KPIT is a global technology company with software solutions that will help mobility leapfrog towards autonomous, clean, smart and connected future. With 13000+ Automobelievers across the globe, specializing in embedded software, AI & Digital solutions, KPIT enables customers accelerate implementation of next generation mobility technologies . With development centers in Europe, USA, Japan, China, Thailand and India

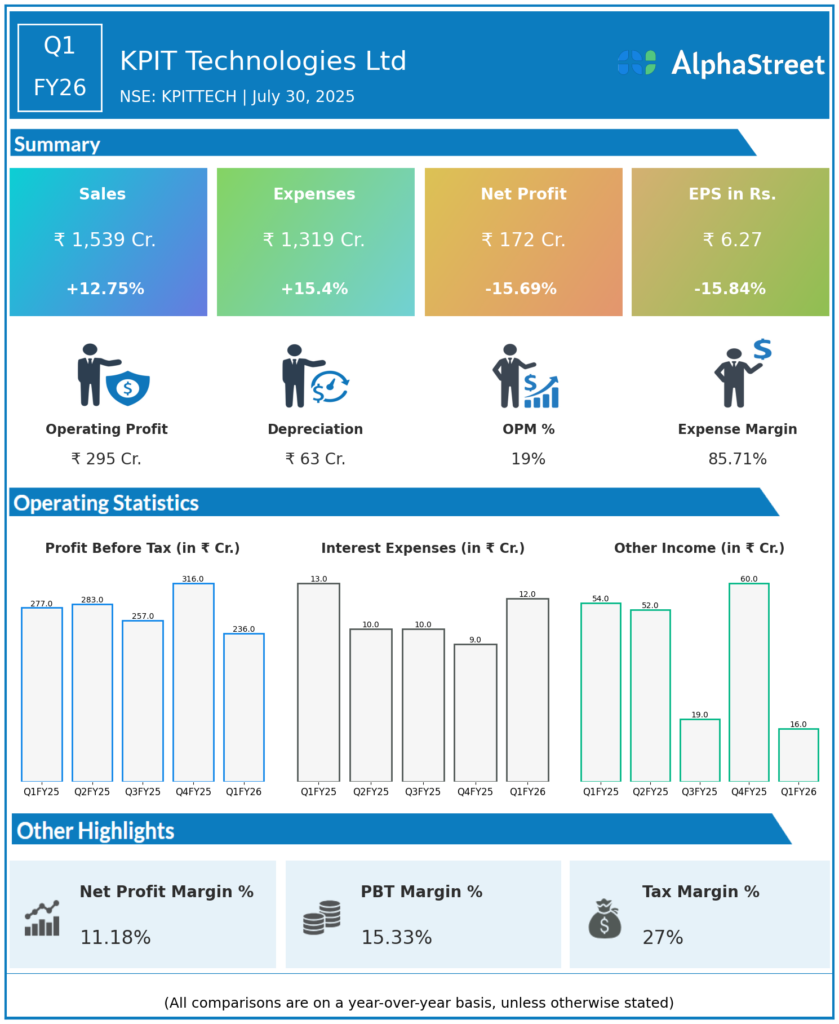

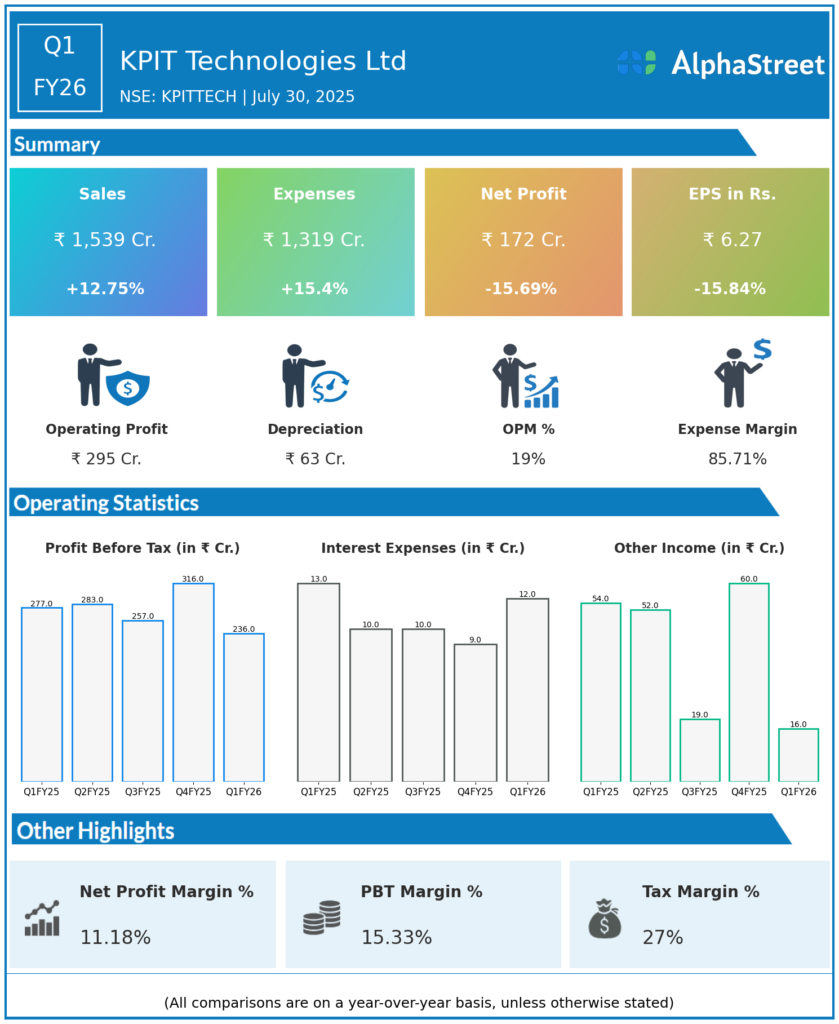

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue from Operations: ₹1,538.7 crore, up about 13% year-over-year (YoY) from ₹1,364.6 crore in Q1 FY25.

-

Net Profit (PAT): ₹171.8 crore, down 15.8% YoY from ₹204.2 crore in Q1 FY25, impacted by currency fluctuations and the absence of one-time income recognized in the prior year.

-

Sequential Performance: Net profit declined nearly 30% sequentially from ₹244 crore in Q4 FY25.

-

EBITDA Margin: Maintained despite macroeconomic challenges (exact margin percentage not specified).

-

Deal Wins: New deals worth $241 million secured during the quarter, adding to a strong pipeline.

-

Management View: CEO and MD Kishor Patil noted that Q1 FY26 performance met expectations despite geopolitical and tariff-driven uncertainties affecting the mobility industry. He expects these to settle, with growth momentum in the second half driven by the top 25 clients.

-

Stock Movement: Shares rose approximately 4-5% post-results announcement, reflecting confidence in longer-term growth prospects.

