KRBL is worlds leading basmati rice producer and has fully integrated operations in every aspect of basmati value chain, right from seed development, contract farming, procurement of paddy, storage, processing, packaging, branding and marketing. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

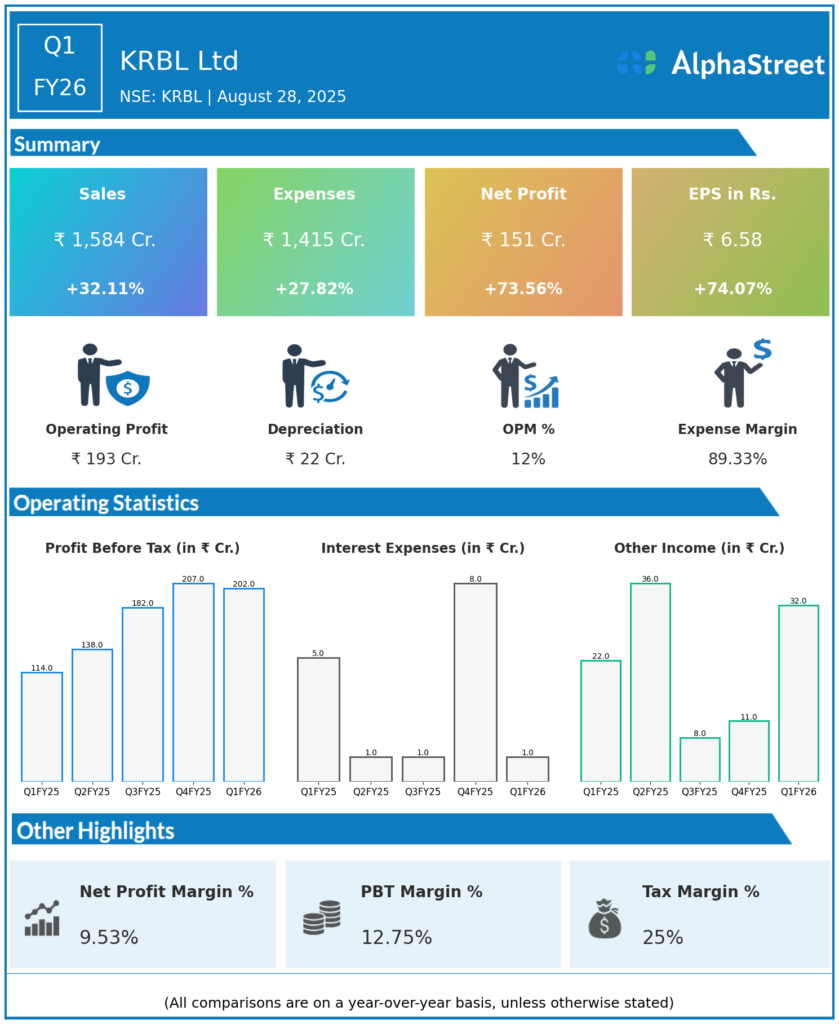

Total Income: ₹1,584 crores, up 32.1% YoY (Q1 FY25: ₹1,220.91 crores) and up 21.8% QoQ (Q4 FY25: ₹1,327.02 crores).

-

Total Expenses: ₹1,415.19 crores, up 27.9% YoY and 20.5% QoQ.

-

Profit Before Tax (PBT): ₹201.55 crores, up 76.8% YoY (Q1 FY25: ₹114.02 crores) and 31.8% QoQ (Q4 FY25: ₹152.93 crores).

-

Profit After Tax (PAT): ₹150.58 crores, up 74.0% YoY (Q1 FY25: ₹86.56 crores) and 32.0% QoQ (Q4 FY25: ₹114.08 crores).

-

Earnings Per Share (EPS): ₹6.58, up 74.07% YoY and 32.0% QoQ.

-

Gross Profit: ₹415 crores with a margin of 25.7%, up 250 bps YoY due to lower average basmati cost of goods sold (COGS).

-

EBITDA: ₹225 crores with a margin of 13.9%, up 250 bps YoY.

-

Export Revenue: Surge of 98% YoY, driven by stronger demand in private label sales contributing ₹489 crores.

-

Domestic Revenue: Grew 15% YoY to ₹1,063 crores.

-

Power Segment Revenue: ₹32 crores.

-

Cash and Bank Balances: ₹1,281 crores, Net Worth: ₹5,391 crores, Inventory: ₹2,953 crores as of June 30, 2025.

-

Global Presence: Leading exporter to over 90 countries with largest contract farming network in India for rice.

Management Commentary & Strategic Highlights

-

KRBL’s management highlighted growth driven by operational efficiencies and product mix, especially in exports and domestic branded sales.

-

Introduction of “Uplife” healthy edible oils brand with a revenue target of ₹40 crores in FY26 and ₹300 crores over 3–5 years to diversify product portfolio.

-

Plans to monetize 150-acre land in Ghaziabad for real estate development by relocation of plant near Meerut within 2.5–3 years, estimated valuation ₹4,000–7,500 crores.

-

Management expects continued revenue and margin improvement in FY26 due to lower COGS and scale benefits.

Q4 FY25 Earnings Results

-

Total Income: ₹1,442 crores.

-

Profit After Tax (PAT): ₹154 crores.

-

EPS: ₹6.74.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.