Krishna Medical Institution Ltd (KIMS) was Incorporated in the year 1973 and is one of the largest corporate healthcare groups in Andhra Pradesh and Telangana in terms of patients treated and treatments offered. The company offers multidisciplinary healthcare services with primary, secondary, and tertiary care across 2-3 tier cities and an additional quaternary healthcare facility in tier-1 cities.

Q2 FY26 Earnings Results

-

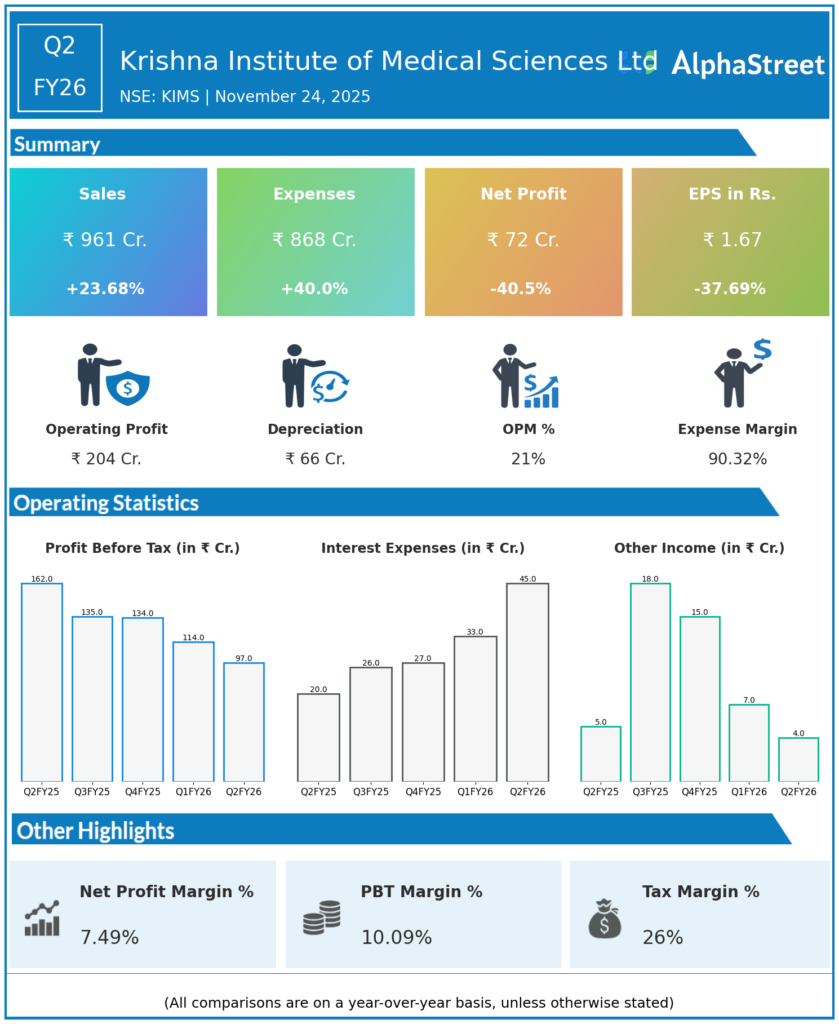

Consolidated Revenue: ₹961 crore, up 23.3% YoY from ₹782 crore and up 10.2% QoQ from ₹879 crore in Q1 FY26, driven by higher volumes and contributions from new hospitals.

-

EBITDA: ₹208 crore, margin at 21.6%, down 680 bps YoY and 90 bps QoQ due to operating cost pressure as new facilities scale up.

-

Net Profit (PAT): ₹72 crore, down 41% YoY (from ₹115 crore) and down 15.3% QoQ (from ₹85 crore) due to margin compression at newly commissioned units in Maharashtra and Karnataka.

-

EPS: ₹1.67 (Q2 FY26).

-

Average revenue per operating bed grew 9.8% YoY; occupancy rates at new hospitals improved sequentially.

-

Board approved merger of two wholly-owned subsidiaries for operational synergies.

-

Operating cash flow exceeded ₹150 crore for the quarter, supporting deleveraging and growth initiatives.

Management Commentary & Strategic Insights

-

Management cited strong top-line growth and market penetration, aided by organic expansion and faster occupancy ramp-up in new hospitals.

-

Margin pressure is mainly due to scale-up costs at new units; stabilization expected over coming quarters as occupancy rises.

-

Ongoing focus on cost control, operational excellence, and sustenance of 27–30% EBITDA margin in core clusters.

-

Pipeline of asset monetization and merger synergies expected to provide capital efficiency and future profitability boost.

-

Sector outlook remains positive, with management emphasizing execution quality, scale-up of peripheral locations, and maintaining sector-leading returns on capital.

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹879 crore, up 26.8% YoY from ₹693 crore.

-

EBITDA: ₹200 crore, margin at 22.7% (down 8.5% YoY), affected by losses from new hospitals as they scale up.

-

PAT: ₹85 crore, down 9.3% YoY, reflecting ramp-up losses and cost inflation.

-

New units reported combined losses of ₹21 crore, primarily from Nasik and Thane (Maharashtra).

-

Occupancy improvement, expansion in inpatient/outpatient volumes, and digitization of supply chain contributed to topline growth.

-

Board remains confident in ability to return to higher profitability as new clusters reach optimal utilization.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.