-

Key Strategic Initiatives: Partnership with JSW Motors to support India’s new energy mobility with a robust software and digital backbone; expansion with new centers in Tunisia and Sweden; focus on AI-driven solutions and software-defined vehicle technologies.

Key Management Commentary & Strategic Highlights

-

The company highlighted a robust deal pipeline and transformative large engagement wins expected to contribute to strong revenue growth in H2 FY26.

-

KPIT is focusing on productivity enhancements through AI, fixed-price and solution-led contracts, and cost optimization through organizational restructuring.

-

The partnership with JSW Motors aims at accelerating India’s transition to clean mobility.

-

Global expansion continues with new engineering centers to leverage local talent in Tunisia and Sweden.

-

KPIT maintains a strategic focus on software-defined vehicles, benchmarking, and cost reduction solutions in automotive software.

-

Management remains optimistic for strong performance in H2 FY26.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

- Revenue: ₹1528 crore, up 16% on the YOY basis.

-

Net Profit: ₹245 crore, up 48% on the YOY basis.

-

The quarter showed stronger profitability before the decline experienced in Q1 FY26.

- The board of directors of KPIT Technologies approved the merger of its wholly-owned subsidiary, PathPartner Technology Private Limited, with itself

- The company’s board recommended a final dividend of ₹6 per equity share of ₹10 each for the FY 2025