Renewable energy developer KPI Green Energy Ltd (NSE: KPIGREEN) has delivered a strong set of consolidated financial results for the third quarter of the financial year ending December 31, 2025, marking another quarter of sustained growth in revenue and profitability.

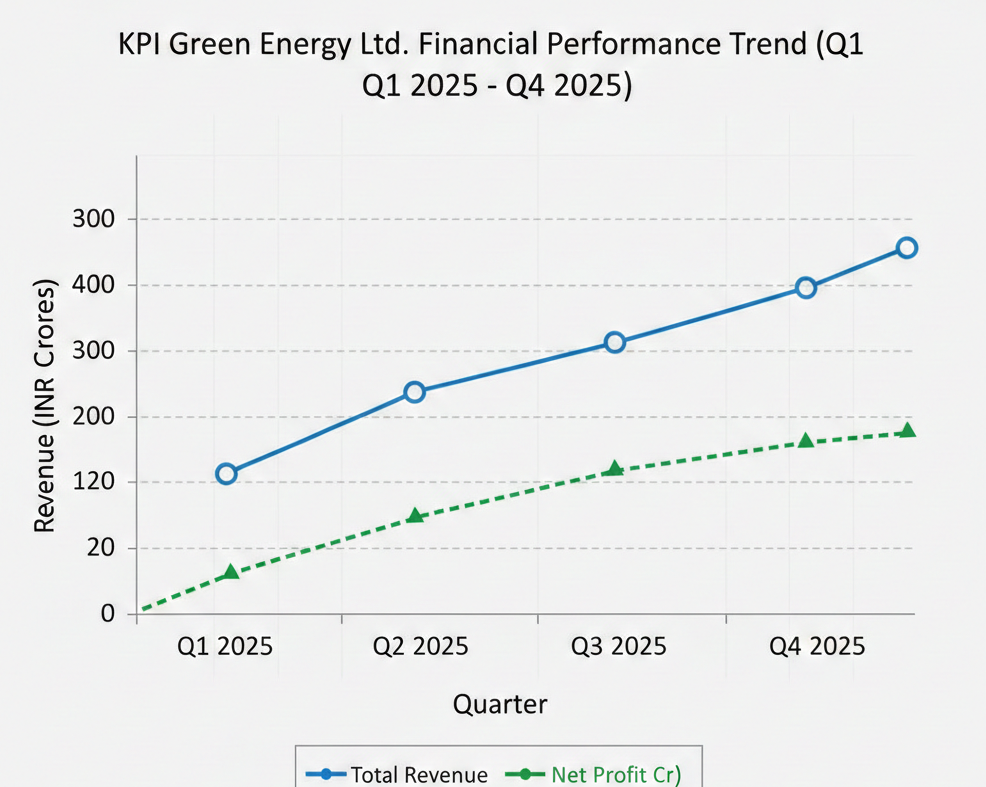

According to the company’s regulatory filing and official press release, KPI Green Energy reported consolidated total revenue of ₹676 crore for Q3 FY2026, representing a year-on-year increase of approximately 45% compared with ₹466 crore in the corresponding quarter of the prior year. This uptick underscores continued demand for the company’s solar and hybrid energy solutions amid a ramp-up in project execution.

Operational Efficiency and Profit Growth

The company’s Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) for the quarter increased to ₹251 crore, up around 73% year-on-year from ₹145 crore, reflecting strengthened operating leverage and cost efficiencies as project scale expands. Profit Before Tax (PBT) rose to ₹170 crore, marking a 48% increase, while Profit After Tax (PAT) climbed to ₹126 crore, up 48% from ₹85 crore a year ago. These gains highlight a healthy balance of revenue growth and margin management across KPI Green’s diversified business segments.

For the nine-month period ending December 31, 2025, KPI Green Energy reported total revenue of ₹1,931 crore, a 64% increase versus ₹1,177 crore in the previous year. EBITDA for the period climbed 71% to ₹701 crore, while PBT and PAT grew 58% to ₹477 crore and 60% to ₹354 crore respectively, underscoring the company’s trajectory towards scalable growth and profitability.

Dividend and Shareholder Returns

Alongside the quarterly results, KPI Green Energy’s board approved a third interim dividend of ₹0.20 per equity share, reflecting the company’s approach to returning value to shareholders while simultaneously funding aggressive expansion plans. The dividend is part of a series of interim payouts consistent with the company’s capital allocation strategy.

Strong Demand Across Solar and Hybrid Segments

Management attributed the quarter’s performance to robust execution momentum and sustained demand for both solar and hybrid energy projects, particularly in markets driven by long-term power purchase agreements and renewable purchase obligations. KPI Green’s operational footprint spans a growing renewable energy portfolio, supported by strategic financing and project wins.

KPI Green Energy’s renewable portfolio—comprising operational and upcoming installations—has expanded significantly, with cumulative capacity and order book strength positioning the company well for future growth. Recent figures indicate the company’s renewable portfolio has surpassed 4.74 GW, supported by a diversified mix of Independent Power Producer (IPP) and Captive Power Producer (CPP) segments.

Industry Context

The renewable energy sector in India continues to benefit from policy support and heightened focus on clean energy infrastructure. KPI Green Energy’s performance aligns with broader industry trends, as corporates and utilities increasingly invest in solar, hybrid systems, and other low-carbon solutions to meet regulatory targets and sustainability commitments. Moving forward, KPI Green Energy’s execution capability and expanding renewable pipeline are expected to play a key role in shaping its operational trajectory through FY2026 and beyond.