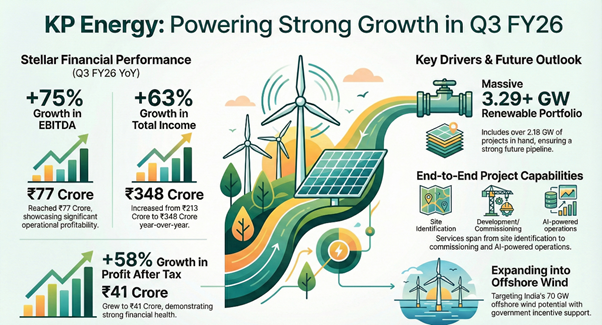

KP Energy Limited (NSE: KPEL) reported its highest-ever total revenue for a third quarter, reaching ₹348 crore for the period ended December 31, 2025. This performance represents a 63% increase compared to the ₹213 crore recorded in the same quarter of the previous fiscal year. The growth was primarily driven by infrastructure development activities, which remain the company’s core revenue segment.

The balance-of-plant developer achieved record quarterly income while declaring a third interim dividend. Financial growth was supported by an expanding 2GW project pipeline and strategic preparations for offshore wind development.

Corporate Actions

During the quarter, the Board of Directors declared a third interim dividend of 4%, equivalent to ₹0.20 per equity share with a face value of ₹5. Additionally, the company completed the allotment of 688,800 equity shares to Promoter Dr. Faruk G. Patel. These shares were issued at ₹412 per share upon the conversion of warrants, a move that increased the promoter group’s shareholding from 44.88% to 45.44%. The conversion marks the receipt of the full issuance amount by the company, with no warrants remaining pending.

Financial Performance

The company’s consolidated financial metrics showed significant year-over-year improvement across all major indicators:

• Revenue from Operations: Increased to ₹345 crore from ₹212 crore in Q3 FY25 (+63%).

• EBITDA: Rose to ₹77 crore, a 75% increase from ₹44 crore in the prior year’s corresponding quarter.

• Profit After Tax (PAT): Reached ₹41 crore, up 58% from ₹26 crore in Q3 FY25.

• Earnings Per Share (EPS): Quarterly basic EPS rose to ₹6.18 from ₹3.96 (+56%).

For the first nine months of FY26, revenue from operations stood at ₹865 crore, compared to ₹538 crore in 9M FY25, representing 61% growth. The company also noted a provision for an Employee Stock Option Plan (ESOP) totaling approximately ₹13 crore during the nine-month period.

Growth Strategy

KP Energy outlined a growth strategy anchored by a multi-year order pipeline of about 2 GW and expansion into adjacent renewable segments. The company is evaluating offshore wind opportunities in Gujarat and Tamil Nadu, with a potential 1–2 GW balance-of-plant participation under assessment.

Operational initiatives include the deployment of a 24×7 Network Operations Center using AI-based alerts and IBM Maximo software to support asset monitoring and generation reliability. During the quarter, the company received in-principle approval for 100 MW of Interstate Transmission System connectivity, which could enable interstate power sales and project scalability.

Market Context

KP Energy operates within India’s renewable energy market, which includes an estimated offshore wind potential of about 70 GW. The company is assessing opportunities supported by government incentives, including viability gap funding of up to ₹7,453 crore for 1 GW of offshore wind capacity.

Alongside domestic operations, KP Energy has entered international collaborations, including a memorandum of understanding with the Government of Botswana for large-scale renewable power infrastructure development. Within India, the company maintains strategic alliances with Inox Wind and Senvion India to jointly develop up to 4.5 GW of wind and hybrid renewable energy projects across multiple states.