase axle units by 50%.

- New Revenue Streams: Entry into the tipping jack and seamless tube markets provides diversification beyond traditional axle and component businesses.

- Export Momentum: New European Tier-1 contracts and a clear roadmap to double-digit export contributions by FY27 suggest a broadening global footprint.

Bear Thesis (Risk Factors)

- Client Concentration: The top five clients accounted for 59.3% of revenue in the nine months ended December 2025, creating significant dependency on a limited number of OEMs.

- Margin Compression: Despite revenue growth, the PAT margin for Q3 FY26 fell to 7.9% from 9.1% YoY, indicating rising costs or pricing pressures.

- Execution Risk: The ₹167 crore seamless tube project and other capital expenditures rely on timely commissioning to meet FY27 growth targets.