Incorporated in 2008, KPI Green Energy Ltd is part of KP Group. They develop, build, own, manage, and maintain renewable power facilities (solar and wind solar hybrid power project) as an Independent Power Producer (IPP) and as a service provider to Captive Power Producers (CPPs) under the ‘Solarism’ brand.

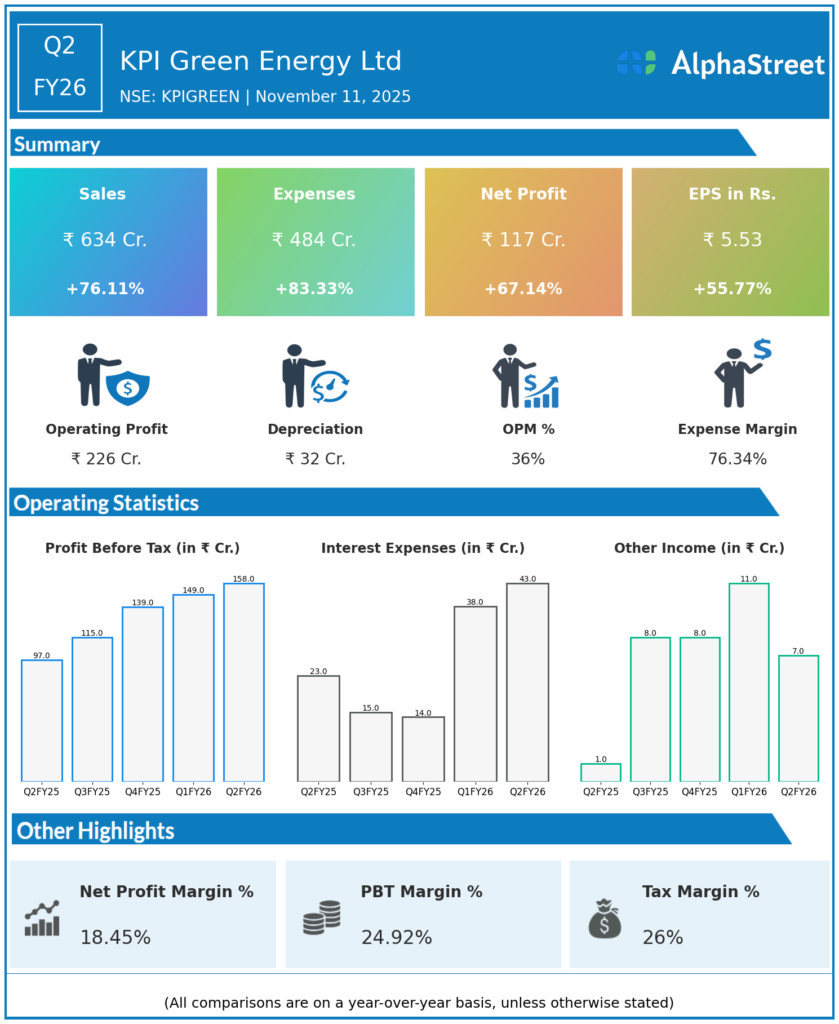

Q2 FY26 Earnings Results

-

Revenue: ₹634 crore, up 76% YoY and 5.2% QoQ

-

EBITDA: ₹232.4 crore, up 73% YoY with a margin of 35.56%, down 158 bps YoY due to increased operating expenses

-

Profit Before Tax (PBT): ₹157.8 crore, up 63.4% YoY

-

Profit After Tax (PAT): ₹116.6 crore, up 67% YoY, PAT margin 18.39% (down 105 bps YoY)

-

Interest expense rose to ₹43.02 crore, nearly doubling YoY, impacting net margins

-

Tax expense: ₹41.11 crore, effective tax rate of 26.06%

-

Depreciation increased to ₹31.61 crore from ₹29.5 crore sequentially

-

Other income declined to ₹6.85 crore from ₹11.18 crore QoQ

-

Strong operational metrics despite finance cost pressure; highest-ever quarterly revenue and profit recorded

-

H1 FY26 revenue: ₹1,237.24 crore, up 74.77% YoY

-

H1 FY26 EBITDA: ₹433.61 crore, up 67.3% YoY

Management Commentary & Strategic Insights

-

Growth driven by increased power generation capacity and favourable power purchase agreements

-

Margin compression attributed to elevated operating expenses and increased employee costs (+27.14% YoY)

-

Management continues investment in expansion projects, including a 1 MW captive green hydrogen plant targeted for FY26 operation

-

Positive outlook with sector tailwinds from India’s renewable energy targets

-

Strong balance sheet with ₹597 crore cash as of March 2025 supports capex and working capital needs

Q1 FY26 Earnings Results

-

Revenue: ₹614.12 crore, up 73.2% YoY and 109.6% QoQ

-

EBITDA: ₹216.9 crore, up 64% YoY, margins around 33%

-

PAT: ₹111.32 crore, up 68.1% YoY and 158.6% QoQ

-

EPS: ₹5.27, up from ₹3.66 YoY

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.